Converting Unstructured Handwritten Data into Actionable Digital Insights

Even in a digitally driven world, businesses still rely heavily on handwritten documents, application forms, medical notes, delivery receipts, field reports, KYC documents, surveys, and claim forms.The challenge? Handwritten data is unstructured, inconsistent, and difficult to process at scale.

Read More

How Health Insurance OCR is Transforming Claims Processing and Reducing Operational Costs

Optical Character Recognition (OCR) has transformed the way organizations digitize and process documents. From banking forms and insurance claims to healthcare records and logistics paperwork, OCR technology enables faster data extraction, reduced manual entry, and improved operational efficiency.

Read More

Future of OCR in Health Insurance: 2026 Trends & Innovations-You need to know.

Optical Character Recognition (OCR) is a technology that converts printed or handwritten text from documents into machine-readable data. In the health insurance industry, OCR is widely used to extract information from medical bills, policy documents, claim forms, prescriptions, and identity records.

Read More

Accuracy Challenges in Handwritten OCR & How Pix Dynamics Handwritten OCR Improve Results

Optical Character Recognition (OCR) has transformed the way organizations digitize and process documents. From banking forms and insurance claims to healthcare records and logistics paperwork, OCR technology enables faster data extraction, reduced manual entry, and improved operational efficiency.

Read More

Top Features to Look for in a Handwriting Recognition Solution in 2026

Handwriting recognition technology has evolved significantly over the past decade. What once struggled with cursive scripts and inconsistent writing styles is now powered by deep learning, neural networks, and intelligent document processing engines capable of understanding complex handwriting with impressive accuracy.

Read More

How to Choose the Best Indian Voter ID OCR Solution?

Identity verification has become a critical foundation for onboarding, compliance, and fraud prevention. Among the various government-issued identity documents, the Indian Voter ID plays a vital role in KYC, financial services, and access to government initiatives.

Read More

Why to Choose the Best Indian Voter ID OCR Solution?

In India’s rapidly digitizing ecosystem, identity verification has become the backbone of secure onboarding, compliance, and fraud prevention. Among various identity documents, the Indian Voter ID card holds a unique position: it is widely accepted, government-issued, and trusted across sectors. This is why choosing the best Indian Voter ID OCR solution is no longer optional but a strategic necessity for businesses.

Read More

How Video KYC Enables Faster Loan Disbursals in Digital Lending Apps?

Digital lending apps are reshaping how consumers access credit making loans available anytime, anywhere. But speed alone is not enough. For lenders, identity verification, fraud prevention, and regulatory compliance remain critical checkpoints before any loan can be approved or disbursed.

Read More

How Video KYC Integrates with OCR, Face Match & Risk Engines?

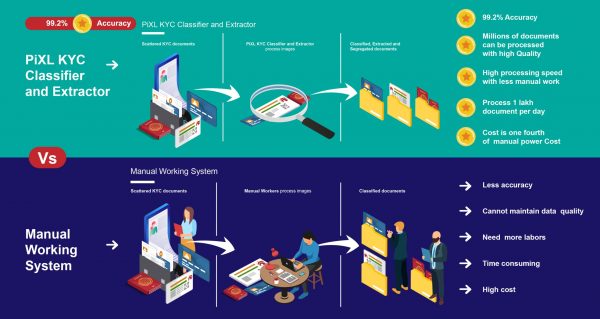

As financial institutions accelerate digital onboarding, Video KYC (vKYC / V-CIP) has evolved from a compliance requirement into a powerful identity intelligence framework. Modern Video KYC is no longer a standalone video interaction it is a tightly integrated ecosystem powered by OCR, facial biometrics, and real-time risk engines.

Read More

From Paper to Digital: How Handwritten OCR Transforms Data Extraction, Automation, and Business Efficiency

Pixl Trial Platform addresses the challenge of manual PAN data entry with an AI-powered PAN Card OCR API that automatically extracts PAN details from PAN card images and documents securely, accurately, and at scale.

Read More

How Medical Prescription Data Can Be Easily Extracted Using Fast and Accurate OCR

Medical prescriptions are small pieces of paper, but the information written on them carries enormous responsibility. A single mistake in reading a drug name, dosage, or instruction can directly impact patient safety.

Read More

Experience the Accuracy of PixDynamics PAN Card OCR for 50 Free Credits Using Pixl Trial Platform

Pixl Trial Platform addresses the challenge of manual PAN data entry with an AI-powered PAN Card OCR API that automatically extracts PAN details from PAN card images and documents securely, accurately, and at scale.

Read More

Experience the Accuracy of PixDynamics Mexican ID OCR for 50 Free Credits Using Pixl Trial Platform

Processing Mexican national identity cards manually is time-consuming, error-prone, and difficult to scale especially for organizations handling high volumes of customer onboarding and compliance checks.

Read More

Experience the Accuracy of PixDynamics Passport OCR for 50 Free Credits Using Pixl Trial Platform

Pixl Trial Platform addresses the challenges of manual passport data entry with an AI-powered Passport OCR API that automatically extracts passport details from passport images and documents securely, accurately, and at scale.

Read More

Mask Aadhaar Card Data Securely for Free with 50 Credits Using Pixl Trial Platform.

Pixl Trial Platform offers an AI-powered Aadhaar Masking API that automatically detects and masks sensitive fields in Aadhaar card images, helping organizations comply with UIDAI guidelines and data protection standards without manual intervention

Read More

Extract Aadhaar Card Data for Free with 50 Credits Using Pixl Trial Platform

Aadhaar cards play a critical role in identity verification, customer onboarding, and regulatory compliance across banking, fintech, telecom, insurance, and government services in India.

Read MoreExperience the Accuracy of Pixl Voter ID Data Capture for Free with 50 Credits Using Pixl Trial Platform

Pixl Trial Platform addresses this challenge with an AI-powered Qatar ID OCR solution that accurately scans, reads, and extracts structured data from Qatar national ID cards in seconds.

Read More

Experience the Accuracy of Pixl Malaysian Driving License OCR for 50 Free Credits Using Pixl Trial Platform

Processing Mexican national identity cards manually is time-consuming, error-prone, and difficult to scale especially for organizations handling high volumes of customer onboarding and compliance checks.

Read More

Experience the Accuracy of Pixl Malaysian Voter ID OCR for 50 Free Credits Using Pixl Trial Platform

Pixl Trial Platform addresses this challenge with an AI-powered Qatar ID OCR solution that accurately scans, reads, and extracts structured data from Qatar national ID cards in seconds.

Read More

Experience the Accuracy of PixDynamics Qatar ID OCR for 50 Free Credits Using Pixl Trial Platform

Pixl Trial Platform addresses this challenge with an AI-powered Qatar ID OCR solution that accurately scans, reads, and extracts structured data from Qatar national ID cards in seconds.

Read More

Why leading Banks & NBFCs Choose Pixl vKYC in 2026?

In 2026, Video KYC (vKYC / V-CIP) has evolved from a digital convenience into a regulatory and operational necessity for banks and NBFCs. With rising customer acquisition volumes, stricter RBI, AML, and CDD requirements, and increasing fraud sophistication, traditional KYC methods are proving too slow, costly, and risky.

Read More

Why Digital Identity Verification Is the Backbone of Modern Banking

From automating data entry and accelerating customer onboarding to improving compliance and reducing human error, advanced OCR solutions enable organizations to transition from manual processes to fully digital workflows. While Aarya.ai is one player in this space, enterprises often explore alternatives that offer higher accuracy, better customization, scalability, and enterprise-grade security.

Read More

Top 5 Emirates ID OCR Providers in 2026

Emirates ID OCR technology has become a core component of identity verification and compliance workflows. From automating KYC processes to enabling faster customer onboarding, OCR solutions designed specifically for Emirates ID are now mission-critical

Read More

OCR API vs Traditional OCR Software: What’s the Smarter Choice?

From automating data entry and accelerating customer onboarding to improving compliance and reducing human error, advanced OCR solutions enable organizations to transition from manual processes to fully digital workflows. While Aarya.ai is one player in this space, enterprises often explore alternatives that offer higher accuracy, better customization, scalability, and enterprise-grade security.

Read More

Invoice OCR for Finance & Accounting Teams

Finance and accounting teams are responsible for keeping business operations running smoothly from invoice processing and vendor payments to compliance and financial reporting. In this environment, speed and accuracy are critical.

Read More

Top 5 Alternatives to Aarya.ai’s Handwritten OCR

From automating data entry and accelerating customer onboarding to improving compliance and reducing human error, advanced OCR solutions enable organizations to transition from manual processes to fully digital workflows. While Aarya.ai is one player in this space, enterprises often explore alternatives that offer higher accuracy, better customization, scalability, and enterprise-grade security.

Read More

Secured Non-Assisted Video KYC for Banks & NBFCs in 2026 for Faster Onboarding

As banks and NBFCs scale digital onboarding in 2026, KYC has become a critical balance between speed, security, and regulatory compliance

Read More

Role of Passport OCR in Remote eKYC & Secured Video KYC

When combined with remote eKYC and Video KYC, Passport OCR plays a vital role in accelerating onboarding, reducing errors, and strengthening compliance in regulated industries like banking and fintech.

Read More

Certificate Attestation in Dubai ,UAE: Where Emirates ID OCR Plays a Key Role

Certificate attestation is a mandatory process in Dubai and across the UAE for individuals and businesses engaging in employment, education, residency, or professional licensing. Whether it’s an educational certificate, marriage certificate, or employment document, identity verification is the foundation of every attestation workflow.

Read More

How Emirates ID OCR Works: From Image Capture to Data Extraction?

In UAE, Emirates ID OCR plays a critical role in automating identity verification. Since Emirates ID is the primary identity document for residents and citizens, businesses across banking, fintech, healthcare, telecom, and government services rely on OCR technology to speed up KYC, reduce manual errors, and ensure regulatory compliance.

Read More

Singapore NRIC OCR vs Manual Data Entry: Which Is Right for Enterprise Data Processing?

As enterprises in Singapore accelerate digital onboarding and document digitisation, the way NRIC data is captured and validated has become a critical operational decision. Many organisations still rely on manual NRIC data entry, while others are adopting AI-enabled Singapore NRIC OCR to extract and validate data at scale.

Read More

Why an AI-Enabled Singapore OCR Solution Is Required for Singapore ID Data Extraction?

Singapore’s digital first economy demands fast and accurate document processing, making manual data entry and legacy tools inefficient.

Read More

Singapore Invoice, Cheque & Insurance Card OCR: AI-Driven Automation for Finance Teams

Finance teams in Singapore are under constant pressure to process high volumes of invoices, cheques, and insurance documents accurately while staying compliant, audit-ready, and cost-efficient.

Read More

OCR Software for Singapore IDs & Documents: A Complete Guide to AI-Powered Data Extraction

Singapore’s digital economy operates under strict regulatory, security, and efficiency standards. From NRIC verification and eKYC onboarding to invoice processing, insurance claims, and workforce compliance, organisations process a wide range of documents every day

Read More

Singapore NRIC, Passport & ID OCR: Automating Identity Data Extraction with AI

From NRIC verification and eKYC onboarding to invoice processing, insurance claims, and claims, and workforce compliance, organisations manage large volumes of critical documents daily. Manual data extraction, data entry, data verification using poor OCR systems can no longer meet the speed, accuracy, and regulatory demands of Singapore so AI-powered OCR is a business necessity.

Read More

Role of Face Match & Deepfake Detection in Video KYC

Video KYC (VKYC) is a critical digital identity verification method used across industries AI-driven fraud and synthetic identities increase, identity verification now depends on more than document checks.

Read More

How Logistics Companies Use Handwritten OCR for Address Extraction?

In the logistics industry, speed, accuracy, and operational clarity are everything. Every package moves through multiple stages pickup, sorting, transport, and delivery and at the core of this journey lies one essential element: the address. Yet, many shipments still rely on handwritten labels, making manual data entry slow, inefficient, and vulnerable to human error.

Read More

Top 5 Alternatives to AuthBridge Non-Assisted VKYC For 2026

Non-Assisted VKYC has become a powerful way for businesses to verify customers without human intervention Auth bridge Non-assisted VKYC is a platform designed for digital onboarding, KYC, remote verification, interviews, and customer support. While it offers some features, it may not be the ideal fit for every organization

Read More

How an AI-Powered Resume Parser Works?

AI-powered resume parsers combine Artificial Intelligence (AI), Natural Language Processing (NLP), Machine Learning (ML), and pattern recognition algorithms to interpret resumes the same way a human recruiter would but faster and more accurately.

Read More

How Passport MRZ Scanning Accelerates Modern Identity Verification & Security

In a world where identity verification must be fast, accurate, and secure, passport MRZ scanning has become the backbone of modern digital onboarding. By using ICAO-standard data and automated data extraction, businesses can verify passports in seconds without manual effort.

Read More

How an ai enabled invoice ocr enhances your buissness Workflows?

AI-enabled Invoice OCR streamlines business workflows by automatically extracting critical invoice details such as vendor information, dates, amounts, and line items from both printed and handwritten documents. It eliminates manual data entry by instantly scanning invoices, identifying key fields, and exporting structured data into your accounting or ERP systems

Read More

Benefits and Use Cases of Resume Parser You Need to Know

Recruitment today moves faster than ever yet many HR teams still spend hours manually screening resumes, copying data, and verifying candidate details. This is where AI-powered resume parsing becomes a game-changer. It automates resume screening, extracts structured data instantly, and accelerates hiring decisions with far greater accuracy.

Read More

Top Business Use Cases for Mexican ID OCR Across Industries

Whether it’s a bank verifying a new customer, a telecom operator activating a SIM, or a ride-hailing app onboarding drivers, organizations across industries are turning to OCR (Optical Character Recognition) technology to process identity documents in seconds instead of minutes.

Read More

Why Recruiters Should Implement Resume Parsing Solutions for Fraud Prevention?

Studies indicate that over 30% of job seekers exaggerate or falsify information on their resumes, including skills, employment history, certifications, and academic qualifications. Such discrepancies not only waste valuable HR time but also expose organizations to significant operational, financial, and compliance risks.

Read More

AI-Powered Resume Parsing: How Pixl Resume Parser Becomes the Future of Resume Parsing?

The recruitment landscape is evolving rapidly, driven by the need for efficiency, accuracy, and a seamless candidate experience. Traditional hiring methods are often slow, error-prone, and resource-intensive, leaving HR teams overwhelmed by large volumes of resumes

Read More

All You Need to Know About Resume Parser : Features, Benefits, and Use Cases

A resume parser is an AI-powered software tool that automatically extracts key information from resumes and CVs, such as contact details, work experience, skills, education, certifications, and more.

Read More

How Automated Data Extraction Works in Passport OCR?

In today's world, driven by data, verification of identity requires speed, security, and accuracy. Passport OCR technology The Fast and Accurate Passport Scanning allows this through automated data extraction. This innovation eliminates manual entry, minimizes human error, and enhances verification efficiency.

. Read More

How to Choose the Best Emirates ID OCR API for Fast and Accurate Data Extraction?

Businesses across the UAE rely on Emirates ID verification as a crucial step in customer onboarding, KYC (Know Your Customer) compliance, and identity management. However, manual ID data entry can be slow, error-prone, and resource intensive.

Read More

How a Prescription Reader Helps To Ease Hospital Operations Effectively?

In today’s fast evolving healthcare landscape, hospitals are under immense pressure to deliver accurate, timely, and efficient patient care. Among the many tasks that contribute to daily operations, prescription management stands out as one of the most error-prone and time-consuming. Illegible handwriting, manual data entry, and misinterpretations often lead to delays or even medical errors.

. Read More

Everything You Need to Know About Handwritten OCR

Even in today’s digitally advanced world, handwritten documents remain a vital part of communication from medical prescriptions and bank forms to classroom notes and government records. But converting these handwritten texts into usable digital data can be tedious and error prone. That’s where Handwritten OCR (Optical Character Recognition) comes in.

Read More

What is Passport OCR and How Does It Work?

Optical Character Recognition (OCR) is an advanced technology that converts printed or handwritten text from images, scanned documents, or photos into machine-readable digital data. Instead of entering information manually, OCR identifies characters and converts them into structured text within seconds.

. Read More

Extract Emirates ID Data for Free with 50 Credits Using Pixl Cognitive Suite (PCS)

From banking and fintech to government services and telecommunications, organizations across the UAE rely on Emirates ID cards as a primary means of identifying individuals. Manually processing these IDs is often time-consuming, error prone, and inefficient, which is where Emirates ID OCR (Optical Character Recognition) technology comes into play.

Read More

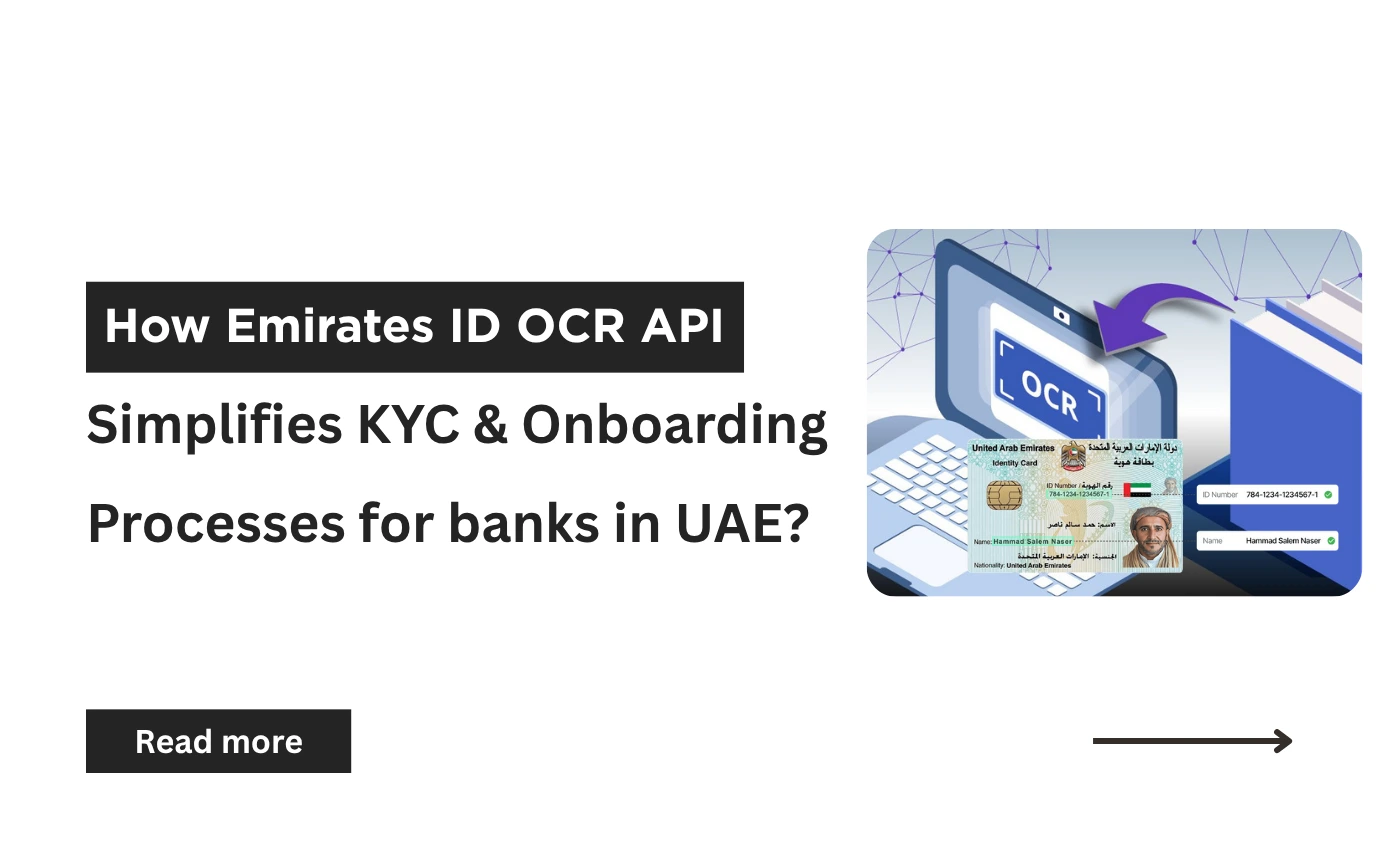

How Emirates ID OCR API Simplifies KYC and Onboarding Processes for banks in UAE?

In the UAE, the Emirates ID is the foundation of identity verification across banking, fintech, telecom, healthcare, and government services. However, traditional manual verification processes slow down onboarding, create operational inefficiencies, and increase the risk of human error.

. Read More

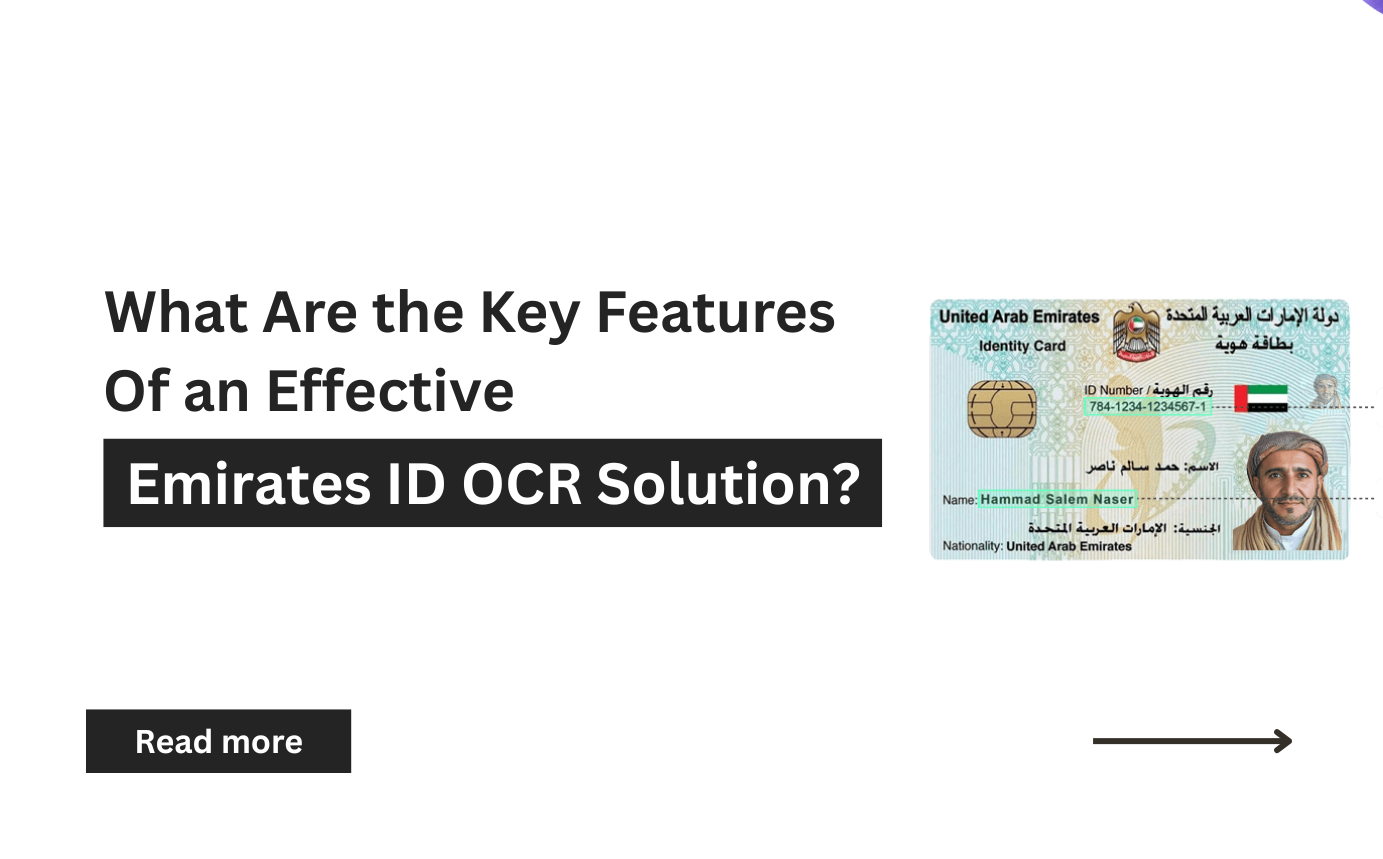

What Are the Key Features of an Effective Emirates ID OCR Solution?

From banking and fintech to government services and telecommunications, organizations across the UAE rely on Emirates ID cards as a primary means of identifying individuals. Manually processing these IDs is often time-consuming, error prone, and inefficient, which is where Emirates ID OCR (Optical Character Recognition) technology comes into play.

Read More

Choose the Best Passport OCR Service Provider | Know Top 5 Leaders in passport OCR solution for fast and accurate data extraction

Passport OCR (Optical Character Recognition) services play a crucial role in streamlining identity verification, onboarding, and compliance processes. These tools automatically read and extract text and data from passports, ID cards, and other identity documents transforming scanned images into structured digital information.

. Read More

Everything you need to Know about Emirates ID OCR and How Does It Work?

Identity verification is at the heart of every secure transaction. Whether it’s opening a bank account, onboarding a customer, or verifying a citizen for a government service, the Emirates ID plays a crucial role across the UAE.

Read More

Passport OCR Technology: The Ultimate Guide to Fast and Accurate Passport Scanning

Passport OCR (Optical Character Recognition) is a technology Optical Character Recognition (OCR) allows computers to read and interpret passport details instantly turning printed text and MRZ (Machine Readable Zone)

. Read More

How to Choose the Best Video PD Solution for Your Business for Smart Onboarding?

However, with dozens of solutions available, choosing the best Video PD solution for your business is not just about picking software it is about selecting a strategic onboarding framework that combines compliance, intelligence, and customer experience.

Read More

How the Data from Medical Prescriptions Can Be Easily Extracted?

Prescription management plays a critical role in ensuring patient safety and operational efficiency. However, medical prescriptions often handwritten and filled with complex details can be difficult to interpret and process manually.

. Read More

How Prescription Readers Reduce Medical Errors and Streamline Workflow?

Medical errors remain one of the leading causes of preventable harm in healthcare, affecting millions of patients worldwide each year. Among these, prescription-related mistakes are particularly concerning, as they can lead to adverse drug reactions, treatment delays, and even fatalities.

Read More

Current Trends in Video PD You Need to Know

Video Personal Discussion (Video PD) is redefining how modern businesses connect, verify, and onboard their customers.

. Read More

Why Video Personal Discussion is the Future of Customer Engagement in 2026 and Beyond?

As industries adapt to digital first engagement models, Video PD is becoming more than just a tool; it is the future of customer engagement.

Read More

Discover Why Banks, NBFCs, and Enterprises Trust Video PD Solution for Secure and Compliant Onboarding

Video Personal Discussion (Video PD) is transforming the way businesses onboard customers in today’s digital first era. It allows organizations, especially banks, NBFCs, and enterprises, to conduct secure, real time face to face interactions remotely.

. Read More.png)

A Complete Guide on Video Personal Discussion (Video PD): All You Need to Know

Video Personal Discussion (Video PD) is a revolutionary approach that allows organizations especially banks, NBFCs, and financial service providers for customer on boarding,to verify identities, discuss policies, and complete KYC procedures remotely.

Read More

Mexican OCR API vs Generic OCR Solutions: Why Localized Accuracy Matters?

OCR (Optical Character Recognition) has become an essential tool for digital onboarding, identity verification, and compliance. However, not all OCR solutions are created equal. While generic OCR tools can recognize global document formats, they often fail when applied to region-specific IDs such as the Mexican INE voter card, CURP documents, and driver’s licenses.

Read More

How to Choose the Best CKYC Solution Provider?

With rising regulatory requirements and growing concerns around fraud prevention,choosing the right Central KYC (CKYC) solution provider can significantly impact efficiency, compliance, and customer trust.

Read More

How to Extract Data from Mexican INE IDs Using OCR?

The INE voter card is Mexico’s most widely used identity document, essential for banking, fintech, and government processes. But manual data entry from INE cards is slow and error-prone.

Read More

Cracking the Code: How OCR is Solving Real-World Document Challenges?

With information informing decisions, proper management of documents is more essential than ever. Governments, companies, and individuals create vast amounts of data on a daily basis much of it still trapped in scanned papers, PDFs, and handwritten documents

. Read More

Handwritten Text Recognition with OCR: A Deep Dive into Accuracy, AI Models, and Use Cases.

In the age of digital first, the power to transcribe handwriting has become as critical as ever. From digitized notes and legal documents to prescriptions and ancient manuscripts, handwritten material continues to dominate many industries. But it takes time to manage and extract data from such unstructured data without automation.

Read More

AI vs Manual: Why Automated Prescription Reading is the Future of Healthcare?

An automated Prescription Reader is used In healthcare such that here, every second matters and so does every word on a prescription. One misread dosage or delayed entry can mean the difference between recovery and risk.here ai powered prescription readers leads the way than manual prescription readers

Read More

How Mexican OCR Transforms KYC for Banks and Fintechs?

Mexican OCR is revolutionizing the way banks and fintechs conduct KYC by substituting traditional identity verifications with quick, automatic document scans.

Read More

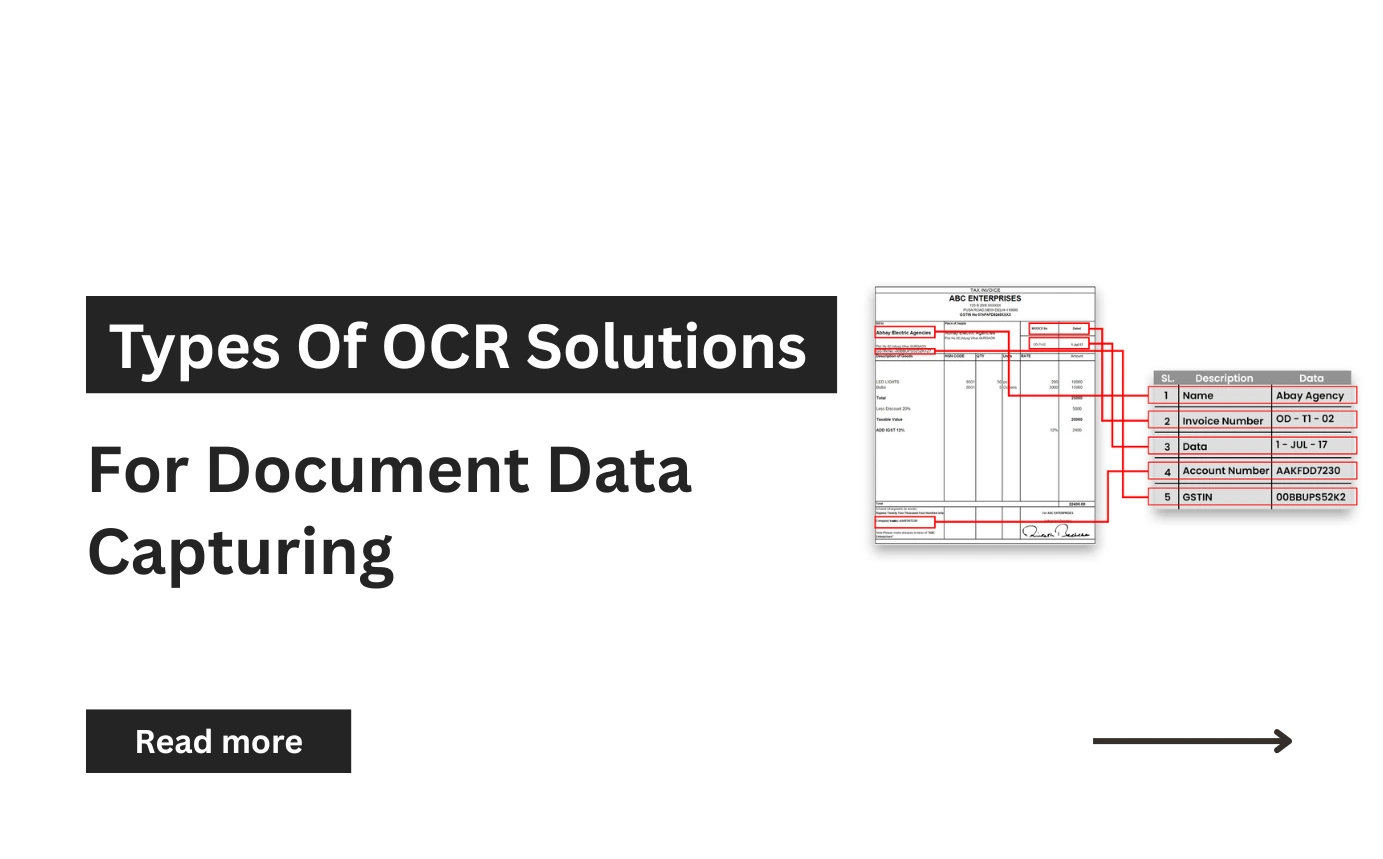

What is OCR Data capturing and different types of OCR for Document Data capturing

OCR, or Optical Character Recognition, is a technology that captures text from images and scanned pages and translates it into machine-readable data. Paired with intelligent data capture

Read More

What is a Prescription Reader ? How OCR is Revolutionizing Medical Workflows

In the ever-evolving landscape of healthcare technology, automation plays a pivotal role in enhancing patient care and operational efficiency. One such transformative technology is Optical Character Recognition (OCR)

Read More

Importance of Invoice OCR in Data Extraction

Efficient financial operations depend heavily on how quickly and accurately a company can process invoice data. Manual entry not only slows down the Accounts Payable (AP) department but also introduces errors and delays that can impact vendor relationships, compliance, and cash flow.

Read More

What is Invoice Data Extraction and It's Use Cases in 2025?

In 2025, finance teams are operating in an automated, real-time decision-making, and increasingly regulated world. As companies keep growing and going digital, manual processing of invoices is simply not feasible anymore.

Read More

What is Invoice OCR and It's Use Cases?

Central KYC (CKYC) is a government-led initiative in India, controlled by the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). Its main objective is to bring KYC information into one central repository to maintain uniformity, minimize redundancy, and increase transparency throughout the financial system.

Read More

How Precision and Speed Are Key’s to an Invoice Data Extraction Process?

With the fast-changing digital world, companies handle thousands of invoices every month .For actual reaping of benefits from automation, companies require two key factors: precision and speed

Read More

CKYC vs eKYC: Understanding the Key Differences in Customer Verification

Central KYC (CKYC) is a government-led initiative in India, controlled by the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). Its main objective is to bring KYC information into one central repository to maintain uniformity, minimize redundancy, and increase transparency throughout the financial system.

Read More

How Central KYC is Revolutionizing Financial Compliance in India

In today’s digital-first financial ecosystem, customer onboarding and regulatory compliance are evolving rapidly. Central Know Your Customer, or CKYC, has emerged as a critical pillar in this transformation

Read More

5 Best Video KYC Providers in India in 2025

With the rapid shift toward digital services, businesses need faster and more secure methods of verifying customer identities. Video KYC has become the go-to method for sectors such as banking, fintech, insurance, and telecom, offering real-time identity verification with enhanced compliance and fraud protection.

Read More

Top CKYC Solution Trends in 2025 : You Need to Know

In an era of increasing digitization and regulatory scrutiny, Central KYC (CKYC) is evolving rapidly to enhance security, transparency, and customer experience across India’s financial ecosystem. For banks, NBFCs, fintechs, and other reporting entities, staying ahead of the latest CKYC trends is not just a compliance requirement—it’s a strategic imperative.

Read More

Everything You Need to Know About CKYC

Explore how the Central Know Your Customer (CKYC) program streamlines compliance and risk management for financial institutions. Learn how PixDynamics' CKYC API Integration Solution ensures secure, scalable, and regulation-ready implementation.

Read More

A Comprehensive Guide to PAN Card OCR – Data Extraction, Verification & Everything You Need to Know

PAN Card OCR automates data extraction and verification from PAN cards with speed and accuracy. This guide covers its working, benefits, and real-world applications.

Read More

Understanding the Role of PAN Card OCR Verification in Indian Compliance

Explore how PAN Card OCR data extraction supports identity verification and ensures KYC/AML compliance in India’s fintech, banking, insurance, and government sectors amid evolving regulations

Read More

What is a PAN Card OCR? A Complete Guide.

In a world where speed and precision are more important than ever, automating the repetitive tasks like manual data entry is not longer a luxury it’s a necessity.That's where PAN Card OCR (Optical Character Recognition) technology comes in. But what is it, really, and why is everyone using it in their systems?

Read More

How to Choose the Best Video KYC Solution: A Complete Guide

In today’s digital-first world, onboarding customers securely and remotely is no longer a luxury—it’s a necessity.Video KYC (Know Your Customer) solutions have revolutionized how businesses verify user identities by blending convenience, compliance, and security into one seamless process

Read More

Use Cases of Video KYC: Real-World Applications Across Industries

As our Ultimate Guide to Video KYCVideo KYC has brought out, the Reserve Bank of India's (RBI) introduction of Video KYC in January 2020 has revolutionized customer onboarding and verification processes in regulated sectors.

Read More

A Complete Guide to Video KYC: Fast, Secure Digital Onboarding

In today’s fast-evolving digital landscape, financial and customer-centric industries are rapidly shifting to remote-first processes. Among these changes, Video KYC (Video-based Customer Identification Process or V-CIP) has emerged as a game-changer—streamlining identity verification

Read More

Understanding Document Verification Meaning: Importance and Process

In this age of digitization, the truthfulness of any document holds great relevance. Organizations in finance, healthcare, and e-commerce need document verification.

Read More

Benefits of Video KYC : A Game-Changer for Identity Verification

In today's digital world, businesses and customers need secure verification processes. They also need these processes to be integrated. The usual Know Your Customer process has users waiting a long time and feeling frustrated.

Read More

Passport Verification API: The Future of Digital Identity Authentication

With more globalization and online transactions, we need strong identity checks. They are vital to prevent fraud and secure onboarding. Of the most reliable methods, passport verification is best.

Read More

Pixdynamics & CIO Association Present InnovX 25 – The Future of Generative AI

Kochi, January 30, 2025 – Pixl, a pioneer in AI-driven enterprise solutions, in collaboration with the CIO Association, is proud to host InnovX 25, an exclusive event focused on the transformative impact of Generative AI on banking and enterprise businesses.

Read More

A Comprehensive Guide to Global KYC Requirements by Country

Globalization has broadened Know Your Customer (KYC) rules. This change creates a complex and ever-changing environment for businesses working globally.

Read More

The Battle Against Document Fraud in 2025: A Comprehensive Guide

As the digital world grows, so does the skill of fraudsters. They use fake IDs and forged documents to exploit businesses and individuals. Document fraud remains a critical concern across industries, costing billions annually. This guide covers the details of document fraud and its forms.

Read More

Transforming KYC Processes with AI and ML

KYC processes are now key to compliance, fraud reduction, and better customer onboarding. AI and ML are revolutionising KYC processes. These cutting-edge technologies help financial firms automate complex tasks.

Read More

Driving Licenses: An Essential Identity Document and Emerging Challenges

A driving license is a vital document. It grants people the right to drive on public roads. It authorizes driving and serves as a versatile ID. It confirms a person's identity, age, and address in non-driving situations.

Read More

Liveness Detection for IdentityVerification

Spoofing attacks are no longer limited to simple phishing emails or fake websites. Cybercriminals have escalated their tactics. They now use advanced tech, like AI deepfakes, to extract sensitive user info. These attacks mimic legitimate messages.

Read More

The Importance of Identity Verification in the Digital Age : Video KYC in Financial Sectors!

Identity verification is now essential for modern businesses. It helps prevent identity fraud, reduce financial crime, and ensure compliance with regulations. This ensures a safer digital environment for users and companies alike.

Read More

The Growing Market for Optical Character Recognition (OCR)!

The OCR market was worth $15 billion in 2019. It's projected to grow at a CAGR of about 15% from 2020 to 2030, reaching $70 billion by 2030. This rapid growth is due to a rising demand for automated verification solutions in industries worldwide.

Read More

Comprehensive Guide to Passport Verification Processes

In today's globalized world, it's crucial to verify passports. This helps maintain security and prevent identity fraud. We aim to provide a deep understanding of passport verification. We will cover its importance and the methods used to check this vital ID.

Read More

Document Verification | Understanding the Process

In today's digital era, organizations must verify document authenticity. It's crucial across all sectors. Document verification is vital. It confirms that documents are genuine, unaltered, and valid. This guide explores document verification.

Read More

Comprehensive Guide to KYC Compliance in Mexico

In global business, compliance with local laws is vital for success. As one of Latin America's largest economies, Mexico has strict KYC rules.

Read More

Unmasking the Future of Fraud Detection and Prevention in 2024

Fraud is evolving rapidly, driven by technological advancements and increasingly sophisticated criminal methods.

Read More

Advancing Identity Verification: Balancing Security and User Convenience

In today's digital world, identity verification is vital. It protects online interactions. Businesses must protect against advanced cyber threats. They must also provide a smooth, user-friendly experience. This article explores ways to balance strong security with great customer experiences.

Read More

How Video PD Revolutionizes Customer Verification Processes

In today's fast-changing digital world, onboarding and engaging customers is vital for success. As businesses seek secure, smooth, and personalized interactions, Video PD is a game-changer

Read More

Harnessing with the Power of Generative AI in Banking: A Comprehensive Overview

Generative AI (GenAI) is changing banking. It boosts efficiency, cybersecurity, and customer satisfaction. As the industry transforms, using advanced AI, like GenAI, is now essential. It's no longer optional.

Read More

How AI chatbots are transforming the Banking Sector

The banking industry is undergoing a digital revolution. AI chatbots are key to this transformation. As financial institutions seek new ways to improve, these systems are vital. They enhance customer experiences, boost efficiency, and drive growth.

Read More

Aadhaar eKYC: Transforming Digital Onboarding with Seamless Verification

In the digital transformation era, Aadhaar eKYC is a game-changer. It is redefining identity verification for individuals and businesses. eKYC uses India's Aadhaar system to simplify, secure, and speed up verification. Let's explore the details of Aadhaar eKYC.

Read More

A Comprehensive Guide to KYC Regulations in the UAE: Strengthening Compliance and Reducing Financial Risk.

The UAE is a key hub for global trade and commerce. This strategic position, however, makes the UAE vulnerable to financial crimes. These include money laundering and terrorism financing.

Read More

A Guide to Video KYC: Transforming Customer Onboarding

In today's digital age, video-based customer identification processes (V-CIP) are a game-changer for finance and other regulated sectors.

Read More

Comprehensive Guide to Driving License Verification: A Critical Solution for Businesses

Driving License Verification (DLV) is vital for many industries. It ensures a driver's license is genuine and legal. A driving license is a widely recognized ID. It proves a person's ability to drive.

Read More

How OCR technology revolutionises identity verification

IDV is crucial for modern businesses in banking, travel, and healthcare. As more transactions go online, companies need fast, secure ways to verify clients' identities. OCR technology is key to this process. It lets organizations read, process, and verify documents with unmatched speed and accuracy.

Read More

The Comprehensive Guide to Digital KYC: Benefits, Challenges, and Future Innovations

Digital KYC (Know Your Customer) is changing how organizations verify customer identities. It shifts from slow, paper-based methods to fast, secure digital platforms.

Read More

OCR data capture and how it is transforming business efficiency with Pixl

Businesses must now speed up operations, reduce human input, and improve data quality. To meet these demands, OCR data capture technology is now a key resource.

Read More

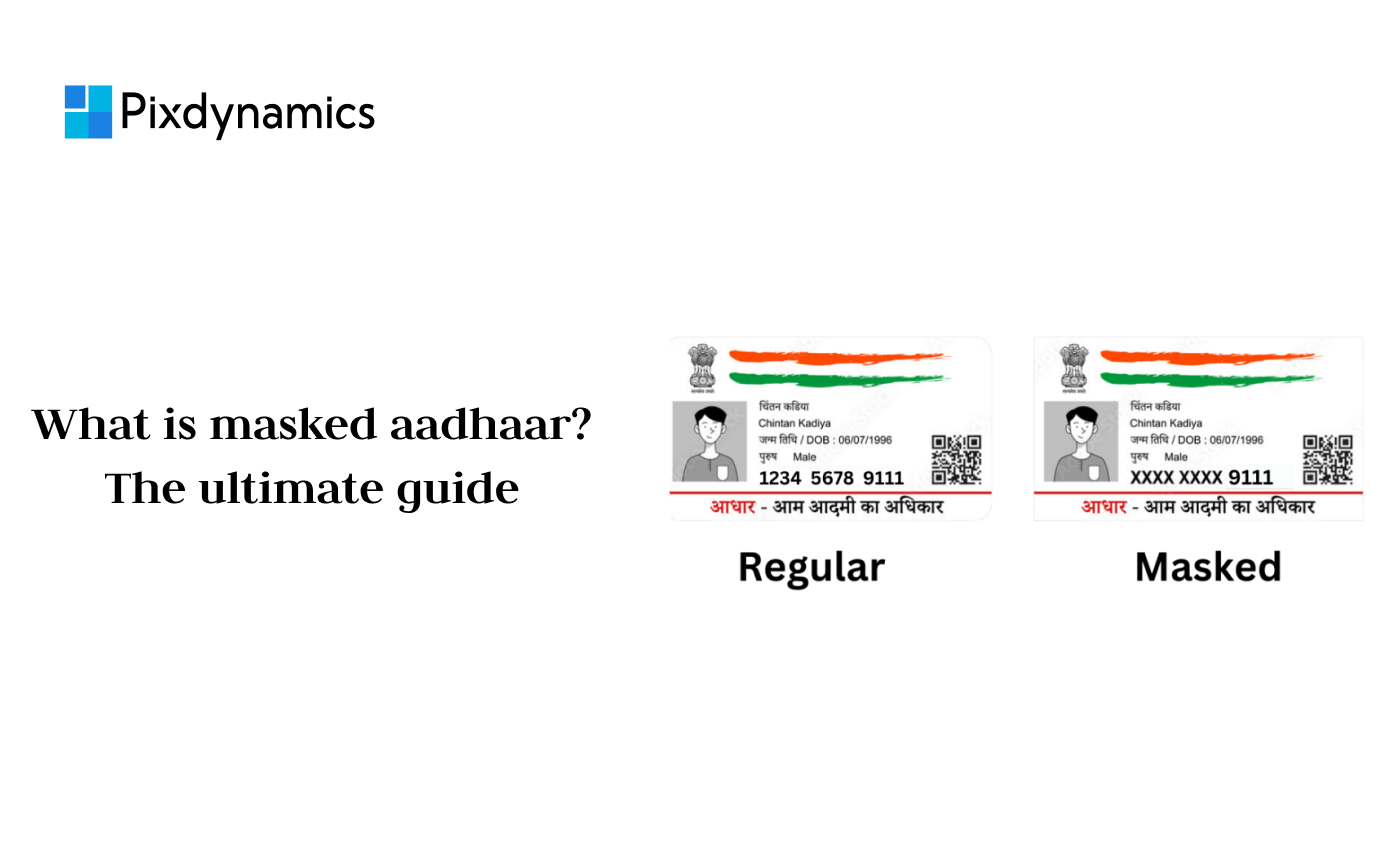

What Is Masked Aadhaar? The Ultimate Guide

Today, privacy is one of our most valued assets. This is due to the rise of technology. With digital ID systems, we must protect such information. Its leakage can have huge consequences.

Read More

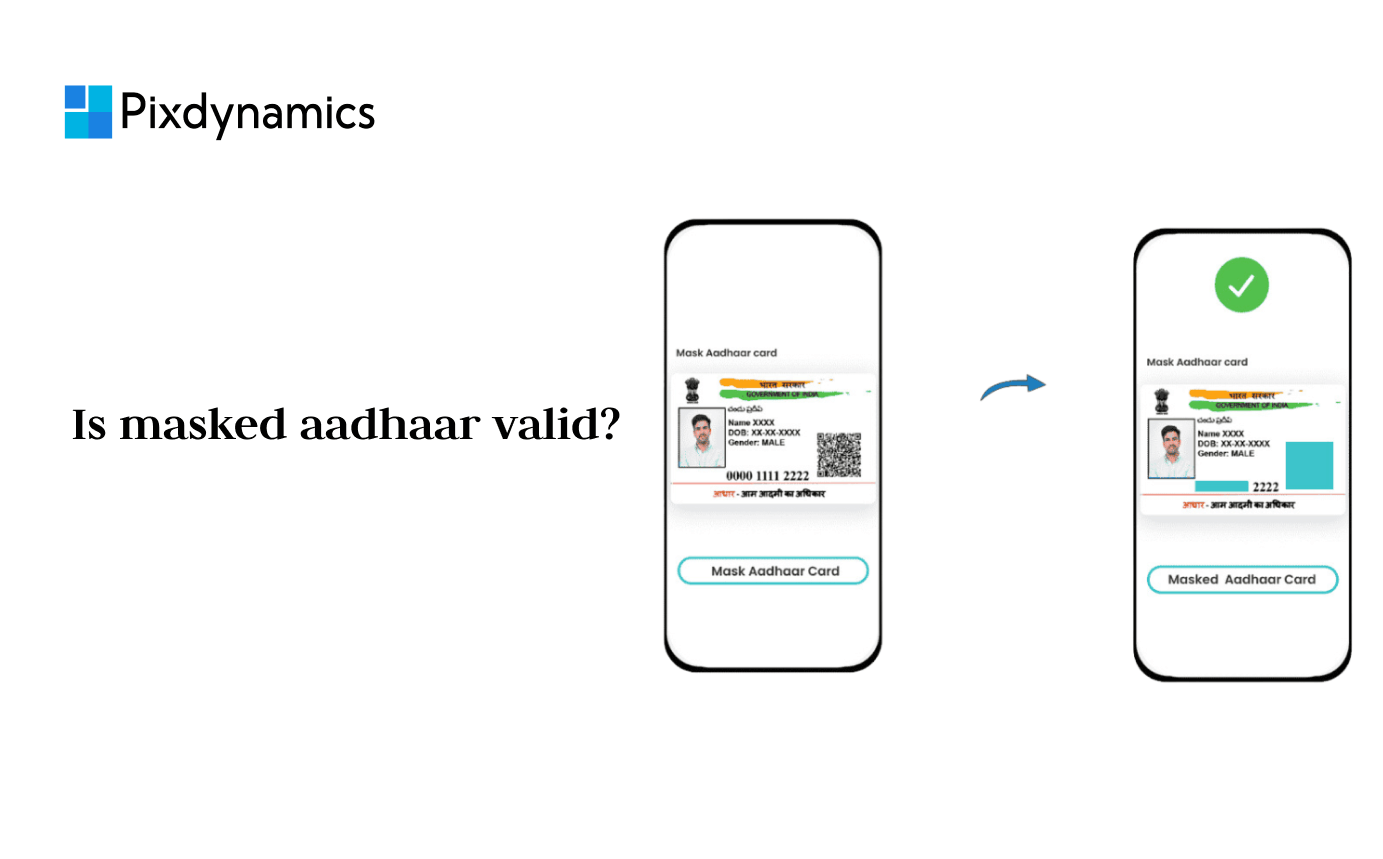

Is Masked Aadhaar Valid?

As the digital age grows and more facilities move online, data security is a must for everyone. In India, the Aadhaar card is one of the most common identification cards people use and it is very important to protect the Aadhaar numbers.

Read More

Visitor Management System India - Revolutionizing Security in Modern Urban Landscapes

Many smart cities of India are implementing advanced technologies in their smart city lifestyle and among them the noteworthy technology is the visitor management system India.

Read More

From Traditional to eKYC for Streamlined Customer Onboarding

In today's fast-changing digital world, customer onboarding and ID verification have evolved. KYC procedures have long been the foundation of compliance for financial institutions. They are now being replaced by electronic KYC (eKYC).

Read More

Guide to Passport Verification: Ensuring Authenticity and Security

Passport verification is vital to proving a person's identity. It is key in many cases, like recruitment, customer onboarding, and border security. With identity fraud on the rise, checking passports is vital for organizations, governments, and banks.

Read More

The Power of Video Personal Discussions (VPD)

In the digital age, businesses must evolve to stay competitive. They must improve their customer engagement strategies. One transformative tool in this endeavor is Video Personal Discussions (VPD)

Read More

Passive Liveness Detection: Elevating Biometric Security

As more sensitive services go online, we need better identity checks. Fraudsters have become increasingly sophisticated, often employing advanced techniques to spoof authentication systems. At the forefront of this battle is passive liveness detection.

Read More

Steps in RBI’s Video-Based Customer Identification Process (VCIP)

The Reserve Bank of India's (RBI) notification, dated January 9, 2020, marked a pivotal shift in customer identification. It officially recognized the Video-Based Customer Identification Process (VCIP). This step introduced a fully digital and remote method for banks and Regulated Entities (REs) to collect Know Your Customer (KYC) information.

Read More

Video KYC - Revolutionize Identity Verification in Finance.

In the fast-paced digital world, identity verification is vital. It is key for security and compliance, especially in finance. As we enter 2024, Video KYC (VKYC) is changing verification methods. It offers better security, speed, and convenience for businesses and customers.

Read More

Workplace Management: Optimizing Your Workspace for Productivity and Efficiency

Workplace management is a methodical way to help employees. It ensures they have the tools, environment, and support to do their jobs well. It is vital to an organization's success. It affects productivity and employee satisfaction. In today's hybrid and remote work environments, effective management is crucial.

Read More

Comprehensive Guide to Parking Management Software

Parking management software greatly boosts the efficiency of public and private parking facilities. As urbanization speeds up, parking demand is rising. Organizations are now using digital solutions to improve parking. They aim to cut costs and boost user experiences.

Read More

Unlocking Workplace Efficiency with Advanced Workplace Management Software

Workplace management software is an integrated system. It manages office spaces, resources, and employee activities through a single platform. It automates tasks like desk reservations, room scheduling, and occupancy tracking. It also provides real-time data on space use.

Read More

Enhancing Logistics Operations with Advanced OCR Technology

In today's fast-paced logistics industry, efficiency, accuracy, and speed are paramount. OCR technology has changed the game for businesses. They want to improve their supply chains. OCR automates data extraction from key documents.

Read More

The Role of OCR in Healthcare Document Management

In the healthcare industry, we must manage vast documentation. It is key to smooth patient care and efficient operations. Optical Character Recognition (OCR) is a game-changer. It has transformed how healthcare providers extract, process, and store critical data.

Read More

Unleashing the Power of OCR in Banking: Revolutionizing Financial Services

OCR technology is now vital to banking. It has changed how banks process data. OCR converts physical documents, like bank statements and loan apps, into machine-readable text. It boosts efficiency, accuracy, and cost savings. Banks adopting OCR can improve customer service, compliance, and workflows

Read More

Maximizing Efficiency with OCR for Insurance Documents. Revolutionizing Data Management

In today's fast-paced insurance industry, managing a lot of paperwork is tough. OCR is a game-changer. It converts paper documents into editable digital files. This streamlines workflows and boosts efficiency.

Read More

Protect your business with an automated fraud detection solution

The world is changing at a rapid pace, and traditional fraud detection techniques are quickly becoming outdated for the modern type of threats we want to protect against. As a result, automation to detect fraud is need of the hour.

Read More

Comprehensive Guide to Resume Parsing: Enhancing Recruitment Efficiency

In today's fast-paced hiring world, firms must quickly and accurately assess candidates. It's vital for staying competitive. Resume parsing is a key recruitment technology. It turns unstructured resume data into structured, searchable info. This process greatly boosts recruiters' efficiency..

Read More

Effective Resolution Using OCR Invoice Capture. How does it become inevitable in management?

OCR invoice capture uses optical character recognition (OCR) technology to automatically extract information from invoices.

Read More.jpg)

For Next-Gen Data Efficiency: The Future is Here with AI OCR SOLUTIONS

Today’s business environment where data plays a key role and helps make decisions and maintain efficiency, AI- based Optical Character Recognition (OCR) is modifying document management.

Read More

Solución OCR para México: Impulsa tu Negocio con Automatización Inteligente

La automatización del procesamiento de documentos es clave para las empresas modernas. Buscan optimizar flujos de trabajo y reducir tareas manuales.

Read More

How OCR is Revolutionizing Insurance Operations

The insurance industry relies on complex documents. Manual processes slow operations, raise costs, and allow errors. But, in today's digital world, tech offers a solution. It promises to revolutionize how insurers handle their paperwork. Enter Optical Character Recognition (OCR). It's a tool that automates document management and data extraction.

Read More

How Visitor Management Systems Enhance Security and Efficiency in Indian Smart Cities

As India's smart cities grow, modern tech is key to better urban management. Of these technologies, Visitor Management Systems (VMS) are key. They improve security and efficiency in workplaces, government buildings, and public institutions.

Read More

How Does a Visitor Management System Work?

First impressions matter more than ever in today’s fast-paced, tech-savvy world. You want visitors to feel welcomed, safe, and organized when they walk in. That's where a Visitor Management System (VMS) comes in. It's a digital tool that improves the guest experience from the moment they arrive.HOW

Read More

How PiXL Video KYC assist banks during COVID -19 pandemic?

As COVID -19 has punched globally, we are on the way to break the chain of Corona virus spreading.

Read More

How easier can bank compliance with CKYC RBI Guidelines?

The boom in technology hasn’t touched some areas of Fin-tech organizations.

Read More

PiXL-Video KYC to an Amendment to Master Direction on KYC

PixL.AI helps the banks in achieving their aim of getting the Video KYC done through PiXL Video KYC.

Read More

How PiXL Technology automates banking sectors?

Banks and other traditional financial service providers have had to respond with an array of digitization and innovation initiatives.

Read More

How Digital KYC Solutions Assist Banks in 2022

In 2021, banks were at the forefront of the pandemic-accelerated digital transformation. This increased customer expectations, which in turn necessitated the need for banks to transform their business models.

Read More

How KYC Practices Can Assist in Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT)?

KYC is a process that financial institutions use to identify and verify the identities of their customers. This verification can help banks fight money laundering and terrorist financing. By identifying suspicious activities, KYC can help banks prevent criminals from using their accounts to launder money or finance terrorism.

Read More

Purpose of KYC in Banks and Financial Services

Banks and other financial institutions have strong KYC procedures in place to ensure that their clients are not involved in money laundering or the financing of criminal activities.

Read More

How do digital KYC services prevent identity theft?

The customer's documents must be uploaded to the bank's system in digital KYC. The bank has its automated software with the help of which the documents get scanned and the data automatically enters into the desired fields in the system.

Read More

OCR for Document Verification

With an increasing number of technology-driven products and services being introduced to the market, the overall customer experience and engagement with companies has changed dramatically. More than ever, today’s customers are looking for intuitive applications and processes that can be completed within a few clicks. All digitally, of course.

Read More

Modernizing Insurance with Insurtech: A Look into the Future

In recent years, technology has revolutionized the way we live our daily lives. From the way we communicate to the way we shop, and even the way we drive, technology has drastically changed the way we function.

Read More

How Artificial Intelligence Delivers Bank-Level Assistance

AI is rapidly transforming the banking industry. With its ability to process vast amounts of data and make complex decisions, AI is delivering bank-level assistance that was once the exclusive domain of human experts.

Read More

Invoice Data Extraction: An Efficient way of Invoice Processing Using OCR.

In recent years, technology has revolutionized the way we live our daily lives. From the way we communicate to the way we shop, and even the way we drive, technology has drastically changed the way we function.

Read More

How Generative AI Restructure the Electronic Bank Guarantee Process

An Electronic bank guarantee document is a digital record or electronic document that represents the electronic bank guarantee issued by a financial institution. It contains all the essential details and terms of the guarantee, including the beneficiary's information, the specified amount, the conditions under which the guarantee can be invoked, and the expiry date.

Read More

Enhancing Passport Verification in India with GenAI-Powered API Solution

Passports are considered ideal for identity verification in India for several compelling reasons. First, they are government-issued and require thorough background checks, making them reliable for identity verification. Passports have lots of information about a person, like their name, photo, birthdate, and unique passport number, which makes it easy to confirm their identity. They also have biometric data, like facial recognition features, that can be used for advanced identity verification.

Read More

The Importance of re KYC: Understanding the Basics and Significance

Re-KYC, or "Re-Know Your Customer," is the process by which your KYC information is reviewed and updated at regular intervals. Think of it as an essential health checkup for your financial identity. Its purpose is to ensure that the information your bank has on file is not only accurate but also current, aligning with the latest regulatory requirements and reflecting any changes in your personal profile.

Read More

Understanding OKYC | The Benefits, Processes & 2024 Outlook

OKYC, short for Offline Know Your Customer, revolutionizes the way banks and financial institutions confirm the identity of their customers by using the power of Aadhaar. Aadhaar, a distinct 12-digit identification number, is administered by the Unique Identification Authority of India (UIDAI) and is allocated to every Indian resident.

Read More

NHAI Takes a Step Forward in Digital Transformation with Acceptance of Electronic Bank Guarantees (e-BG)

The National Highways Authority of India (NHAI) is making waves in its digital transformation journey with the announcement of its decision to embrace electronic bank guarantees (e-BGs). This strategic move not only reflects NHAI's commitment to modernization but also promises to streamline and enhance the ease of doing business with this influential organization.

Read More

Understanding ICR | 2024 Trends And Overview

ICR is useful for organizations that handle extensive paperwork daily, including those in finance, legal, and healthcare sectors. In these industries, efficient document management is critical for maintaining precise consumer records, demanding impeccable data accuracy. ICR emerges as a straightforward solution to error reduction, simultaneously optimizing time and human resource utilization.

Read More

Resume Parsing: How Gen-ai is Transforming the Hiring Process

In the realm of modern technology, Gen-ai, a cutting-edge iteration of artificial intelligence, has emerged as a powerful force transforming numerous sectors, including the intricate world of recruitment and hiring processes.

Read More

Understanding OCR & ICR in Healthcare | Automating Complex Medical Records in One Single API

Imagine transforming the pages of a dusty old book or a handwritten medical record into digital text effortlessly. That's precisely what Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) technologies do

Read More

What is Deduplication | Understanding the Dedupe tool

Deduplication involves the identification and removal of duplicate or redundant data within a dataset. This practice is especially valuable in scenarios where data replication occurs, such as during backups, file storage, or within databases.

Read More

What is Aadhaar Authentication Api

Aadhaar Authentication API is a web-based interface that enables applications to verify the identity of individuals by sending a request to the UIDAI's Aadhaar Authentication Server. The request contains the individual's Aadhaar number and other relevant information, such as their demographics and biometrics.

Read More

What is CRM Dedupe: A Masterclass in Data Precision

As businesses accumulate vast volumes of data, the challenge lies in ensuring the accuracy and reliability of this information. CRM deduplication—a strategic process that goes beyond the surface, offering a sophisticated solution to enhance data precision and elevate your business to new heights.

Read More

Understanding Redacted Aadhaar Number: A Comprehensive Guide

In recent years, the Indian government has implemented the use of Aadhaar numbers for various services and transactions. However, with the increasing concerns over privacy and security, the concept of redacted Aadhaar number has emerged. In this guide, we will explain what a redacted Aadhaar number is and why it is important.

Read More

What is Data Capture?

Data capture is the process of gathering and storing information from various sources, including physical documents, digital forms, sensors, and online interactions. It's the crucial first step in transforming raw data into valuable insights.

Read More

Database Deduplication: The Impact of Eliminating Redundancy

Database deduplication, or deduping, is the process of identifying and eliminating duplicate records or entries within a database. This involves comparing data entries and removing redundant information to create a more streamlined and efficient database. The primary purpose of deduplication is to enhance data quality by ensuring accuracy, consistency, and completeness.

Read More

What is KYC & CDD?

The mutual relationship between Customer Due Diligence (CDD) and Know Your Customer (KYC) plays an important role in preventing financial crimes like money laundering and terrorist financing. KYC serves as a system employed by financial institutions to authenticate and find out the identity of customers, calculate their risk profile in the course of delivering financial services. Conversely, CDD involves gathering and scrutinizing pertinent information about a customer to assess the inherent risks associated with engaging in business with them.

Read More

Invoice Data Capture Software

In every company, the Accounts Payable department plays an important role in ensuring smooth financial operations. At the heart of this function is Invoice Data Capture and Processing, a vital process that involves extracting key data, including invoice number, supplier details, address, and amount, from invoices. This extracted information undergoes a meticulous validation process before being uploaded to an Enterprise Resource Planning (ERP) software.

Read More

Digital ID Verification

Digital id verification involves the verification of online identities to ensure the existence of individuals with digital personas. This process authenticates the claimed identity, investigates reputation, and serves to prevent fraud, manage risks, and ensure compliance.

Read More

VCIP- Simplifying your customer onboarding | 100% Compliance

Learn how this innovative approach helps businesses identify and understand their customers on a deeper level. Drive targeted marketing campaigns and boost customer engagement with VCIP.

Read More

What is a Resume parser and how is it helpful in finding the right candidate

Imagine having an assistant that sifts through stacks of resumes with lightning speed, extracting vital information about candidates. That's the essence of a Resume Parser. It's a software tool designed to analyze, interpret, and categorize data from resumes, making the hiring process more efficient

Read More

what is Liveness detection?

Liveness detection stands as a security checkpoint, using algorithms to verify if a presented biometric sample (think fingerprint, iris scan, or selfie) originates from a living, breathing human rather than a cunning imposter. This technology shields systems from "presentation attacks," where fraudsters attempt to fool the system with masks, photos, or videos.

Read More.jpg)

What are the different Types of KYC

KYC is crucial because it serves as a foundational component of risk management and regulatory compliance, especially within the financial sector. By verifying the identity of customers and understanding their financial activities, businesses can mitigate various risks, such as fraud, money laundering, terrorist financing, and identity theft.

Read More

License Plate Recognition: Enhancing Security and Efficiency on the Roads

License Plate Recognition, often abbreviated as LPR or ALPR (Automatic License Plate Recognition), is a technology that utilizes optical character recognition on images to read vehicle registration plates.

Read More

What is Video KYC | everything you need to know

Looking for a faster, more secure way to complete your KYC requirements? Video identification offers a simplified solution, with real-time verification via an agent-assisted video call. Dive deeper into the Video KYC process and its applications – read on!

Read More.jpg)

what is digital kyc | benefits of digital kyc | overview 2024

what is Digital KYC, How does Digital KYC work, Types of Digital KYC, Benefits of Digital KYC and the Digital KYC Verification process

Read More

Resume screening software is changing the hiring process and simplifying recruitment efforts for companies or recruiters

Resume screening software is changing the hiring process and simplifying recruitment efforts for companies or recruiters alike. What exactly is resume screening software, and how does it work? In this article, we'll let you know the difficulty of this technology, exploring its benefits, challenges, and future trends.

Read More

What is Invoice Data Extraction?

s your accounts payable team drowning in invoices? As your business grows, the mountain of paperwork only gets taller.

Read More

what is a visitor management system | how it works

A visitor management system is a solution that helps organizations track individuals entering their premises. It ensures compliance with legal requirements and organizational rules, unlike relying solely on a human receptionist

Read More

What is Cheque OCR?

Cheque OCR ( Cheque Optical Character Recognition). OCR technology transforms an image or PDF of a bank cheque into machine-understandable data. It helps extract key information such as the amount, payee, date, and cheque number.

Read More

Data Entry Automation & How it Works

Learn the benefits of data entry automation technology. Discover steps, applications, and how it enhances efficiency. Stay ahead with our expert guides.

Read More

Invoice Processing Software

Enhance your financial operations with invoice processing software that automates and simplifies invoicing, reduces errors, and improves efficiency.

Read More

OCR Receipt Scanner

Experience the transformative power of OCR receipt scanners in expense management. Save time, boost accuracy, and gain valuable insights effortlessly.

Read More

What is Data Annotation

Learn how labeling data trains AI for tasks like facial recognition & self-driving cars. Explore the future & become AI-informed.

Read More

What is MRZ OCR ?

MRZ OCR, standing for Machine-Readable Zone Optical Character Recognition, is a technology specifically designed to extract the encoded data from the designated Machine-Readable Zone (MRZ) found within your passport.

Read More

The Future of KYC | How AI is Revolutionizing Video Verification

Discover how AI-powered video KYC revolutionizes customer onboarding with faster, secure identity verification, avoiding paperwork & enhancing user experience.

Read More

OCR Credit Card Statement | Enhance Your Financial Management

Learn how OCR technology can revolutionize your credit card statement management, saving time, reducing errors, and enhancing data security.

Read More

Advanced Identity Verification APIs | Secure Solutions by Pixl

Explore Pixl's advanced Identity Verification APIs: Enhance security, automate KYC, accelerate onboarding. Ensure compliance, prevent fraud. Discover more today.

Read More

e-Bank Guarantees: Secure and Efficient Solutions for Modern Business

Explore the transformative impact of e-Bank Guarantees (eBGs) in modern business transactions: enhanced security, streamlined processes, and global accessibility.

Read More

What is AML Anti Money Laundering complete guide 2024 | PixDynamics

Your complete 2024 guide to understanding Anti-Money Laundering (AML). Learn what AML is, how it works, and its importance in combating financial crime.

Read More

eKYC Verification: The Future of Secure and Convenient Identity Checks

Streamline onboarding, fight fraud, and simplify compliance. Learn how eKYC verification benefits businesses and customers in the digital age.

Read More

Optimizing Accounts Payable with Automated Invoice Data Extraction

Discover the power of automated invoice data extraction to enhance productivity and accuracy in your financial processes. Learn about the latest tools and techniques.

Read More.webp)

What is Digital Kyc complete guide 2024 | PixDynamics

Discover the ins and outs of digital KYC in 2024 with our comprehensive guide. Learn about its benefits, types, required documents, and how it's transforming customer onboarding. Stay compliant and secure in the digital age.

Read More

Exploring the Potential of Facial Recognition | How It Works and Its Applications

What is Facial Recognition? Unlock your phone, secure borders, and more! Explore this tech that identifies faces in images and videos.

Read More

Mexican invoice ocr for simplified ocr processing

Utilize Pixl's Mexican OCR invoice processing for efficiently extracting information from various invoice formats.

Read More

The Importance of Aadhaar Card Masking Solutions for Data Privacy

Discover why Aadhaar card masking is vital for data privacy in India. Learn how it protects personal information, prevents identity theft.

Read More

Enhancing Compliance with Video KYC Verification Software

Discover how Video KYC Verification Software enhances compliance, reduces fraud, and streamlines customer onboarding with benefits like enhanced security and global reach.

Read More

How Video KYC Enhances Security with Biometrics authentication

Discover how video KYC leverages biometric authentication to enhance security and simplify customer onboarding processes.

Read More

API de OCR de facturas | Software automatizado de extracción de datos de facturas

Simplifique el procesamiento de sus facturas con nuestro OCR de facturas. Extraiga datos cruciales de las facturas de forma precisa y eficiente, lo que permite una fácil automatización. Integre nuestra API/SDK fácilmente en sus sistemas y experimente una productividad mejorada.

Read More

Advantages of Implementing an Identity Verification (IDV) Solution

Why Your Business Should Invest in Identity Verification (IDV) solution and the Advantages It Offers. Learn more about Pixl IDV solution.

Read More

Emirates ID OCR API | Detailed Blog

Effortlessly extract data from Emirates ID cards with precision using our highly accurate OCR API. Seamlessly integrate it into your application for fast and reliable results. Access the API today.

Read More

KYC through video call: What It Is, How It Works

KYC through video call refers to any Know Your Customer process that leverages video in some capability. Learn what it is, how it works, its benefits, and more.

Read More

AML Fraud Detection Explained: Your Guide to Prevention & Benefits

AML fraud detection: how financial institutions stop money laundering, safeguarding businesses & customers. Learn key methods, benefits & best practices to protect yourself from financial crime.

Read More

Say Goodbye to Manual Entry: by Implementing OCR Software Invoice Processing in Your Business.

Manually processing invoices can be a nightmare. It causes many errors and slows your enterprise's processes. Work quality and timely delivery hold equal value in today's society. This is where OCR software invoice processing comes in.

Read More

How to Choose the Right Aadhaar Card Masking Service for Your Business

In today's fast-changing digital world, we must protect sensitive information. It's both a legal and ethical duty. For businesses in India, Aadhaar cards are the main ID. So, it's vital to protect this info. Aadhaar card masking hides the first eight digits of the Aadhaar number, showing only the last four. This technique is now vital for companies. It helps them comply with regulations and maintain customer trust.

Read More

OCR impulsado por IA : Revolucionando el Análisis de Documentos con Precisión y Eficiencia

En el mundo actual impulsado por los datos, necesitamos un procesamiento de documentos preciso y eficiente. Las empresas en todos los sectores enfrentan un desafío: deben extraer información valiosa de montañas de documentos.

Read More