How do digital KYC services prevent identity theft?

The customer's documents must be uploaded to the bank's system in digital KYC. The bank has its automated software with the help of which the documents get scanned and the data automatically enters into the desired fields in the system. The software helps to speed up the process of filling up various forms, information entry, and retrieval. This also saves time and money for both the bank and its customers. Customers who want to use the new online verification process and automated screening to complete their onboarding process should first complete the online steps. This includes providing identifying information such as a government-issued photo ID and confirming your address. Automated screening is also performed to verify your identity and citizenship. Customers who complete the online verification process and automated screening are then sent to a screen that asks them questions. Fraud risks, therefore, decrease as a result. Digital KYC, also known as continuous authentication, is a process that uses digital methods to verify the identity of a customer. This process ensures that the account of the customer is continuously monitored and that any changes to the information provided are immediately detected. To keep its system up-to-date, any missing document is immediately flagged by the system. This ensures that all documents are checked frequently and that any discrepancies are caught as soon as they arise. By doing this, the system remains accurate and efficient.

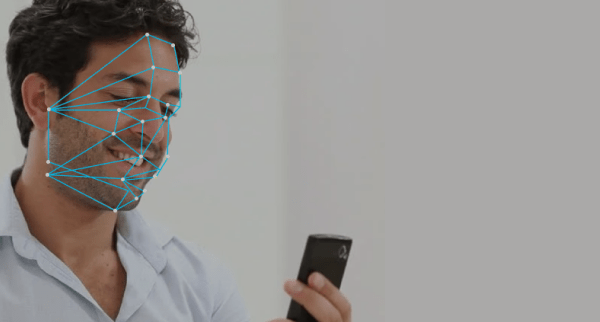

The use of biometric identification technologies has become increasingly widespread in recent years. These technologies, which include face recognition verification or optical character recognition (OCR) and other biometric techniques, help reduce the risk of fraud. This is because customers cannot fake their IDs with these technologies. This aids the bank in enhancing system security. The financial technology system developed by the FIU is very efficient as it is compliant with the regulatory guidelines set by the FIU. The digital KYC process has been found to increase operational effectiveness and improve the customer onboarding experience. The process is faster and more secure, making it a preferred way for businesses to verify their customers’ identities. This improves the overall customer experience, making it easier for them to access the products and services that the business offers.

Everything You Need to Know About How Fraud Works

One of the most common types of white-collar crime is financial fraud. This type of crime can present itself in many different ways, from cyberattacks on big fintech companies to small businesses falling victim to loan fraud scams. Financial fraud can be very costly for businesses and individuals, and it can also have a negative impact on the economy as a whole. Despite the risks, financial fraud continues to be a problem for businesses and customers across the globe-Any attack on a business always has an effect on the financial industry as a whole. When it comes to which parties are affected, data certainly doesn't discriminate. Whether you're a fintech organization or a university scholar, you can be equally as susceptible to falling prey to online swindlers. While there are many different types of loan scams, those that falsify identities and mimic banks tend to be the most damaging. Not only do they steal from the banks, but they also steal from their customers. These scams can be difficult to detect, as they often use legitimate-looking websites and emails.

Why KYC Identity Checks are Essential

To reduce the risk of financial losses, many institutions conduct identity checks on potential customers. This involves verifying the customer's identity and checking their credit score. Financial losses can be costly for businesses, so by conducting these checks, institutions can assess a potential customer's risk classification and decide whether or not to do business with them. One way to verify a customer's identity is through strong customer authentication. This involves using multiple forms of identification, such as an Aadhaar and PAN cards. Organizations are unintentionally becoming involved in financial crime due to a lack of understanding of the risks associated with their activities. This can be massively reduced through undertaking a risk assessment which will identify the key areas of risk and provide practical steps to mitigate these.

Deploying KYC authentication is good for banks and financial institutions because it reduces fraud cases. Fintech Businesses that deploy KYC authentication can trust their customers more because it becomes more difficult for criminals to commit fraud. This builds trust between businesses and their customers, which is beneficial for both parties. Additionally, deploying KYC authentication can help businesses reduce the amount of money they lose to fraud each year. Though it may seem like an inconvenience, adhering to stringent KYC procedures is actually a good thing for a financial institution. By being diligent in ensuring that only lawful business is conducted, a financial institution can boast a good business reputation and improved trust from its customers. This, in turn, can lead to increased profitability and stability.