We know how much attention and timing each process needs to be given in the banking sector, as well as the accuracy of each thing. Now, when a customer approaches the bank for their needs, they are unable to complete their needs on time due to the increased processing time there. Even a small banking service takes a lot of time.

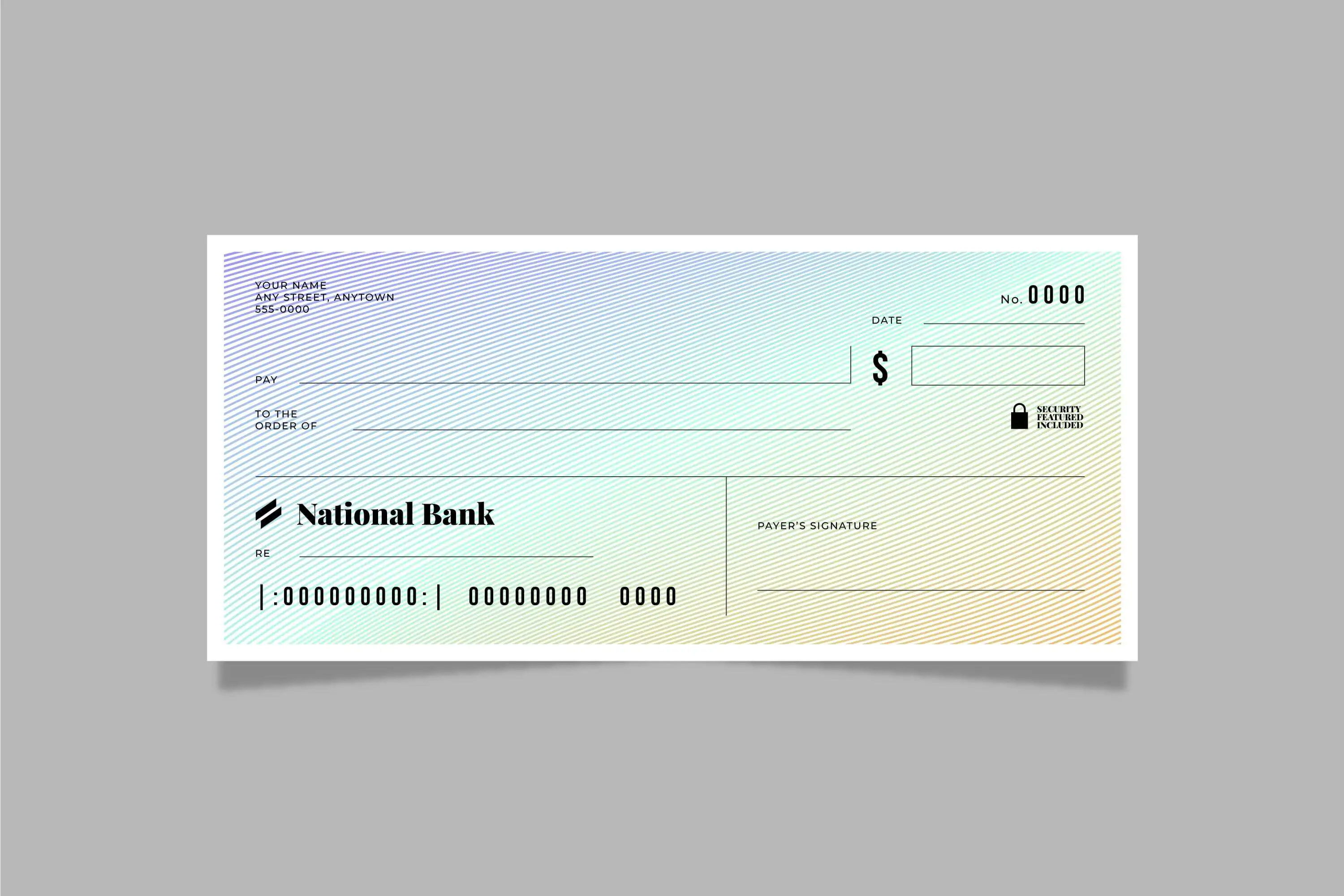

Cheque OCR (Cheque Optical Character Recognition). OCR technology transforms an image or PDF of a bank cheque into machine-understandable data. It helps extract key information such as the amount, payee, date, and cheque number. OCR technology simplifies daily banking tasks, making them more efficient and accurate.

How Cheque OCR Works

OCR technology has revolutionized the banking sector by automating cheque processing. The process involves several key steps:

Image Uploading

Uploading high-resolution images or PDFs of a cheque involves using scanners or cameras. When a user submits the document for a service, the scanner or camera captures the document.

Pre-Processing

- Noise Reduction : Think of it like a magic eraser for your cheque's image. It gets rid of all those stray marks, smudges, and background noise that can confuse the computer. We want the important stuff

- Contrast Adjustment:Contrast Adjustment does just that! It makes the text pop, separating it from the background and making it nice and crisp

- Skew Correction: when you take a picture, the cheque might be a little tilted or off-center. Skew Correction swoops in and straightens everything out, making sure all the lines are nice and neat for the computer to read.

Text Recognition

OCR technology identifies numbers and characters through the utilization of specialized algorithms.

- Character Segmentation : breaking down the entire block of text on your cheque into individual letters and numbers. Now the computer can handle each piece separately.

- Pattern Recognition : compares each segmented character to a vast library of patterns it knows, like letters of the alphabet and different fonts. It's like a matching game, finding the best fit for each piece.

- Context Analysis: it considers the surrounding information on the cheque, like where certain types of information typically appear, to make sure the letter or number is recognized correctly. This is especially helpful for handwritten text that might be a bit messy.

Data Extraction

After recognizing data from the cheque, the next step is to extract specific details.

- Field Identification : The software identifies specific fields on the cheque based on predefined templates and patterns. Key fields include:

- Amount: The numerical value of the cheque.

- Payee: The individual or organization designated to receive the funds specified on the cheque.

- Date: The date the cheque was issued.

- Cheque Number: The unique number identifying the cheque.

- Bank Details: Such as the account number and routing number.

- Pattern Matching : Uses regular expressions and predefined rules to locate and extract text patterns that match the specified fields.

- Natural Language Processing (NLP) : Helps in identifying and extracting contextual data, improving the accuracy of fields like payee names and handwritten amounts.

This extraction process involves parsing through the text and identifying predefined patterns or structures corresponding to the desired data fields.

Data Validation

Once the relevant data fields are identified and extracted, the OCR software may further process the data to ensure accuracy and consistency. This may involve performing validation checks to verify the extracted information against predefined rules or reference databases. Additionally, the extracted data may be formatted and structured according to a standardized schema for easy integration with downstream systems or applications.

- Cross-verifying : The data extracted from the document is checked against the existing database and rules to ensure its accuracy and completeness. For example:

- Bank Databases: Validate account numbers and routing numbers against official bank records.

- Customer Records: Cross-check the payee's name and details with existing customer information to confirm legitimacy.

- Historical Data: Compare cheque numbers and amounts with previous transactions to detect any discrepancies or potential fraud.

- Error Correction : Automatically corrects common errors, such as misrecognized characters or misplaced decimal points, based on contextual information and standard formats.

Benefits of Cheque OCR

- Increased Efficiency :It is true that when data is written by humans, it takes a lot of time and mistakes are made, but instead of that, by introducing OCR technology, the data is directly extracted and helps to save time and increase accuracy and clarity.

- Reduced Errors :As data is extracted directly from documents, errors caused by direct data entry are reduced, and hence costs are reduced.

- Enhanced Security : OCR technology is leading the charge in security through its robust data validation capabilities. By cross-referencing extracted data with secure databases, it effectively identifies and prevents fraudulent activities.

- Customer Satisfaction : Using cheque ocr technology to provide timely service to users, this increases customer satisfaction and loyalty, which is crucial in a competitive banking environment.

- Cost Reduction : By automating the cheque processing workflow, banks can reduce their operational costs. The need for manual data entry is minimized, and resources can be allocated to more strategic tasks.

- Improved Record Keeping : A digital record of cheque becomes easier to collect and save as well as retrieve and manage as needed

Applications of Cheque OCR

- Banking Sector :Banks are the main users who benefit from cheque ocr technology. A lot of transactions are facilitated through cheque ocr processing. The Bank's customers are served very quickly and accurately.

- Corporate Finance :Businesses that handle numerous cheques regularly, such as retail companies and service providers, can streamline their financial operations with cheque OCR. This technology ensures that payments are processed swiftly, improving cash flow management.

- Government and Public Sector :By automating cheque processing with OCR technology, government agencies and public sector organizations can significantly improve efficiency in disbursing payments and grants. This ensures funds reach their intended recipients quickly and accurately, reducing delays and administrative burdens.

Future of Cheque OCR

The future of cheque ocr looks promising, with ongoing advancements in machine learning and artificial intelligence. These technologies are expected to enhance the accuracy and capabilities of OCR systems further. As cheque OCR continues to evolve, we can anticipate even greater efficiency, cost savings, and security in financial processes.

Conclusion

All the hassles of banking are simplified with cheque OCR technology. Banking process becomes simple by scanning the cheque and fetching the required information using a smartphone. Through this technology, customers' perspective towards banking processes is changing. It puts an end to the situation of not getting banking assistance on time. It also increases security and efficiency by verifying the extracted data.

Whether you are a bank, a business, or a government agency, adopting cheque ocr technology can significantly streamline your financial operations, saving time and money while ensuring precise and secure transactions. Embrace the future of financial processing with cheque OCR and experience the transformative power of automation.