Purpose of KYC in Banks and Financial Services

Banks and other financial institutions have strong KYC procedures in place to ensure that their clients are not involved in money laundering or the financing of criminal activities. These procedures include conducting thorough customer identification checks (KYC) to ensure that customers are who they say they are and that their transactions do not involve suspicious or illegal activity. The KYC process is a key part of a regulated company's compliance regime. It helps identify and mitigate any risks associated with unlawful activities. The process can also help protect the reputation and financial stability of the company. Background screening is an essential part of protecting a business from fraudulent activities. It is important to remember that any business can be a target for fraudsters, no matter how large or small. There are several ways that fraudsters can exploit a company, and one of the most common is through financial fraud and money laundering. By performing background screening on customers, you can help to mitigate these risks and protect your business.

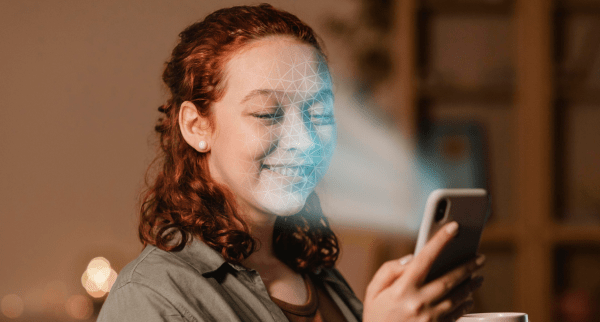

An effective KYC process for banks requires the presence of these key aspects: Customer Identification Program (CIP), Customer Due Diligence, and ongoing monitoring are essential. The Customer Identification Program attempts to ensure that banking institutions comply with laws by looking for reasonable reasons to believe that customers who enter into a formal banking relationship with them are recognizable. An organization wants to assess the extent to which a customer exposes the institution to a range of risks. The Customer Due Diligence (CDD) process includes gathering information about the customer. This information can include facts about the customer, such as their financial situation, business activities, and contact details. KYC is an important process to ensure that they are compliant with regulations. The collection of documents that prove identity can be a complex undertaking and, as such, businesses must be prepared to devote time and resources to ensure that all the necessary documents are collected and safeguarded. To maintain customer trust and security, it is important to establish and verify customer identity, screen the identity information, and take appropriate measures to protect against fraud. A bank needs to understand how a customer uses their accounts and their relationship with them, monitor the customer's activities associated with their finances, and observe and acknowledge any suspected discrepancies to ensure that they do not deviate from the expected behavior. KYC norms play an important role in establishing trust between a bank and its customers. They allow the bank to understand the nature of customer activities, which helps prevent fraud and losses. Additionally, banks can use KYC data to improve their marketing efforts and identify new customers who may be interested in their services.

Money laundering and terrorist financing are complex crimes that rely on exploiting loopholes in financial regulations. To combat this, many banks and other financial institutions have adopted anti-money laundering (AML) and Know Your Customer (KYC) procedures.

Who needs KYC these days?

Businesses and professionals are required to comply with specific regulations in order to operate. The types of businesses and professionals who fall under this category can vary, but typically include financial institutions and healthcare providers. Compliance with regulations is designed to protect the public from harm, and those who operate within the regulated sector are typically subject to rigorous oversight. KYC procedures are necessary to prevent money laundering and terrorist financing. Financial institutions and other companies that deal with money must comply with the Anti Money Laundering directives as per their jurisdictions. This requires a robust KYC procedure for onboarding new clients and timely reviews of existing clients.

This sector is highly regulated by the government, and there are many rules and regulations that must be followed. Despite the increase in regulated professions and business types, this regulated sector continues to grow. The regulated professions and businesses vary in their level of importance, but each has a role to play in the economy and society as a whole. Money laundering is the process of making illegally-gained proceeds look like they came from a legitimate source. This is done in an attempt to conceal the illicit origins of the money. Money laundering is a global problem, and it can be difficult to track down the criminals who are responsible for it. In order to combat money laundering, various international organizations have developed guidelines and regulations.