In 2025, finance teams are operating in an automated, real-time decision-making, and increasingly regulated world. As companies keep growing and going digital, manual processing of invoices is simply not feasible anymore. Having fast, accurate, and automated extraction of invoice data has never been more important.

With invoices coming in various forms PDFs, scans, emails, and electronic feeds pulling out relevant information with ease is the backbone of contemporary financial operations.

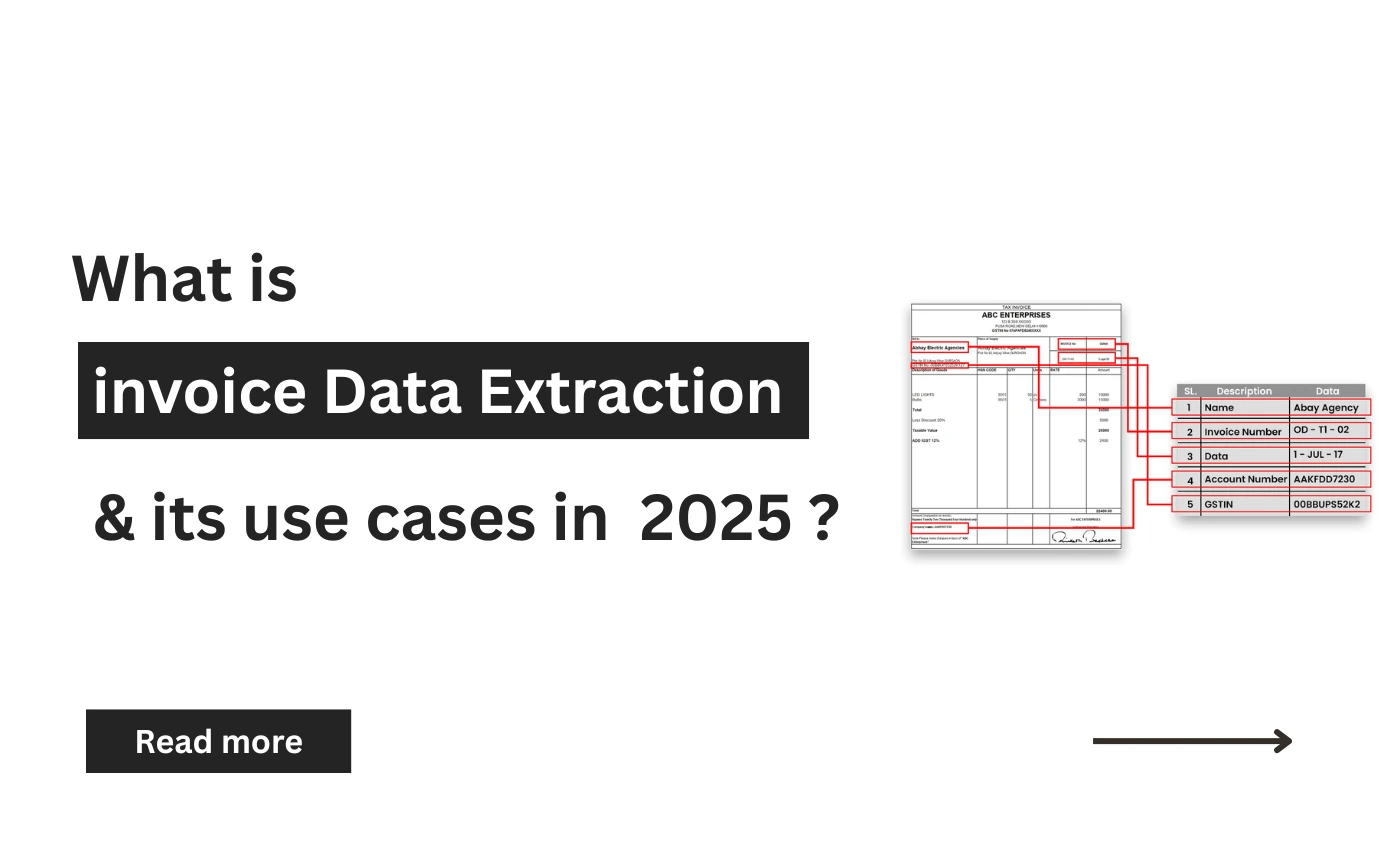

Invoice data extraction is the process of automatically identifying and capturing essential details from invoices, which follows:

Using invoice OCR (Optical Character Recognition) and AI, modern systems convert unstructured or semi-structured invoice data into structured, machine readable formats. This structured data can then be processed, analyzed, or integrated into financial platforms for decision-making and automation.

Tools like Pixl's invoice reader leverage AI and deep learning to intelligently extract data across languages, layouts, and formats making invoice processing accurate, scalable, and future ready.

The move to real-time finance in 2025 requires organizations not to waste time on delays brought about by manual data entry or uneven invoice formats.In short the Intelligent invoice processing allows for:

This is how businesses in 2025 use invoice data extraction to remain competitive:

With hyperautomation being a prime corporate trend, invoice extraction software is complemented with robotic process automation (RPA), AI, and no code platforms. This allows for end to end AP automation from receiving invoices to approval and payment through automation without any human intervention.

Extracted invoice information flows directly into business intelligence dashboards. CFOs and procurement leaders leverage the real-time visibility to track cash flow, optimize terms with vendors, and track category- or department-level spending instantly.

AI-based invoice readers are now able to identify anomalies such as duplicate invoices, odd tax rates, or suspect vendors. This lowers financial fraud and assists compliance teams in real-time.

By 2025, most organizations will have to monitor and report sustainability performance data. Invoice data extraction allows for classification of carbon offset expenses, renewable energy purchasing, or ethical sourcing from invoice line items

With increasingly connected global supply chains, companies require tools able to read data from invoices in multiple languages, currencies, and tax regimes. Multilingual invoice OCR enables international operations with auto-currency conversion and tax compliance tagging.

Visionary companies are incorporating extracted data into blockchain-ledgers for immutable audit trails. Structured and accurate data extraction is critical for bridging physical invoice data to smart contract execution.

In 2025, finance tech stacks are API-first and cloud-native.Invoice extraction software integrates smoothly with ERPs, procurement software, and AI assistants to allow for seamless workflows between departments.

Legacy OCR systems are being replaced by intelligent, AI powered invoice OCRthat:

As AI technologies continue to evolve, businesses no longer settle for tools that simply extract data they demand systems that interpret, adapt, and respond in real time. In this landscape, the effectiveness of invoice OCR is increasingly measured by two critical factors: precision and speed. These determine not only how accurately the data is captured, but also how quickly it can move through approval cycles and financial systems.

Solutions like Pixl’s invoice reader reflect this evolution, offering intelligent invoice data extraction that keeps pace with the demands of today’s digital enterprises ensuring every invoice is processed accurately, efficiently, and without delay.

As 2025 continues to accelerate digital transformation in finance, invoice data extraction is no longer a back office function it is a strategic capability. With use cases ranging from hyperautomation to ESG reporting, organizations that adopt intelligent invoice processing tools gain a competitive edge in speed, accuracy, and insight.

Whether you are looking to automate AP workflows, enhance compliance, or fuel real time analytics, invoice data extraction is the key to unlocking a smarter financial future.

Ready to transform? Commence your Digital Transformation journey now!

Get Started