Today we are living in a world, where financial transactions and online interactions are commonplace. Ensuring the security and authenticity of individuals and entities is more important than ever. The prime aspect of this security process is Know Your Customer (KYC) verification. KYC serves as the first line of defense against fraud, money laundering, and other illegal activities by verifying the identity of customers. Understanding the different types of KYC processes is essential for businesses and individuals alike to navigate the complex landscape of identity verification requirements.

What Is KYC?

KYC which stands for Know Your Customer, is a crucial process for banks and other financial companies. They have to follow KYC rules to check who their customers are and where they come from. This helps to stop bad activities like financial crime, money laundering, and funding terrorism. This guide will explain what KYC is, why it matters, and how businesses can follow the rules.

Why KYC is important?

UIDAI has set up rules called KYC regulations to protect customers and businesses from crimes and reduce the chance of fraud. In India, organizations like SEBI, RBI, and IRDAI watch over banks, financial companies, and insurance providers. They make sure that people's identities are verified according to certain rules.

These steps help companies understand their customers' financial activities to offer better service and manage risks effectively.

The rules require companies to:

- Make sure customers are who they say they are.

- Check where customers live.

- Use physical traits like fingerprints or facial recognition for verification.

- Confirm transactions with a one-time password.

Regulatory bodies may also assess customers' risk levels and check for money laundering to keep things safe.

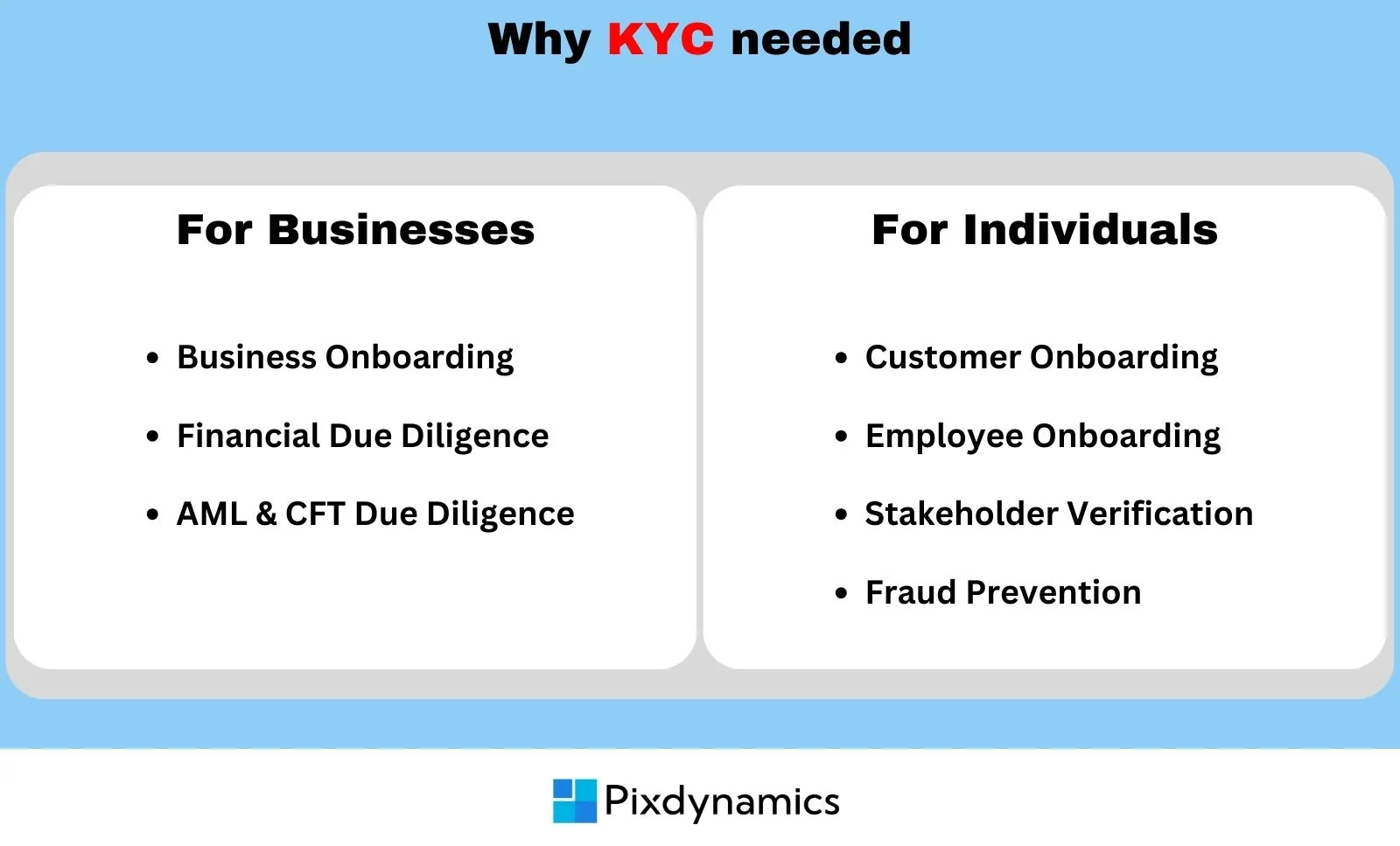

Why is it needed?

For individuals

- Make sure customers are who they say they are.

- Customer Onboarding :Financial institutions use KYC to confirm customer identities, meeting anti-money laundering rules and reducing legal and reputational risks.

- Employee Onboarding : KYC involves background checks for new staff to maintain a safe workplace, protect sensitive data, and uphold company trustworthiness.

- Stakeholder Verification :Businesses use KYC to verify key stakeholders' legitimacy, such as clients, partners, and investors, to meet legal requirements.

- Fraud Prevention :KYC helps minimize fraud risk, shielding organizations from financial losses, legal troubles, and damage to their reputation.

For businesses

- Make sure customers are who they say they are.

- Business Onboarding :KYC/KYB compliance ensures that businesses only engage with legitimate partners, supporting informed decision-making and guarding against risks like corruption or money laundering.

- Financial Due Diligence :Employing KYC/KYB solutions helps assess the financial health of partners, avoiding potential losses in return on investment, time, and reputation.

- AML & CFT Due Diligence :A robust KYC process is crucial for complying with anti-money laundering (AML) and countering the financing of terrorism (CFT) regulations. It helps combat fraud and prevents money laundering and terrorist financing

Proof of identity for KYC

What are the 4 elements of KYC?

The Company has framed its KYC policy incorporating the following four key elements

Customer Acceptance Policy

This outlines the criteria and conditions under which the company will accept customers. It defines the types of customers the company is willing to do business with and the circumstances under which potential customers may be rejected.

Customer Identification Procedures

These procedures detail how the company will verify the identity of its customers. This includes the types of documents or information required from customers to establish their identity and comply with regulatory requirements.

Monitoring of Transactions/ On-going Due Diligence

This involves continuously monitoring customer transactions to detect any unusual or suspicious activities. The company implements ongoing due diligence measures to ensure that customer profiles remain consistent with their expected behavior and to identify any changes that may indicate increased risk.

Risk Management

This component addresses the company's strategies for managing and mitigating risks associated with its customers and their transactions. It includes processes for assessing and categorizing the level of risk posed by different customers and transactions, as well as implementing controls and measures to manage those risks effectively.

Types of KYC

Offline kyc

Aadhaar paperless offline eKYC

Aadhaar Offline e-KYC involves users creating a password-protected XML file containing their Aadhaar data on the UIDAI website. They then share this file with the organization verifying their identity, along with the password.

Benefit: The main advantage of Aadhaar Offline e-KYC is that it is accessible to all private BFSI entities. Users can easily download the XML file and give their consent for its use in verifying their identity.

Physical KYC

Physical KYC or paper-based KYC involves customers submitting copies of their Proof of Identity (POI) and Proof of Address documents, which they have attested, to the relevant financial institutions. This process requires the customer to be physically present at the bank branch or financial institution when submitting the documents.

Benefit: This type of KYC can be very useful in rural areas like villages and smaller towns where both customers and institutions may not have access to digital services.

Online KYC

Aadhaar eKYC

There are two methods for Aadhaar verification: OTP-based and Biometric-based.

In OTP-based verification, users need to have their mobile numbers linked to their Aadhaar.

In Biometric-based verification, users must use UIDAI-approved biometric scanners to authenticate themselves.

Benefit: Aadhar e-KYC verification doesn't require user participation, resulting in improved user experience and ultimately higher conversion rates.

Digital KYC

Digital KYC typically entails taking a live photo of the customer along with Officially Valid Documents (OVDs). According to the RBI, authorized officials need to be physically present during the verification process and geo-tag the documents.

Benefit: This approach can offer significant cost savings as it primarily relies on digital processes, while also providing users with a smooth experience through a predefined digital pathway.

Central KYC

The Central KYC Registry is a centralized database of KYC records overseen by the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI). Through CKYC, users undergo KYC verification just once and receive a unique KYC Identification Number (KIN) afterward.

Benefit: Financial institutions gain improved accessibility, while customers benefit from not having to repeatedly provide the same information, ultimately enhancing their convenience.

Video KYC

VKYC entails customer onboarding via a video call. The process involves two steps: first, the customer submits their documents during the video call, and second, the call is reviewed to approve or reject the KYC.

Benefit: VKYC can significantly decrease customer onboarding time from days to minutes and lead to up to a 90% reduction in costs for financial institutions.

Read our blog to know more about Video kyc solution and how it transforms customer on boarding

ReKYC

ReKYC is the process where banks periodically update their customers' information to ensure that their KYC records remain current at certain intervals. Through ReKYC, any changes in customers' addresses or other details such as phone numbers are regularly updated, ensuring that customer information remains up to date.

What are the Benefits of KYC?

KYC, or Know Your Customer, offers several benefits to both businesses and individuals:

- Enhanced SecurityBy verifying the identity of customers, KYC helps prevent fraud, money laundering, and other illegal activities, thus ensuring a safer environment for financial transactions

- Regulatory Compliance :KYC helps businesses comply with legal and regulatory requirements by ensuring that they have accurate information about their customers, which is necessary for anti-money laundering (AML) and counter-terrorism financing (CTF) efforts.

- Risk Mitigation :By understanding their customers better through KYC processes, businesses can assess and manage risks more effectively, thus reducing the likelihood of financial losses and reputational damage

- Improved Customer RelationshipsKYC helps businesses build trust with their customers by demonstrating their commitment to security and compliance. It also streamlines the onboarding process, leading to better customer experiences.

- Operational EfficiencyImplementing KYC processes can streamline operations by automating identity verification processes, reducing manual efforts, and speeding up customer onboarding.

Overall, KYC plays a crucial role in maintaining the integrity of financial systems, protecting businesses and individuals from financial crimes, and fostering trust between customers and businesses.