What is Rekyc?

Re-KYC is the process employed by banks to verify and update a customer's information, including documents and contact details, originally collected during the opening of a bank account, ensuring that it remains current and accurate.

Dynamic Re-KYC Compliance

Banks do Re-KYC to ensure the information they have about their customers is accurate and current. They check things like documents, contact details, and addresses. This is done regularly as per RBI rules. Banks need to be careful and consider the level of risk when doing this. The RBI guidelines say regulated entities should regularly update KYC using a risk-based approach.

For high-risk customers, KYC should be updated every two years. For medium-risk customers, it should be updated every eight years. And for low-risk customers, it should be updated every 10 years. ReKYC can be done digitally to make the process easier and ensure accurate data updates.

Customer Types

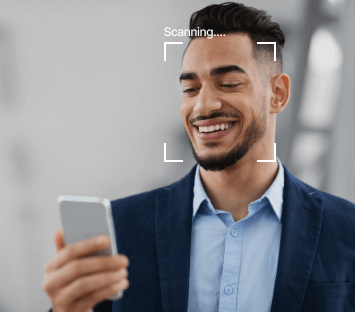

How does Pixl

Rekyc platform

works

Key features of Pixl Re-kyc solution

Verifies Customer information

Ensuring the accuracy of customer data is a critical task that involves systematic checks and updates to maintain the integrity and reliability of information within a database or system. This process typically includes thorough examination and validation of customer details, such as contact information, preferences, and transaction history.

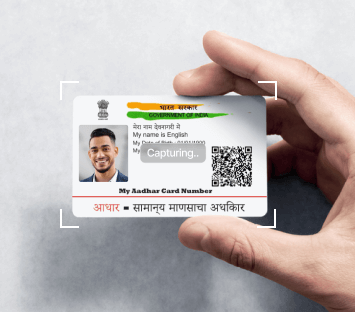

Paperless Process

Digitizing Know Your Customer (KYC) processes is a game-changer in the financial world. By using advanced digital tools,institutions can make KYC procedures faster and more efficient, ditching the heavy reliance on paperwork. This shift not only boosts operational efficiency but also aligns with environmentally friendly practices.

Customized Workflows

Empowering customers to update their information through tailored workflows involves the implementation of customized processes and interfaces that seamlessly guide individuals through the task of updating their personal details.

Compliance

Assisting businesses in maintaining compliance with regulatory standards is crucial for their sustained success and reputation. This includes adherence to regulatory requirements established by authoritative bodies such as the Reserve Bank of India (RBI).

Client Reactivation

Assists in reactivating dormant clients, unlocking business potential. Utilizing effective communication channels and employing relationship-building strategies fosters trust and re-establishes the brand's relevance, enticing dormant clients to re-engage.

Various Industries

Used in banking, financial services, telecommunications, and more for efficient data management.

our benefits

Benefits of our Re-KYC solution

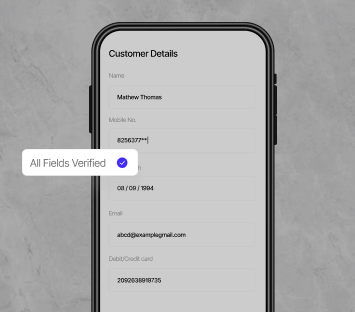

Verify & update customer information

Confirm and refresh essential customer data, including identification details, contact information, and financial records.

Streamline KYC processes

Simplify KYC procedures, reducing paperwork and manual effort while ensuring regulatory compliance.

Reactivate dormant customer accounts

Revive and re-engage with inactive customer accounts to maximize business opportunities.

Automate data updates

Implement automated systems to seamlessly refresh customer information, reducing the need for manual intervention.

Utilize customized workflows

Employ tailored workflows that match the specific needs and preferences of individual customers.

Register nominees

Facilitate the process of appointing nominees for customer accounts, ensuring smooth succession planning.

RegisFacilitate Demat account changes

Enable customers to efficiently modify their Demat (Dematerialized) accounts, which hold securities in electronic form.

Ensure data accuracy

Maintain the precision and correctness of customer information to enhance decision-making and regulatory compliance.

Enable online account closure

Provide customers with a digital method to close their accounts, ensuring convenience and efficiency in the process.

Keeping the ecosystem updated

Keep all customer databases and records up-to-date to ensure accuracy and compliance in all business operations.

FAQS

Frequently Asked Questions

Re-KYC stands for "Re-Know Your Customer." It's a process to verify and update customer information regularly. It's crucial for businesses to maintain accurate customer data to comply with regulations and minimize fraud.

The frequency of Re-KYC depends on the risk profile of the customer. High-risk customers may need updates every two years, while medium-risk customers may require updates every eight years. Low-risk customers can update every ten years.

Yes, Re-KYC is mandatory for businesses regulated by financial authorities like the RBI to ensure compliance with anti-money laundering (AML) and customer due diligence (CDD) regulations.

Re-KYC solutions streamline the customer data update process, reduce paperwork, enhance security, and help reactivate dormant customer accounts, unlocking business potential.

Re-KYC typically involves collecting updated customer information, verifying it, and storing it securely. Many solutions use digital methods such as video-based KYC for convenience.

Yes, customer consent is typically required for any updates or changes to their information. It ensures compliance with data privacy regulations.

Non-compliance with Re-KYC may result in account restrictions, closure, or the inability to access certain services,depending on regulatory requirements and business policies.

Yes, Re-KYC can be done digitally, making the process more convenient for customers. We can use secure forms, document uploads, and other digital verification methods.

Re-KYC solutions should employ robust security measures, including encryption and data access controls, to protect customer information from unauthorized access or breaches.

No, there is no need to fill the Re-KYC form or any kind of forms