Table of content

Digital id verification involves the verification of online identities to ensure the existence of individuals with digital personas. This process authenticates the claimed identity, investigates reputation, and serves to prevent fraud, manage risks, and ensure compliance.

Identity is characterized as the essence of an individual, encompassing the distinctive qualities that set them apart from others. It comprises both enduring features such as date of birth, ethnicity, and fingerprints, as well as semi-permanent attributes like height, weight, eye color, and name.

Utilizing a digital id verification service provides a swift and dependable method to establish trust in remote business interactions. This capability enables organizations to securely deliver services and conduct transactions for customers on a global scale.

What is digital identity verification?

Biometric verification, face recognition, and digital id document verification are instrumental methods for authenticating the identity of individuals in the digital realm. These technologies play a crucial role for companies, governments, and financial institutions in verifying the identity of individuals conducting online transactions.

Utilizing Digital id verification dbecomes essential when individuals and their identification documents are not physically available. Moreover, this approach serves to expedite ID verification processes, exemplified by technologies like e-gates that swiftly scan passports at airports.

Digital Id Verification Best Practices For Financial Institutions And Fintechs

Digital id verification must seamlessly integrate into the entire customer journey, encompassing the onboarding of new customers, interactions with returning customers, and the approval of high-risk transactions. Notably, existing Know Your Customer (KYC) and identity fraud prevention solutions face challenges in effectively addressing customers with limited digital footprints and thin files.

To effectively control fraud, financial institutions and Fintech companies must adhere to digital identity verification best practices. These practices are essential for enhancing security measures and ensuring the integrity of online financial transactions.

Best Practices for Digital Id Verification

Formulating best practices for digital id verification is crucial in enhancing your organization's verification procedures. Below are the recommended practices that businesses should adhere to:

Multiple Verification Methods:

Using just KYC and KBA is inadequate to prevent fraudsters. All industries rely on two-step verification as a fundamental standard. To boost security and reliability, employ multiple digital ID verification methods for enhanced accuracy.

Stay Up-To-Date With Regulations:

Staying updated with regulations is the best way to keep up with digital identity verification . These include KYC and AML requirements. Stay up to current laws and ensure the organization complies to avoid loss and legal penalties.Third-party verification solutions such as DIRO document verification help enhance the digital ID verification process and comply with regulations.

Verify Users

Customer verification needs to be part of every step of the customer journey. Not just onboarding but continuous monitoring and transaction monitoring should be implemented.Fraudsters build perfect synthetic identities to trick the onboarding processes. This is why financial institutions and FinTechs must implement continuous onboarding to monitor customers.

Ensuring Compliance in Digital Identity Verification

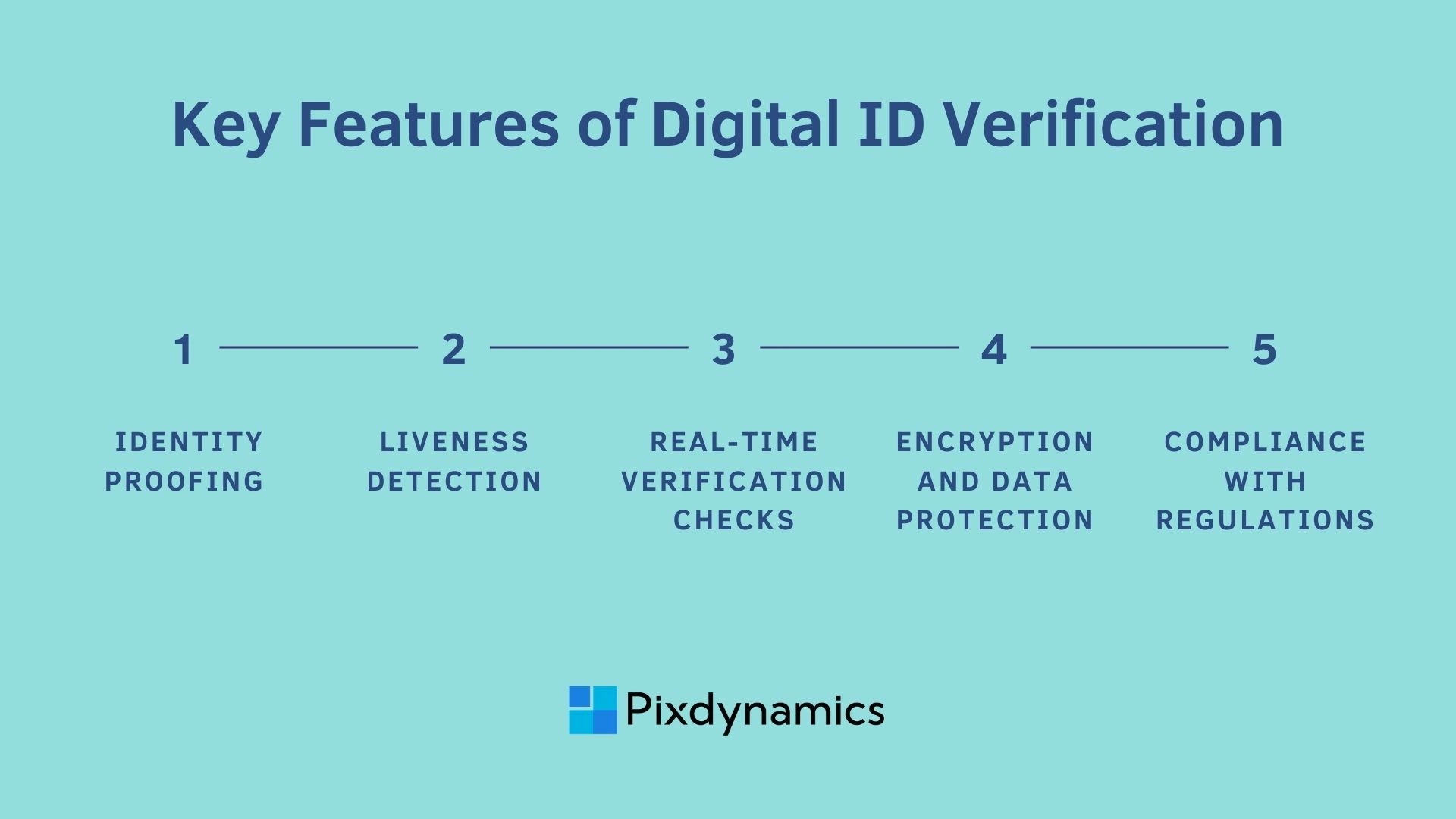

Ensuring compliance in digital id verification involves implementing processes and technologies to adhere to relevant laws, regulations, and industry standards while verifying the identities of individuals in online transactions or interactions. This is crucial for preventing fraud, ensuring security, and maintaining trust in digital transactions. Here are key aspects to consider when ensuring compliance in digital identity verification:

Regulatory Compliance

- Know Your Customer (KYC) Regulations: Understand and comply with KYC regulations that require businesses to verify the identity of their customers. KYC regulations vary by jurisdiction, and compliance is essential to prevent money laundering, terrorist financing, and other illicit activities.

- Data Protection LawsAdhere to data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in the European Union or other regional data protection regulations. Ensure that customer data is handled securely and with respect to privacy rights.

Secure Data Handling:

- Encryption: Implement strong encryption protocols to protect sensitive customer information during transmission and storage. This helps prevent unauthorized access to personal data.

- Data Minimization: Collect and retain only the necessary information required for identity verification. Minimizing data reduces the risk of misuse and aligns with privacy principles.

Audit Trails and Documentation

- Auditability : Maintain detailed audit trails of identity verification processes. This helps demonstrate compliance and provides a record in case of audits or investigations

- Documentation: Document your identity verificationprocesses and procedures, including how they align with regulatory requirements. This documentation can serve as evidence of compliance

User Consent and Transparency

- Informed Consent: Obtain clear and informed consent from users before collecting and verifying their identity information. Clearly communicate the purpose, methods, and implications of identity verification.

- Transparency: Be transparent about how identity verification is conducted, what information is collected, and how it will be used. Transparency builds trust and helps demonstrate compliance with privacy regulations.

Ongoing Monitoring and Updates

- Continuous Compliance Monitoring: Regularly review and update your identity verification processes to ensure ongoing compliance with changing regulations and security best practices.

- Risk Assessments: Conduct risk assessments to identify and mitigate potential risks associated with digital identity verification processes.

Third-Party Providers

- Due Diligence: If using third-party identity verification services, conduct thorough due diligence to ensure they comply with relevant regulations. Assess their security measures, data protection practices, and overall reliability.

Benefits of Digital Identity Verification

Enhanced Security

- Fraud Prevention: Digital identity verification helps prevent identity theft and fraudulent activities by ensuring that individuals are who they claim to be. This is achieved through the use of multi-factor authentication, biometrics, and other advanced verification methods, making it more difficult for malicious actors to impersonate legitimate users.

- Secure Data Transmission: By implementing encryption and secure channels for transmitting and storing identity information, digital identity verification enhances the overall security of sensitive data. This reduces the risk of unauthorized access and data breaches, contributing to a more secure online environment.

Seamless User Experience

- Efficiency and Speed: Digital identity verification processes can streamline onboarding and authentication procedures, reducing the time and effort required from users. This creates a more efficient and user-friendly experience, as individuals can quickly and easily access online services without lengthy manual processes.

- Reduced Friction: Traditional identity verification methods, such as manual document checks, can be cumbersome and time-consuming. Digital identity verification, especially when incorporating biometrics or mobile-based solutions, minimizes friction in the user experience, leading to higher customer satisfaction and increased user adoption.

Compliance with Regulations

- KYC and AML Compliance: Many industries are subject to regulations that require businesses to implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Digital identity verification provides a systematic and auditable way to meet these regulatory requirements, ensuring that businesses can verify the identities of their customers and comply with legal standards.

- Data Protection and Privacy Compliance: Digital identity verification systems can be designed to align with data protection and privacy regulations, such as GDPR. By incorporating privacy-enhancing features, providing transparency in data handling, and obtaining user consent, businesses can demonstrate their commitment to protecting customer information.

- Auditability: Digital identity verification processes often generate audit trails and records, facilitating compliance audits. This auditability is valuable for regulatory authorities and internal compliance teams, allowing them to verify that the identity verification processes adhere to established standards.

How does liveness detection work?

Ensuring the integrity of facial biometric processes involves preventing spoofing and fraudulent activities. A prevalent spoofing method involves presenting a static image acquired earlier, posing a threat to the comparison with the trusted source image. To address this vulnerability and verify the physical presence of the individual, various liveness detection methods come into play.

Diverse liveness detection approaches are accessible in the current market. A widely adopted method prompts users to perform a series of head movements as evidence of their liveness. However, more advanced techniques like 3D recognition and thermal imaging necessitate specialized hardware, making them impractical for everyday commercial applications.

Conclusion

Establishing consumer trust is paramount for businesses, and failure to do so can lead to significant revenue loss. The imperative for stringent authentication practices arises from the vulnerability of inadequate identity verification systems, which cybercriminals exploit to compromise consumer identity and tarnish brand reputation.To mitigate these risks, businesses should explore robust Customer Identity and Access Management (CIAM) solutions. These solutions play a crucial role in securely verifying user identities, providing a protective barrier against cyber threats, all while ensuring a seamless user experience.