HOW WE STAND OUT

Exclusive Benefits, Assured by None

01

Secure Onboarding

ID verification APIs facilitate seamless and effortless onboarding by aiding in the establishment of accelerated validation processes.

Immediate verification is seamlessly achievable through our real-time procedure .

02

Real-Time Verification

The ID verification processes on is a real-time API platform assure the legitimacy of individuals, completely eradicating any chance of identity theft..

Immediate verification is seamlessly achievable through our real-time procedure .

03

Accurate Authentication

The verification process is executed through the Fast and Secure Authentication ID Verification API autonomously,without reliance on third parties. This expedites the digital customer onboarding process, thereby enhancing the security of the digital platform. Employing web app firewalls and API gateways proves effective in curbing a significant portion of fraudulent activities and minimising online risks.

04

Reduced TAT for Vital Processes

The simplified user onboarding process and smooth digital KYC significantly enhance enterprise productivity and efficiency, leading to an impressive reduction in Turnaround Time (TAT) by up to 50% and a decrease in operating expenses ranging from 85% to 90%.

01

Secure Onboarding

02

Real-Time Verification

03

Accurate Authentication

04

Reduced TAT

CHECK OUT

Verification APIs

Implement automated ID document verification to onboard new customers 24/7 and strengthen regulatory compliance within your industry.

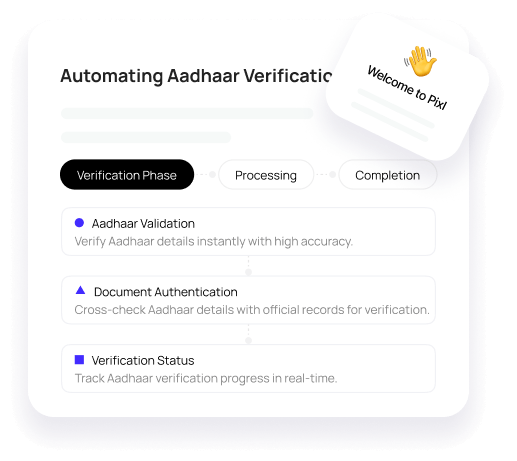

Aadhaar Verification

An Aadhaar Verification API enables businesses to authenticate Aadhaar cards by cross-referencing demographic details and performing biometric authentication against the Aadhaar database. These solutions help ensure the reliability and integrity of information submitted by individuals and strengthen the accuracy and security of identity verification processes. Integrating Aadhaar verification helps businesses build customer confidence, minimize the risk of identity fraud, and ensure adherence to legal standards.

Read moreGuarantees the reliability and integrity of the information submitted by individuals

Reinforces the assurance of accuracy in identity verification

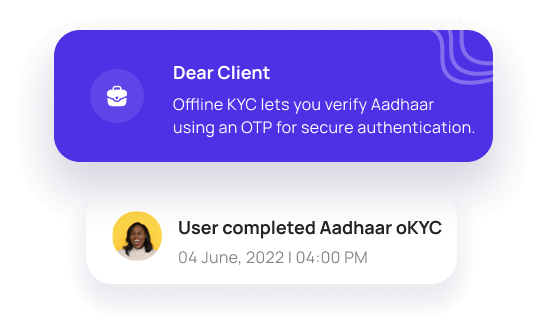

Aadhaar oKYC Verification

Offline KYC allows them to verify their Aadhaar details by utilising a one-time password (OTP) sent directly to their mobile phones. This step ensures a secure and efficient verification process. Read more

Upon successful OTP authentication, the financial institution gains access to the customer's Aadhaar data. This information contains essential details such as demographic information, a photograph, and the registered address.

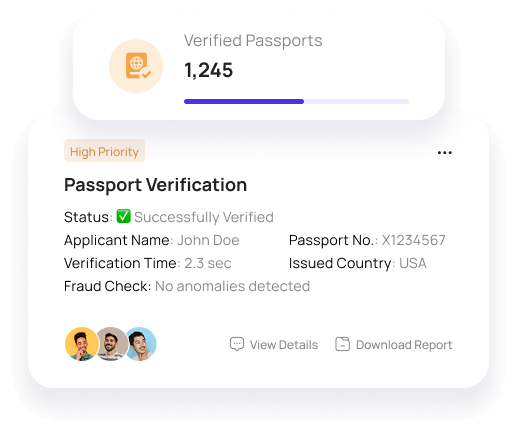

Passport Verification

A Passport Number Verification API allows businesses to seamlessly and securely validate the authenticity of passport details provided by users. By integrating such solutions, organizations can efficiently verify client identities, strengthen compliance measures, and protect against fraudulent activities ensuring greater confidence in the legitimacy of customers. Read more

Identity verification is designed for practicality, offering a reliable and safe approach for organisations and businesses.

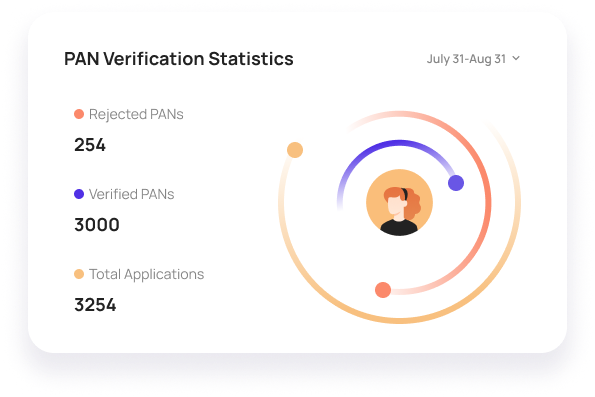

PAN Verification

The PAN Verification API streamlines online PAN card verification, offering a reliable and accessible solution. Easily integrated, it ensures accuracy and compliance, enhancing efficiency in customer information verification. Read more

Businesses benefit from improved reliability in identity checks, fostering secure and efficient digital transactions.

The API verifies PAN cards for individuals, safeguarding against fraud and illegal activities.

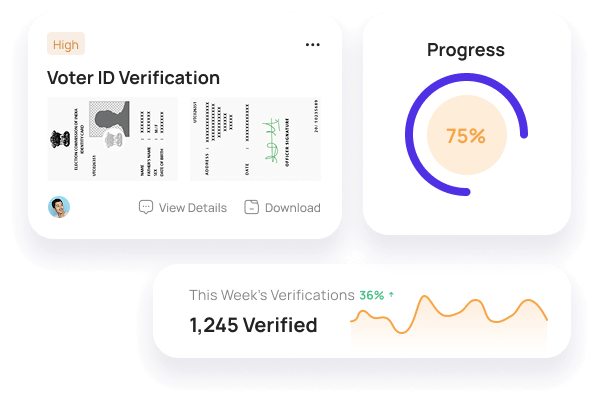

Voter ID Verification

Elevate your identity verification process with advanced Voter ID Verification API. In India, a Voter ID is not just a card; it's a crucial document for citizens. Whether you're a financial institution, business, or government entity,our API, unlike the competition, ensures swift access to essential details such as names, ages, and addresses. Read more

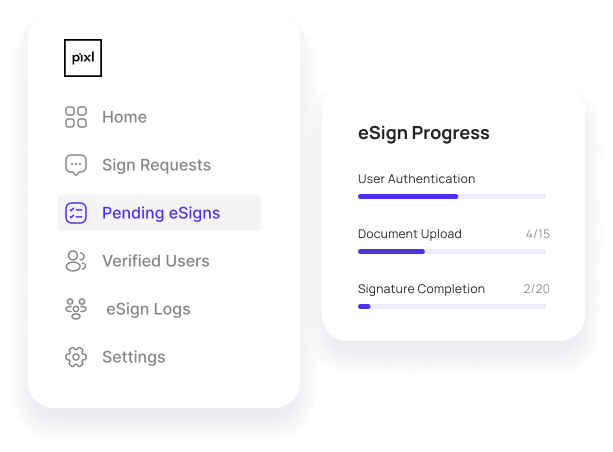

Aadhaar eSign Verification

Aadhaar eSign Verification lets you electronically sign documents securely using your Aadhaar credentials. It adds extra authenticity to digital signatures by using the unique identification provided by Aadhaar. Read more

Integrating Aadhaar eSign Verification can help businesses streamline document signing, improve security, and meet regulatory standards.

This user-friendly solution makes it easier to authenticate signatories and creates a smoother digital documentation experience.

01

Integration

Begin by integrating the ID verification API into your system or application. This often requires obtaining an API key and incorporating the necessary code.

02

User Input

Collect the user's identification information through your interface. This may include documents like ID cards,passports, or driver's licence.

03

Document Capture

Use the API to capture and upload images of the user's identification documents. The API will then analyse these images to extract relevant information.

04

Validation & Authentication

The extracted data is validated against predefined rules. The API checks document authenticity, security features, and watermarks to ensure compliance.

05

Validation & Authentication

The API generates a verification result confirming if the ID is valid or not. This enables businesses to make secure,informed decisions based on user identity.

06

Data Extraction

OCR and AI extract key details like name, DOB, and document number. The system ensures accuracy, reducing errors and streamlining identity verification.

07

Feedback to User

Notify users instantly about their verification status. If needed, request additional details to complete authentication and prevent verification failures.

08

Record Keeping

Maintain records of the verification results for compliance and audit purposes. This step ensures a traceable history of the verification process.

09

Decision Making

Based on your use case, use the verification result to take action. This may include granting access, processing transactions, or flagging risks.

Onboarding new customers

When a new customer opens an account with a bank, brokerage firm, or other financial institution, the institution needs to verify their identity to comply with know-your-customer (KYC) regulations. Identity verification APIs can be used to automate this process, which can save time and money.

Bank customer opening an account

Preventing fraud: Identity verification APIs can be used to prevent fraud by verifying that the person who is using a credit card or making a purchase is the authorised user. This can help to reduce losses from fraud and protect businesses from liability.

Online shopping fraud

Age gating: Identity verification APIs can be used to age gate websites and services that are restricted to adults. This can help to protect children from accessing harmful content.

Age gating for online gambling

Employee onboarding: Identity verification APIs can be used to verify the identity of new employees, which can help to prevent identity theft and ensure that only authorised employees have access to sensitive information.

Employee onboarding process

Renting an apartment or applying for a loan: When renting an apartment or applying for a loan, individuals may need to verify their identity to the landlord or lender. Identity verification APIs can be used to automate this process, which can make it more convenient for both parties.

Renting an apartment

Identity verification APIs can also be used in a variety of other industries, such as healthcare, education, and government. The specific use cases for these APIs will vary depending on the industry and the specific needs of the business.

See How Industries Leverage Identity Verification APIs

Identity verification APIs can be used to verify the identity of patients, which can help to prevent medical identity theft. They can also be used to verify the credentials of healthcare providers, which can help to ensure that patients are receiving care from qualified professionals.

Education: Identity verification APIs can be used to verify the identity of students, which can help to prevent cheating and ensure that only authorised students have access to educational resources. They can also be used to verify the credentials of educators, which can help to ensure that students are receiving instruction from qualified teachers.

Government: Identity verification APIs can be used to verify the identity of citizens, which can help to prevent fraud and protect against identity theft. They can also be used to verify the eligibility of citizens for government benefits,such as social security or unemployment benefits.

As the use of online services continues to grow, the demand for identity verification APIs is likely to increase. These APIs can help businesses to comply with regulations, prevent fraud, and protect their customers.

Healthcare

Patient identity verification in healthcare

Student identity verification in education

Government identity verification

Advanced OCR powered by AI for all government-issued IDs

Advanced OCR powered by AI for all government-issued IDs

Verify customer identity by matching their selfie with the image on their ID card

Real-time API for instantaneous verification.

FAQS

Frequently Asked Questions

An ID Verification API serves the primary purpose of ver++++ifying the identity of individuals in real-time during online interactions.

Biometric authentication adds an extra layer of security by using unique physical or behavioural traits, such as fingerprints or facial recognition, to confirm an individual's identity.

Common challenges during integration include system compatibility issues, data migration complexities, and ensuring a smooth user experience.

Regulatory compliance ensures that businesses adhere to legal standards, protecting both the organisation and the individuals whose identities are being verified.

API customization involves tailoring the verification process to align with specific business requirements, ensuring a more personalised and efficient user experience.