Video KYC Solution For Online Identity Verification

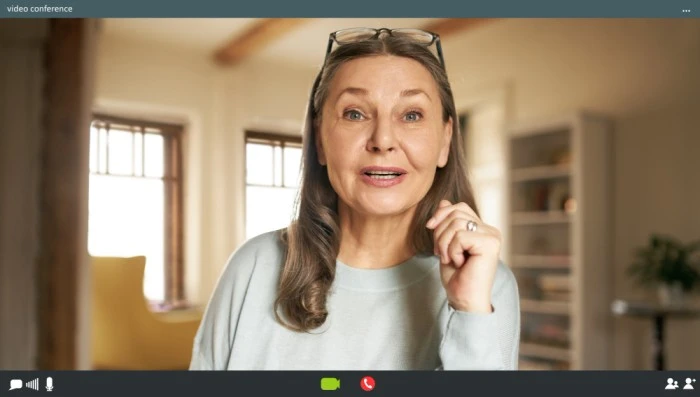

Video KYC (V-CIP) serves as a virtual approach to conducting face-to-face identity verification, a valuable resource employed by businesses to authenticate customers' identities through video calls facilitated by agents.

Within this interaction, customers furnish their identity documents to establish and validate their personal information. Video KYC streamlines the KYC process, affording customers the ease of finalizing it from the comfort of their residences.

With just a few simple clicks, customers can initiate and finalize the video KYC procedure, subsequently affirming their identity through a prearranged video session. video kyc have various other use cases.

.webp)