Introducing Pixl eKYC Solution

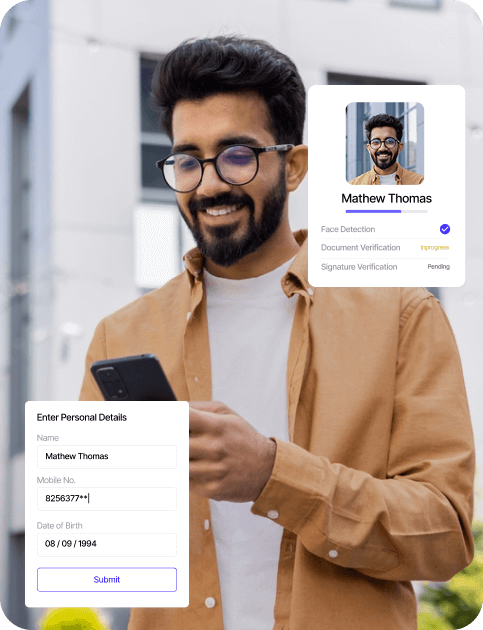

Our self registered eKYC solution refers to a KYC process where the customer does not require any assistance from the bank. This type of verification can be completed entirely online, using a customer's digital identity and documents. This eKYC software typically involves the use of biometric authentication and document verification technology. A customer can submit their personal information, such as name, date of birth, and address, and then upload a government-issued ID card or passport.

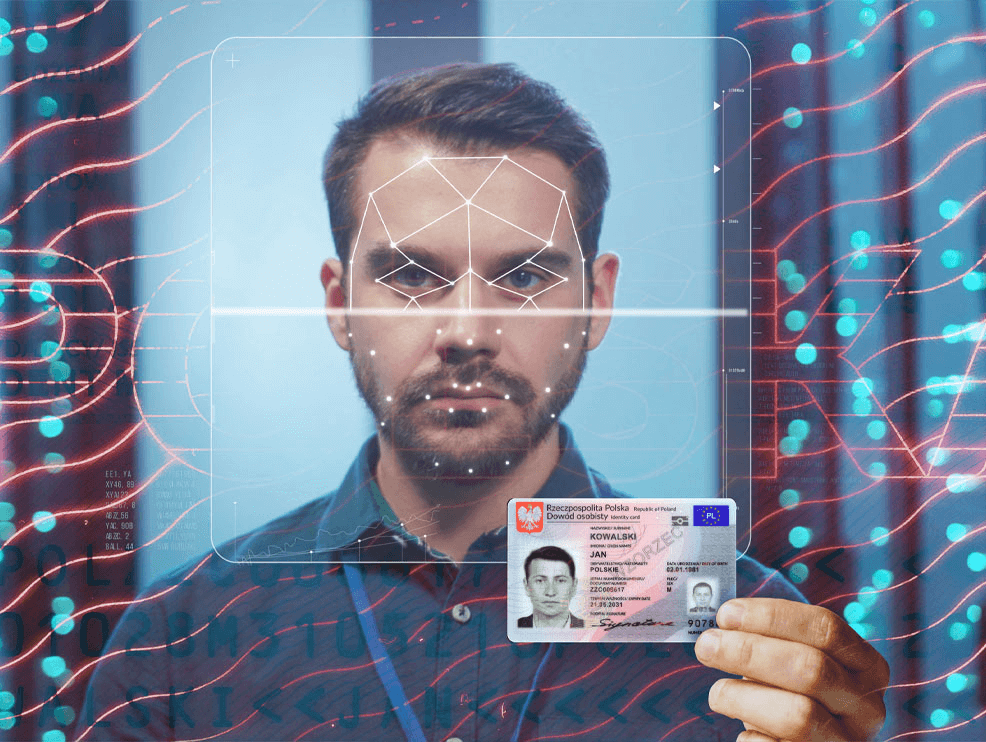

The technology matches the customer's face to their ID,ensuring

authenticity. This fast, cost-effective eKYC eliminates the need for branch visits.

Advantages of eKYC online service Integration

Verify Customer Identity Instantly

Pixl offers a secure eKYC platform that helps you to quickly and easily verify customer identity online. Our platform is designed to provide a hassle-free experience with minimal complexity.

Improved Efficiency

With eKYC Solution, banks can complete the verification process in real-time, which saves time and effort for both customers and bank staff. This also enables banks to onboard new customers faster, which is crucial in today's fast-paced business environment.

Low Cost Provider

Pixl eKYC service reduces the need for bank staff to perform manual verification tasks, such as document verification and face-to-face interactions. This results in reduced time & cost savings for banks, which can be passed on to customers in the form of lower fees or better products and services.

Enhanced Customer Experience

Pixl offers a convenient and seamless experience for customers, allowing them to complete the verification process from the comfort of their homes or offices. This also eliminates the need for customers to visit bank branches

Enhanced Customer Experience

Pixl offers a convenient and seamless experience for customers, allowing them to complete the verification process from the comfort of their homes or offices. This also eliminates the need for customers to visit bank branches

How Does the eKYC Platform Work?

User Initiation

The user starts eKYC online or via an app, providing their name, date of birth, and mobile number.

Document Submission

The user starts eKYC online or via an app, providing their name, date of birth, and mobile number.

Biometric Verification

The user’s biometrics (face, voice, or fingerprint) are verified against government records for identity authentication.

Verification Completion

If verified, eKYC is complete, and the user is onboarded. If failed, additional info or Full KYC may be required.

Account Opening Form Validation for Seamless eKYC Compliance

Our Account Opening Validation ensures accurate, compliant, and seamless bank onboarding with thorough checks.

eKYC Solution Process Flow

FAQS

Frequently Asked Questions

eKYC solution is an electronic Know Your Customer (KYC) process that allows customers to verify their identity remotely using an online platform or mobile application without the assistance of a customer service representative.

eKYC solutions provide several benefits, including improved customer experience, faster verification times, and reduced costs for organizations. Customers can complete the KYC process from the comfort of their homes without the need for physical documents or visits to verification centers, resulting in faster onboarding times and increased convenience.

Customers typically need to provide personal information such as their name, date of birth, mobile number and signature.They may also be asked to upload a scanned copy or a picture of their government-issued identity document such as passport,PAN card (optional). Additionally, they may be required to undergo a biometric verification process such as facial recognition, voice recognition.

Self-service eKYC solutions use advanced encryption and security protocols to safeguard customer data and prevent fraud. However, there are still risks associated with the process, such as cyber-attacks and data breaches. It is essential for organizations to implement robust security protocols and compliance measures to protect customer data and prevent fraud.

The time taken for an eKYC process depends on various factors such as the complexity of the verification process and the quality of the customer's data. However, the process is typically faster than traditional verification methods, and customers can complete the process within a few minutes.

The eligibility for eKYC may vary depending on the services offered by the organization. Some services may require additional verification or documentation, depending on the regulatory requirements and the policies of the organization.