Before we dive into re-KYC, let's establish a solid understanding of what KYC is. KYC stands for "Know Your Customer," and it's a regulatory and legal requirement in the financial industry. The primary goal of KYC is to verify the identity of customers, assess their risk, and ensure that they're not involved in any illicit activities, such as money laundering or fraud. When you open a bank account or engage in financial transactions, your bank will typically ask you to provide certain documents and information to complete the KYC process. This information can include your name, address, identification documents like a passport or driver's licence, and more.

The Significance of KYC - A Pillar of Banking

As a customer of a bank, you're no stranger to the acronym "KYC," which stands for "Know Your Customer." KYC is a fundamental cornerstone in the world of banking, and its importance cannot be overstated. This critical process serves as the bedrock upon which the entire banking system is built. At its core, KYC is designed to ensure that financial institutions possess and maintain accurate and up-to-date information about their customers. It's the first line of defence against a multitude of risks and is essential for the smooth and secure functioning of the financial industry.

The KYC Journey: A Brief Overview

When you first engage with a bank, whether to open an account, apply for a loan, or invest in financial products, you're asked to provide certain personal information and documentation. This includes your name, address, identification documents such as a passport or driver's licence, and more. These pieces of information are the building blocks of your KYC profile. They not only establish your identity but also help the bank assess your risk level and ensure that you're not involved in any illegal activities, such as money laundering or fraud.

Introducing re-KYC: The Need for Periodic Reassessment

Now, let's pivot to the central theme of this discussion - re-KYC. While KYC is your passport to the world of banking, it's not a one-time affair. The dynamics of life, regulations, and even your personal circumstances are in constant flux. Your address may change, your marital status might evolve, or you might legally change your name. Moreover, the financial industry itself evolves, with new regulations and guidelines regularly being introduced.

It's at this juncture that the concept of "re-KYC" comes into play. Re-KYC, or "Re-Know Your Customer," is the process by which your KYC information is reviewed and updated at regular intervals. Think of it as an essential health checkup for your financial identity. Its purpose is to ensure that the information your bank has on file is not only accurate but also current, aligning with the latest regulatory requirements and reflecting any changes in your personal profile.

Understanding the RBI Guidelines

At the core of these guidelines is the resolute focus on preserving the accuracy of customer information and complying with the stringent provisions of the Prevention of Money Laundering Act (PMLA). This dual commitment ensures that not only the trust but also the security of the financial ecosystem remains unwavering. Let's delve into the key facets of the RBI guidelines concerning re-KYC:

- Frequency of Re-KYC: The RBI mandates that banks, as custodians of financial integrity, carry out the process of re-KYC at regular intervals. The frequency of these renewals varies based on the perceived risk level associated with a customer. For high-risk customers, re-KYC becomes a biennial ritual, occurring every two years, ensuring that their financial profiles are meticulously scrutinised and updated. Meanwhile, the rhythm of re-KYC slows down for low-risk customers, with a decennial renewal cycle of ten years. This risk-based approach harmonises the frequency of customer updates with the level of vigilance warranted, assuring the security of the financial network.

- Threshold Limits: A critical element of the RBI guidelines is the establishment of threshold limits for different types of accounts, taking into account the risk profiles of customers. These limits act as a trigger mechanism. When transactions exceed the defined thresholds, they act as a siren, signalling the need for a re-KYC update. This proactive approach helps detect anomalies and potential risks, preserving the integrity of the financial system.

- Up-to-Date Information: The RBI places a premium on maintaining updated customer information. Customers are the linchpin of the financial ecosystem, and their lives are dynamic. Consequently, the guidelines require customers to provide fresh information if significant changes occur in their profiles. This includes alterations in address, contact details, or employment status. Keeping these details current is not merely a matter of administrative convenience but a vital element in safeguarding the financial system from vulnerabilities and threats.

- Digital Verification: The RBI, mindful of the digital era, advocates for the use of cutting-edge technology and online mechanisms to streamline the re-KYC process. Embracing digital verification not only augments convenience for customers but also enhances the efficiency and accuracy of the re-KYC journey. This modern approach aligns seamlessly with the evolving technological landscape, making the process accessible and hassle-free for all stakeholders.

In the upcoming sections of this blog post, we'll take a closer look at the intricacies of the re-KYC process itself. We'll walk you through the steps, highlight its significance in preserving the robustness and security of the banking ecosystem, and equip you with the knowledge needed to navigate the dynamic landscape of banking and finance. Stay with us as we uncover the multifaceted world of re-KYC and its pivotal role in the ever-evolving financial realm.

Things Banks & NBFCs Should Know About ReKYC

Re-KYC, short for "Re-Know Your Customer," is not just a regulatory requirement; it's a dynamic process that banks and Non-Banking Financial Companies (NBFCs) must navigate effectively. In this blog post, we'll explore the key things that financial institutions should be aware of when it comes to ReKYC, shedding light on its significance and the steps involved.

Regulatory Compliance is Non-Negotiable

First and foremost, banks and NBFCs need to recognize that ReKYC is not a choice; it's a legal and regulatory obligation. It's a vital component of anti-money laundering (AML) and combating the financing of terrorism (CFT) efforts. Non-compliance can result in hefty fines and legal consequences, so ensuring adherence to the guidelines is paramount.

Risk-Based Approach

Re-KYC isn't a one-size-fits-all process. It involves a risk-based approach where customers are categorised into high, medium, or low-risk groups. The frequency and intensity of ReKYC checks are determined by this risk classification. High-risk customers require more frequent updates, while low-risk customers have a more extended renewal cycle.

Leverage Technology for Efficiency

The digital age offers remarkable tools and solutions to streamline the ReKYC process. Banks and NBFCs should embrace cutting-edge technology to make ReKYC checks more efficient. Digital verification, automation, and online mechanisms can simplify the process for both customers and institutions.

Encourage Customer Cooperation

While ReKYC is an obligation, it's a process that customers must actively participate in. Banks and NBFCs should encourage and facilitate customer cooperation in providing updated information and documents as and when required.

Document Management is Crucial

Managing customer documents efficiently is a critical aspect of Re-KYC. Implement robust document management systems to securely store and access customer information as needed for the Re-KYC process.

Data Accuracy is Paramount

Accuracy is not negotiable. Inaccurate or outdated customer data can undermine the entire ReKYC process. It's essential to ensure that customer information is precise, up-to-date, and complies with regulatory standards.

Focus on Customer Experience

The Re-KYC process should be as smooth and customer-friendly as possible. A positive customer experience can make the process more efficient and encourage customer cooperation.

In conclusion, Re-KYC is not just a regulatory box to check; it's a vital component of financial institutions' risk management and compliance efforts. Banks and NBFCs must be proactive, leverage technology, communicate effectively, and ensure data accuracy to navigate the Re-KYC landscape successfully. By doing so, they not only meet their regulatory obligations but also contribute to a safer and more secure financial ecosystem for all stakeholders.

The Re-KYC Process

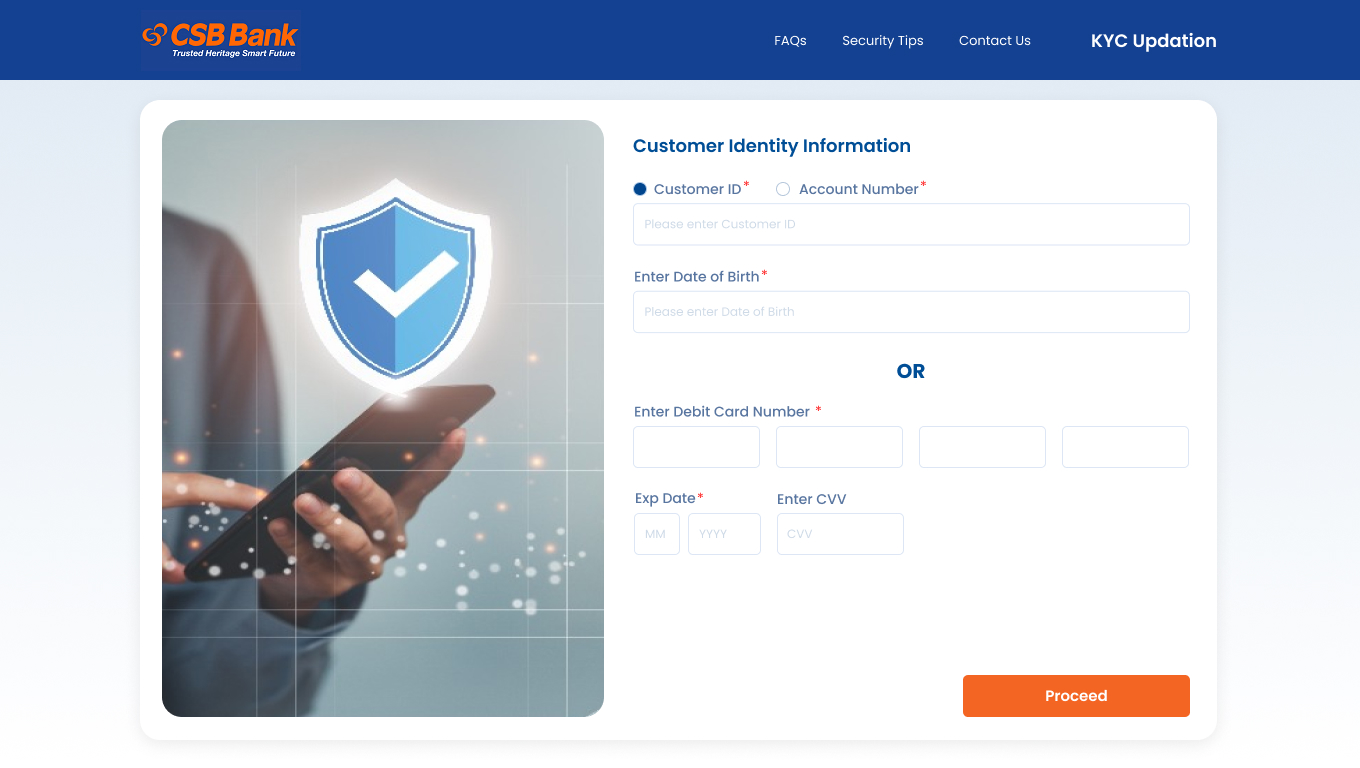

Step-1 - KYC Update Options

Choose a method to update your KYC with your customer ID, account number, and debit card number. When the bank sends a KYC update request, the customer must complete the personal information fields.

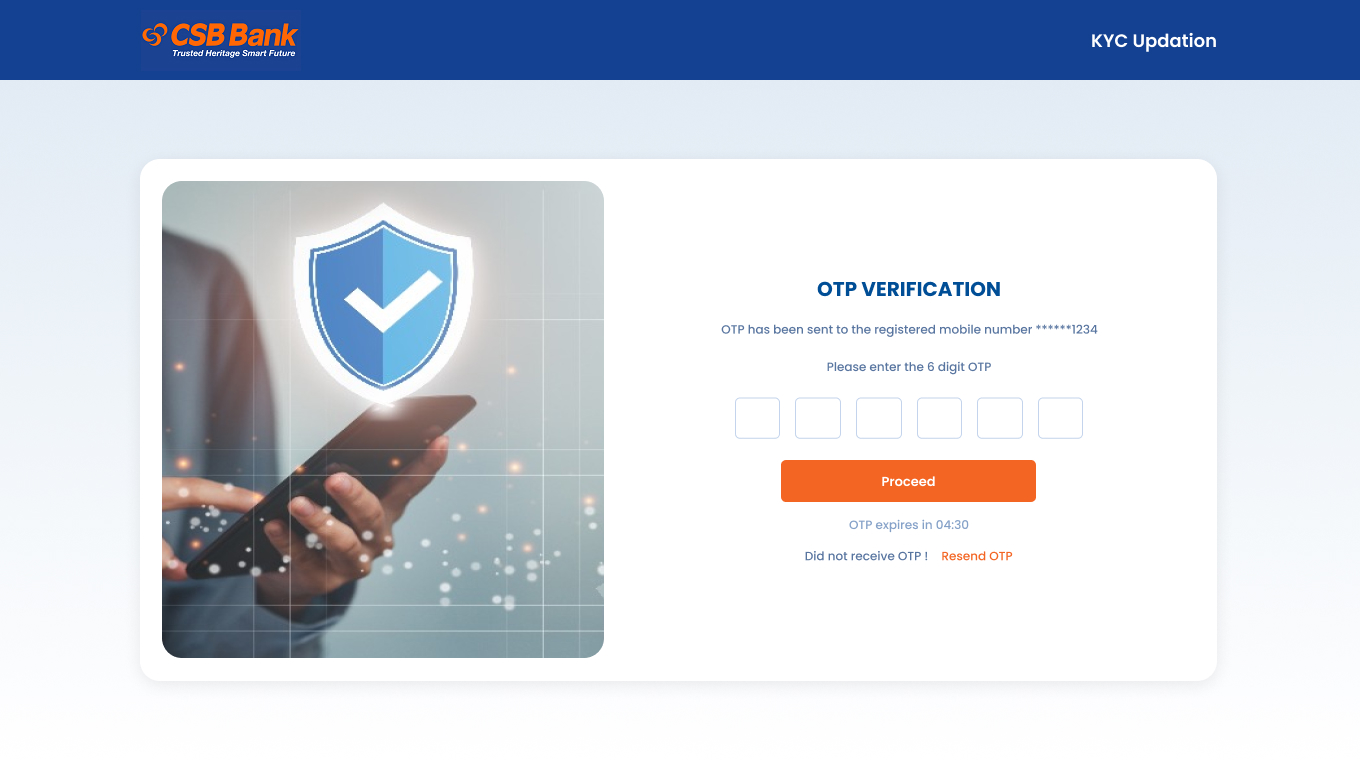

Step 2 – OTP Verification

Then verify with the OTP sent to your mobile number.

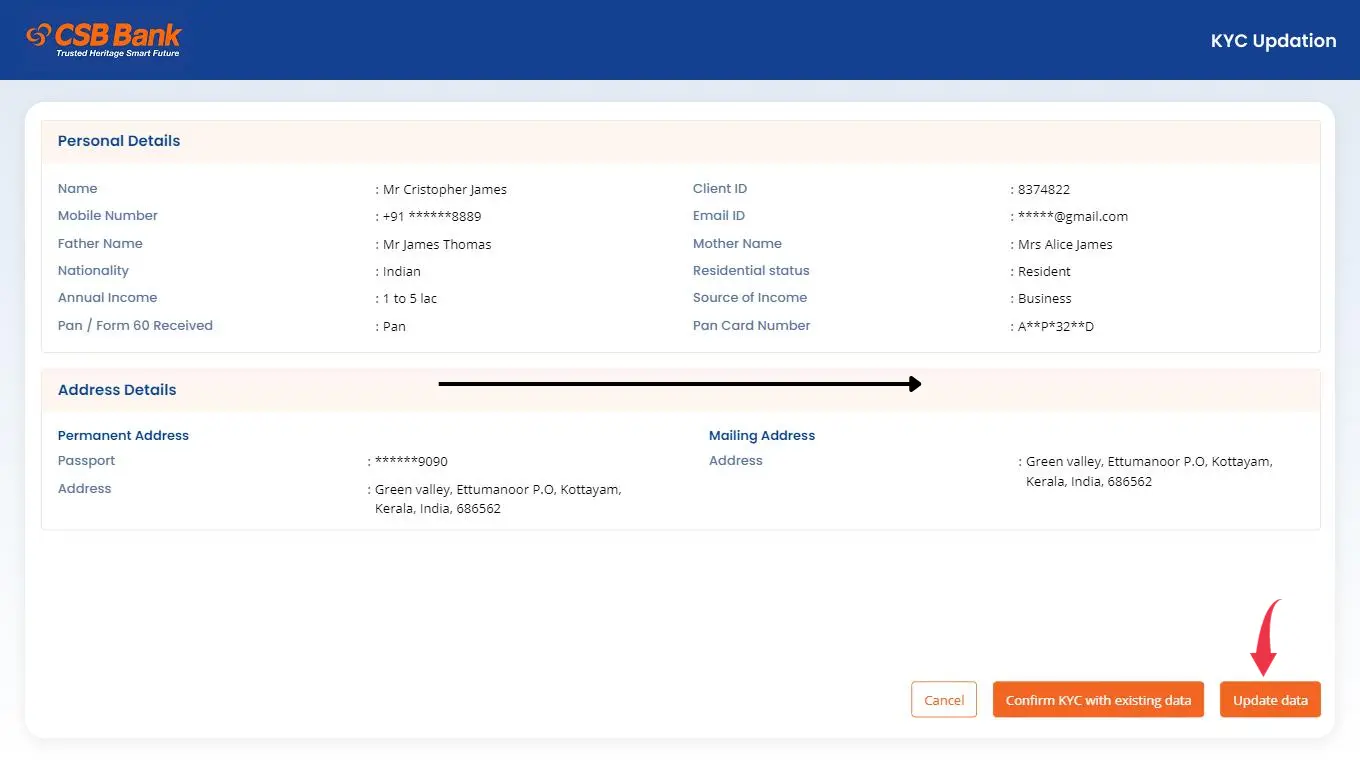

Step 3 – Modification

Once the existing data is displayed on the screen, you can proceed with the KYC update by clicking the 'Update KYC' button and modifying the data as needed.

Step 4 – Document Submission

Next, the customer is required to self-attest copies of the valid identity and residential proof documents. These will be submitted alongside the re-KYC form. Here is a list of the accepted documents for individual customers:

Acceptable documents for person of indian origin:

- Valid Passport

- PAN card

- Aadhaar card

- Valid Permanent Driving licence

- Voter’s ID card

Acceptable documents for Non-resident:

- Passport

- Visa/OCRI/RP

- Other Document

- Civil ID

Step 5 – Verification

Once the existing data is displayed on the screen, you can proceed with the KYC update by clicking the 'Update KYC' button and modifying the data as needed.

Step 6 – Confirmation

Once the existing data is displayed on the screen, you can proceed with the KYC update by clicking the 'Update KYC' button and modifying the data as needed.

Re-KYC for NRI Clients: Streamlining Compliance

For Non-Resident Indian (NRI) clients, maintaining updated KYC profiles can be a daunting task due to geographical constraints. That's where our online Re-KYC service steps in to simplify the process.

With just a few clicks, NRI customers can seamlessly update their KYC information. Our platform ensures that your customer data remains accurate, secure, and compliant with regulatory standards, no matter where you are in the world.

Here's how it works:

- Effortless Access: Log in securely from anywhere, at any time, using your unique credentials.

- User-Friendly Interface: Our intuitive interface guides you through the process step by step, making it easy to update your KYC details.

- Document Submission: Upload the required documents directly on our platform. It's a secure and hassle-free way to share your information.

- Verification: Our system verifies the submitted documents promptly, ensuring that they meet regulatory criteria.

- Completion Notification: Once your Re-KYC is successfully updated, you'll receive a notification confirming the process's completion.

Our online Re-KYC service offers NRI clients a convenient and efficient way to meet their compliance obligations. No more paperwork, no more distance barriers—just a seamless experience that keeps your financial data accurate and compliant. Join us in the digital age of Re-KYC for NRI clients.

Why Re-KYC Matters

Re-KYC is essential for maintaining the integrity of the banking system. By periodically updating customer information, banks can continue to meet their legal and regulatory obligations. It also helps in preventing fraud, money laundering, and other illicit activities by ensuring that the information on file is accurate and up-to-date.

In conclusion, re-KYC is a crucial part of the banking process, aimed at keeping customer information current and compliant with regulations. Understanding its significance, following RBI guidelines, and promptly cooperating with your bank during the re-KYC process will help ensure a smooth and secure banking experience for everyone.

So, the next time your bank requests you to undergo a re-KYC, you'll know exactly what it means and why it matters.

Key Features of Pixl Re-KYC Platform

Pixl Digital's Re-KYC solution is a game-changer for businesses seeking to optimise their KYC processes. Let's explore some of its key features:

- Verification of Customer Information: Pixl's platform is designed to rigorously check and update customer data, ensuring its accuracy and compliance with regulatory requirements.

- Paperless Process: Say goodbye to mountains of paperwork. Pixl transforms KYC procedures into a seamless, paperless mechanism, reducing the administrative burden and environmental impact.

- Customised Workflows: Pixl empowers customers to update their information through tailored workflows, providing a personalised and user-friendly experience.

- Compliance: Businesses can rest easy, knowing that Pixl's platform helps them adhere to regulatory requirements, including those set by authorities like the RBI, thereby mitigating risk.

- Client Reactivation: Reviving dormant clients has never been easier. Pixl assists in reactivating inactive accounts, unlocking untapped business potential and increasing revenue.

- Versatility Across Industries: Whether you're in banking, financial services, telecommunications, or other sectors, Pixl's Re-KYC platform is a versatile tool for efficient data management and compliance.