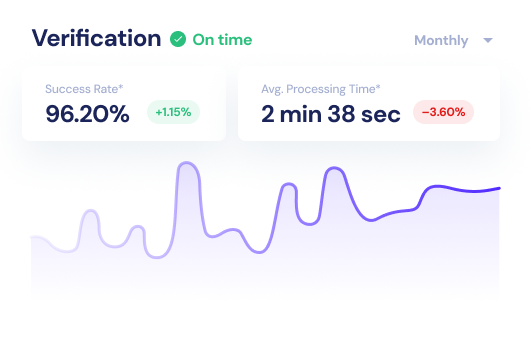

This cutting-edge method drastically reduces verification time compared to manual processes.

90%

Reduction in

onboarding time

99%

Compliance accuracy with US regulations

EXCLUSIVE BENEFITS, ASSURED BY NONE

Overview of Pixl eKYC Solution Software

Reduce verification time drastically with our cutting-edge video-based KYC. Leverage photos, vivid comparisons, and facial recognition for secure and rapid identity authentication. Ideal for banks, NBFCs, and digital payment providers across the USA.

Assisted eKYC Solution

Agent-Guided Process

Interactive Support

Accuracy & Completeness

Ideal for Users Needing Help

Human Touch

Boosts Satisfaction

Non-Assisted eKYC Solution

Self-Service Process

Ideal for Tech-Savvy Users

User-Friendly Interface

Speed & Efficiency

AI-Powered Verification

24/7 Accessibility

Secure, Fast & Compliant

Why Choose Our eKYC and AML

Solutions?

Effortless Onboarding

Say goodbye to cumbersome manual processes. Our eKYC solutions enable swift and hassle-free customer onboarding,

Learn More

Advanced Identity Verification

Our advanced technology confirms identities by checking government-issued documents,

Learn More

Comprehensive AML Screening

Stay compliant and combat financial crimes with our robust AML screening solutions.

Learn More

Real-Time Monitoring

With our real-time monitoring capabilities, you can proactively detect suspicious activities and react promptly to emerging threats, safeguarding your business from potential risks.

Learn More

Customer-Centric Approach

We prioritize the user experience while maintaining the highest security standards. Our intuitive interface ensures a smooth process for both your team and your customers.

Learn More

Expert Support

Our dedicated support team is available to assist you at every step, from implementation to ongoing maintenance,guaranteeing a seamless experience.

Learn MoreFeatures

Highly

Secured

Highly

Accuracy

Hassle Free

Integration

Value for

money

Dedicated

Engineer

Faster

Processing

Next-Generation Interaction Platform

Elevate your customers' experience and revolutionize interactions with our end-to-end Pixl eKYC software. Say goodbye to generic processes and welcome personalized interactions that address common issues, leaving your customers delighted and satisfied.

Get Started

Lightning-Fast Implementation

Integration with Pixl's identity verification service is a breeze! Unlike other banking software setups that take weeks, our solution can be seamlessly integrated with your banking systems in just a few days. It's the perfect choice for businesses looking for a quick and efficient implementation. Our user-friendly eKYC software seamlessly works with your existing systems, catering to businesses of all sizes.

Get Started

AI-Powered Customization for Effortless Onboarding

Our team is at the forefront of AI development, crafting models that excel in real-time performance, even in low bandwidth environments and on low-end devices. This adaptability ensures that we can promptly address new challenges and provide smooth onboarding experiences across a wide range of devices.

Get Started

AI-Powered Customization for Effortless Onboarding

Our team is at the forefront of AI development, crafting models that excel in real-time performance, even in low bandwidth environments and on low-end devices. This adaptability ensures that we can promptly address new challenges and provide smooth onboarding experiences across a wide range of devices.

Get StartedFAQS

Frequently Asked Questions

USA digital eKYC (Know Your Customer) solution is an electronic system that allows businesses to verify the identities of their customers remotely. This is done through a secure and automated process that verifies customers' identity documents and biometric data.

The digital eKYC solution can be used by any business that needs to verify the identities of their customers, including banks, financial institutions, telecommunication companies, and online service providers.

The digital eKYC solution works by using customers'identity documents and biometric data, such as facial recognition,to verify their identity remotely. Customers can upload their identity documents and take a selfie or record a video of their face to be compared against their identity document. The system uses advanced technology to ensure the authenticity of the documents and the accuracy of the biometric data.

Yes, USA digital eKYC solution is designed to be secure and compliant with industry regulations. The system uses dvanced encryption and authentication technologies to protect customers' data and prevent fraud.

The digital eKYC solution provides businesses with a secure and efficient way to onboard customers remotely, which saves time and resources. It also reduces the risk of fraud and ensures compliance with regulatory requirements.

Yes, customers can choose to opt-out of using the digital eKYC solution and provide their identity documents in person instead. However, this may result in a longer and more cumbersome onboarding process.