Digital eKYC & AML Verification Solution for Uganda

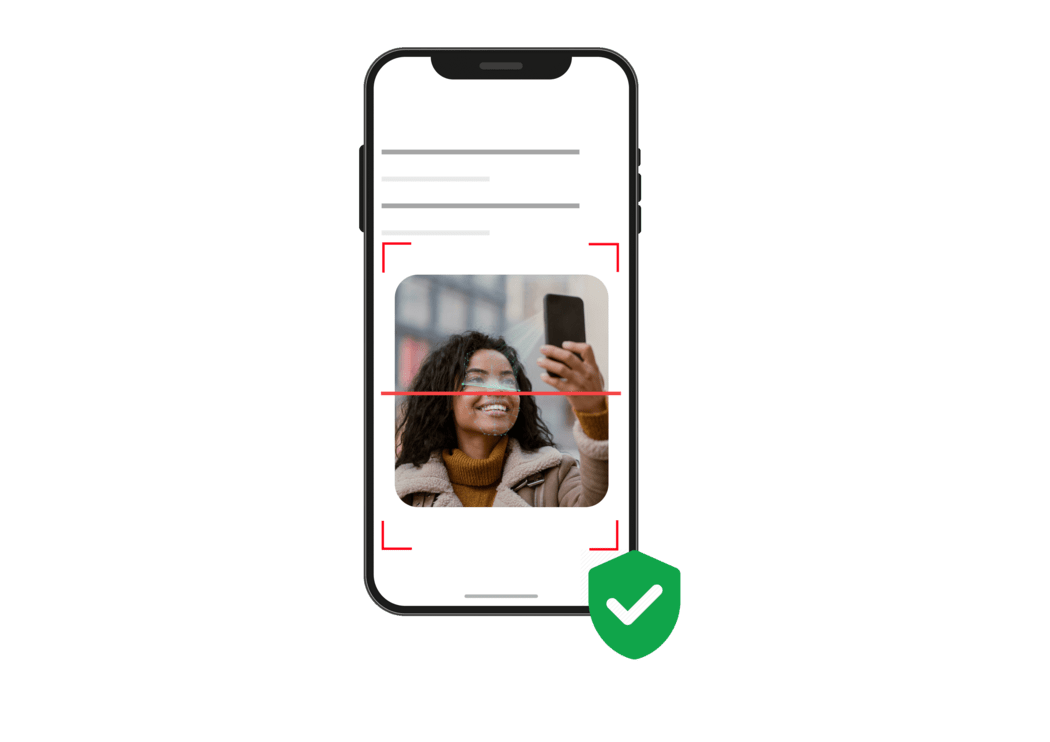

Pixl provides advanced eKYC software in Uganda that meets regulatory requirements and simplifies the process of remotely onboarding customers for businesses. Our software guarantees a seamless onboarding journey while strictly adhering to KYC and AML regulations. Furthermore, we provide specialized low-bandwidth solutions tailored for financial institutions operating in regions with limited connectivity. Our software is designed specifically for Ugandan businesses, prioritizing convenience and compliance to help you stay ahead of the competition.

Get Started