Trusted by

Industry Leaders Worldwide

What Is Singapore NRIC OCR?

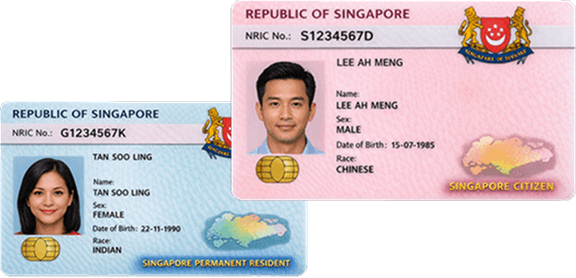

Singapore NRIC OCR is an AI-enabled identity verification solution that scans and reads NRIC ID cards to extract structured data with high accuracy. Pixl’s NRIC OCR API eliminates manual data entry by automatically capturing identity information from both Pink and Blue NRIC cards, even when images vary in quality or format.

Powered by AI-based Optical Character Recognition (OCR), Machine Learning, and Computer Vision, the solution supports real-time NRIC scanning, automated data extraction, and secure identity verification for digital onboarding workflows.

Designed for banking, fintech, insurance, telecom KYC, and government use cases, Pixl NRIC OCR helps organisations reduce manual effort, improve accuracy.This makes it ideal for eKYC in Singapore, customer due diligence (CDD), and automated KYC workflows.

NRIC Fields Extracted with High Accuracy

Pixl’s AI-powered NRIC OCR accurately extracts the following

semantic identity fields in real time

NRIC number

Full name

Date of birth

Nationality

Gender

Residential address

Issue date

Card type (Pink NRIC / Blue NRIC)

Example usage:

Our Singapore NRIC OCR API accurately extracts NRIC number, full name, date of birth, address, and nationality in real time for digital onboarding and identity verification.

Experience Pixl Singapore NRIC

ID Card OCR

Why Choose Pixl Singapore NRIC OCR ?

AI-Powered & High-Accuracy NRIC OCR

Built using deep learning-based OCR, computer vision, and ML models, Pixl delivers high-accuracy NRIC OCR even with low-resolution scans or mobile-captured images.

Automated NRIC Data Extraction at Scale

Enable automated NRIC data extraction for both single and bulk processing, reducing manual effort and accelerating onboarding timelines.

Secure Identity Verification for Singapore

Designed with bank-grade security, encrypted data handling, and access controls to support secure identity verification in regulated environments.

Compliance-Ready for Singapore Regulations

Supports PDPA Singapore, MAS compliance, and data privacy & consent management requirements critical for banks and financial institutions.

Flexible Deployment Options

Available as cloud-based NRIC OCR or on-premise NRIC OCR API, supporting enterprise data residency and infrastructure needs.

Key Features of the NRIC OCR API

Singapore NRIC ID Card Scanner API with real-time processing

AI-powered NRIC OCR with ML & Computer Vision

Automated NRIC data extraction and validation

NRIC OCR REST API & SDK support

Batch NRIC processing for enterprise volumes

Encrypted OCR APIs with role-based access control

ISO 27001 compliant OCR architecture

API-first, microservices-based OCR design

Industry Use Cases for Singapore NRIC OCR

Banking & NBFCs

Automate NRIC OCR for KYC, reduce onboarding time, and improve CDD accuracy while meeting MAS requirements.

Fintech & Digital Wallets

Enable instant customer verification with real-time NRIC scanning and automated identity checks.

Insurance Providers

Streamline policy onboarding and claims verification using NRIC card data extraction.

Telecom KYC

Accelerate SIM registration and identity checks using Singapore ID OCR API.

Government & Public Sector

Digitise Singapore government ID verification workflows securely and efficiently.

HR & Employee Onboarding

Automate identity verification during hiring with enterprise NRIC OCR solutions.

Get Started with Pixl Singapore NRIC OCR

Whether you are implementing eKYC in Singapore, improving digital onboarding, or strengthening identity verification,Pixl’s Singapore NRIC ID Card OCR API provides a scalable, compliant, and enterprise-ready solution.

Automate NRIC verification. Reduce risk. Scale onboarding with confidence.

FAQS

Frequently Asked Questions

Pixl Singapore OCR can process a wide range of document types, including NRICs, passports, invoices, receipts, cheques,resumes, insurance cards, and other business or identity documents commonly used in Singapore.

Singapore OCR delivers significantly higher accuracy and consistency than manual data entry. AI models adapt to different formats, layouts, fonts, and image qualities, minimising human errors and ensuring reliable data extraction at scale.

Yes. Singapore OCR is designed to support regulated industries such as banking, insurance, healthcare, and government by enabling secure, compliant, and auditable document processing workflows.

Singapore OCR automates document digitisation and data extraction, reducing processing time, lowering operational costs,and enabling faster decision-making.It helps organisations handle high document volumes efficiently without increasing manual resources.