It Works

Faster,

Smarter, and

Better!

It Works Faster, Smarter, and Better!

01.

User enters the PAN number or uploads PAN card.

02.

Realtime hit will be done on database

03.

Rapid confirmation of PAN verification status

Voter ID Verification API

AI-based Voter ID verification APIs are designed to quickly identify fraud and forgery, such as the use of fake voter IDs or misrepresentation of personal information. These Voter ID verification APIs use advanced image recognition technology (OCR) to accurately identify Voter IDs and prevent fraud. By uploading a Voter ID, users can get instant verification of its authenticity and legitimacy. Many organizations utilize Voter ID verification APIs to verify customer identities. This type of API software is relied upon to achieve various business goals.

Accurate

Reliable

Integration

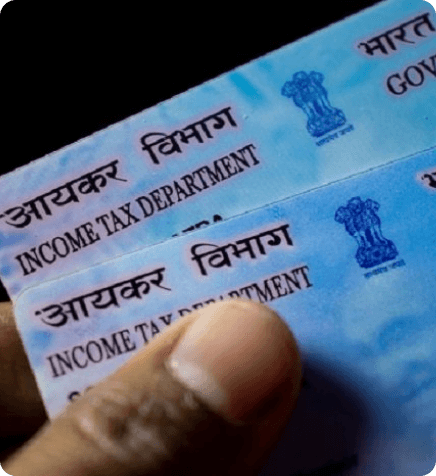

Effortless Integration with India's PAN Database

PAN Verification API seamlessly links with India's PAN databases, providing accurate and up-to-date information to simplify the verification process. This equips you with comprehensive and reliable data, giving you the confidence to confirm the legitimacy of your customers' PAN cards.

Authentication

Authenticating PAN Cards with Advanced PAN Verification API

PAN cards encapsulate a trove of data within their unique identifier, summarising vital information such as name,nationality, date of birth, PAN number, gender, and card expiry date. OCR technology, empowered by artificial intelligence, efficiently retrieves and cross-references this data, guaranteeing a smooth and accurate verification process.

Gender Detected

Name Detected

DOB Detected

PAN Number Detected

Easy to Use

PAN verification API with a high level of protection and flexibility for the best user experience. It is easy to use and reliable and is a robust way to verify.

Instant Checks

The data is transferred and verified within seconds, saving you time, and money, without any hassle.

Trustworthy Verification

API process verifies all details provided by the PAN and NSDL rendering them legitimate and accurate.

Accurate

An algorithm to ensure compliance with the PAN to prevent mistakes. As a result, our results are very reliable!

Address Fraud at its Roots

Provide accurate details like your DOB, name, email, mobile number, and PAN, then verify via OTP.

Online Bulk PAN Verification

Enable bulk PAN verification on a pay-per-use model to meet regulatory needs quickly.

Seamless Impeccable Integration

Attentive support staff can provide remote support around 24×7 to ensure that the integration process is seamless.

⚠️

The information presented here is for educational and informational purposes only. Pixdynamics does not provide PAN Verification API. PAN Verification API is subject to regulatory guidelines and is performed only by authorized entities.

FAQS

Frequently Asked Questions

The pan verification API is software that helps to verify an individual's identity using their PAN (permanent account number) card. This can be used to confirm the identity of an online user to verify and validate the authenticity of the PAN credentials of an individual.

The backend API will connect to the depository portal and get the data as soon as the PAN number is entered. The information identified by the API and the depository server will be included in the response.

The PAN verification process is quite accurate. The data collected is cross-checked with the government’s system to ensure accuracy and generate a response without any errors.

Using the online PAN verification API is fast and user-friendly and the user has to type in only their PAN number or provide a photo of a PAN. The response is generated within moments with the data.