Keep your Business on Track

with this User-Friendly Dashboard

When you initiate a verification check with a customer, you can view the progress in the dashboard.

Key Checks in our KYC Solutions

How does this work?

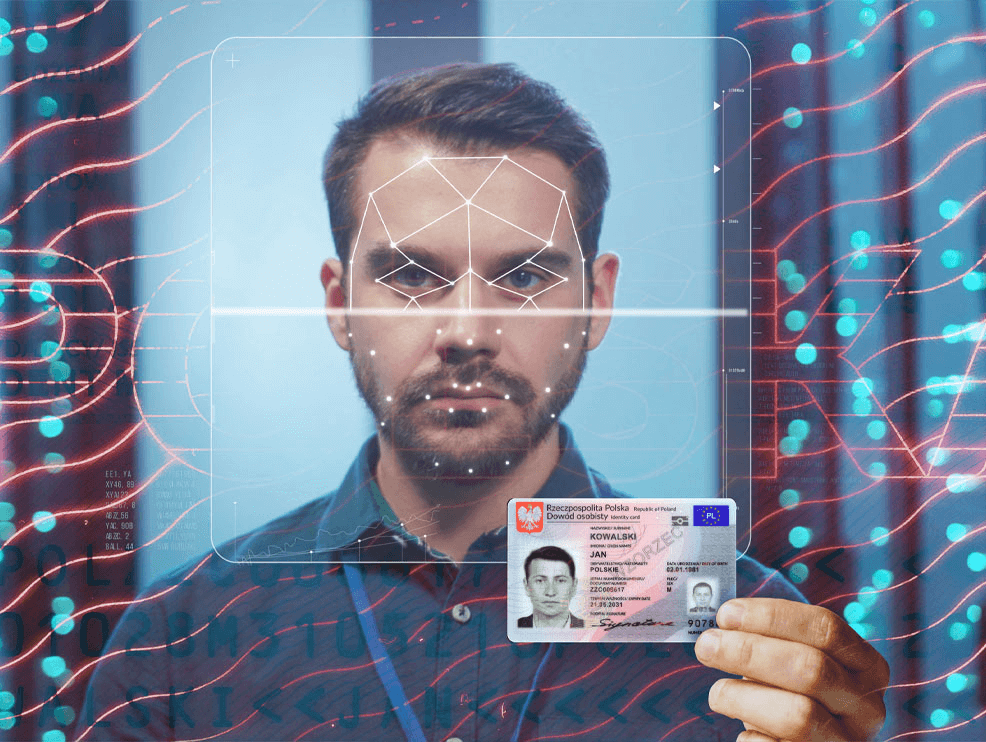

The success of any business depends on capturing accurate and complete information about its customers. We provide you with a platform where you can capture images and videos of your customers' IDs in order to verify their identities.

Verify important documents in real-time and without any hassle!

When you initiate a verification check with a customer, you can view the progress in the dashboard. This will help ensure that the process is going smoothly and that the customer is receiving the verification check as quickly as possible.

The future of identity verification is here!

Business Structure & Strategy

Digital identity is an increasingly important part of our lives and businesses. It allows us to access our information, interact with the outside world, and conduct transactions online. We need senior leadership to buy into the importance of digital identity and ensure that their employees are using digital identities properly. Security and business service lines are an important intersection for organizations to focus on.

Customer Relation

As a business, sets Pixl apart is their customer service. Understanding the needs of your customers and catering to them is the key to success. Here are some ways that you can improve your customer service: Provide efficient customer service. Keep your customers informed of what is happening and always aim to resolve their issues as quickly as possible.

Procedures

The financial industry is constantly evolving and changing. This means that the processes involved need to be seamlessly integrated across the whole financial organization's operations and its objectives, in support of an enhanced user experience. This integration should be done in a way that supports an overall goal, such as enhancing customer service or increasing efficiency.

Make Compliance Easier with Seamless UnAssisted Video KYC Solution

Once a customer completes verification, you can track all checks in your dashboard, manage approvals, and store a full atically across platforms, making compliance quick and easy for small businesses.