HOW WE STAND OUT

What is Pixl’s

Invoice OCR Software?

Pixl’s Invoice OCR software is a robust solution designed to revolutionize invoice data extraction and automation. With our advanced OCR software for invoice processing, developers can seamlessly integrate capabilities to capture and extract structured data from unstructured invoice formats using our intelligent Invoice OCR API.

This cutting-edge invoice data capturing solution leverages Generative AI, converting invoice images into searchable digital formats through prompt-based automation. It simplifies operations, ensures accuracy, and drastically reduces manual effort — transforming how businesses handle invoice data processing and financial workflows.

Machine learning algorithms are employed to improve data extraction accuracy. These algorithms learn to recognize patterns and adapt to variations in invoices, ensuring that data is accurately captured. AI also assists in context recognition. For example, it can identify key information such as invoice numbers, dates, and vendor details, even when the formatting varies from one invoice to another. This adaptability is crucial in handling diverse invoice formats.

Key Features of Pixl’s Invoice OCR API & Software

AI enabled data extraction with high accuracy

Our Invoice OCR API utilizes AI models trained on massive global datasets, delivering outstanding precision in invoice data extraction. Whether dealing with scanned, digital, or printed invoices, our system accurately identifies and extracts key invoice fields like invoice numbers, dates, amounts, tax information, and vendor data — making it a reliable accounts payable data extraction solution. .

Capture data from any source

Pixl’s intelligent Invoice OCR software supports a wide range of input sources — including scanned documents, PDFs, images, emails, physical paper, and cloud storage. No matter the format or origin, invoice data capturing is seamless and efficient.

Simplify workflows and operations

Automate your end-to-end invoice data processing with our AI-powered solution. It reduces manual data entry, eliminates costly errors, and accelerates approval cycles ideal for finance teams seeking an efficient accounts receivable data extraction service and smooth ERP integration.

Invoice Annotation And Training

Our annotation engine enhances model learning by labeling data points like totals, due dates, and line items. This continuous improvement process increases accuracy and boosts reliability in invoice data extraction, especially for high-volume or complex invoice formats..

Working of Invoice OCR API

Using LLM and Generative AI, Pixl’s Invoice OCR API processes invoices through the following steps:

Scanning or Uploading

Invoices are uploaded or scanned into the system.

DATA CAPTURE

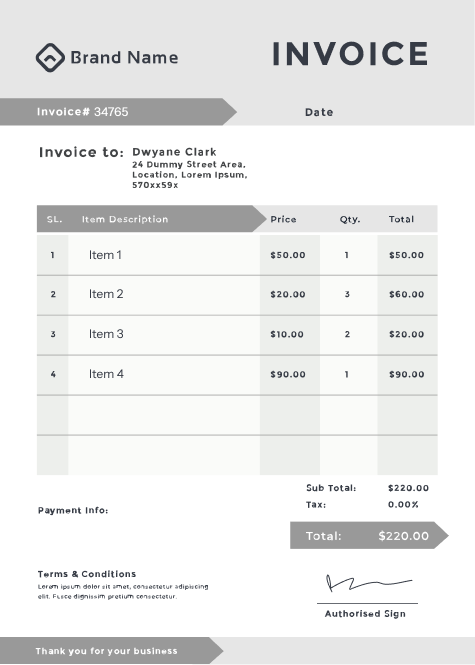

Fields that can be Extracted

Save your valuable time by avoiding the hassle of training a brand new invoice OCR model. Our solution is already equipped with advanced capabilities to accurately identify a diverse range of invoice fields.

Invoice number

PO number

Currency

Vendor/Buyer name

Vendor/Buyer Address

Vendor/Buyer Phone

Vendor/Buyer email

VAT ID

Tax ID

Payment Method

Bank name

Bank code

and many more fields!

Benefits of using Pixl Invoice OCR Software

Reducing Manual Data Entry

Say goodbye to labor-intensive tasks — our Invoice OCR software automatically populates invoice data into your accounting system, saving time and eliminating errors.

Accelerating Invoice Verification

Automated invoice data capturing speeds up verification by comparing data against pre-set business rules and formats, helping businesses manage large invoice volumes effortlessly.

Detect Discrepancies Proactively

Our AI models help identify inconsistencies or anomalies, making this tool not only an invoice data extraction engine but also a preventive check for financial control.

Cloud-Based Accessibility

Enjoy the flexibility of managing invoices from anywhere. Our cloud-based invoice data processing system ensures accessibility, scalability, and secure remote collaboration.

Seamless Integration with ERP Systems

TPixl’s Invoice OCR API integrates effortlessly with platforms like Tally, SAP, Zoho, and QuickBooks, ensuring minimal disruption and quicker go-live timelines.

Ensure Compliance with Financial Regulations

Our AI-powered system helps businesses stay compliant with the latest accounting and regulatory standards through accurate, auditable, and structured invoice data processing.

Enable Data-Driven Decisions

Accurate and real-time invoice data extraction empowers decision-makers with insights for cash flow forecasting, budget planning, and vendor performance analysis.

FAQS

Frequently Asked Questions

Pixl ensures end-to-end encryption and adheres to industry compliance standards (like GDPR), protecting sensitive financial data during processing and storage.

Our OCR software for invoice processing supports multilingual and multi-format invoices, adapting to diverse layouts using machine learning and NLP.

Yes, Pixl’s invoice OCR software includes handwriting recognition, making it capable of extracting data from handwritten or mixed-format invoices.

Absolutely. The Invoice OCR API is designed for easy integration with platforms like Tally, SAP, Zoho, QuickBooks, and more.

Depending on business needs, implementation can be as quick as a few days to a couple of weeks with our plug-and-play APIs.

Depending on business needs, implementation can be as quick as a few days to a couple of weeks with our plug-and-play APIs.

Pixl uses enterprise-grade cloud infrastructure with rigorous access controls, offering maximum data protection and auditability.

Some challenges include handling non-standard invoice formats, data mismatches, integration with legacy systems, and ensuring high accuracy in extraction. Advanced AI-based solutions help overcome these issues.

Most Invoice OCR solutions are designed with flexible APIs and connectors that allow easy integration with ERP, accounting, and payment systems. This seamless connection ensures that invoice data flows automatically into your existing workflows without requiring manual intervention.

Invoice OCR can capture key details such as invoice numbers, vendor names, dates, amounts, line items, tax details, and payment terms. It also supports different formats, layouts, and even handwritten notes, ensuring accurate data extraction.

These solutions offer benefits such as automated data entry, reduced errors, streamlined approval workflows, and significant cost savings.

Our Latest Blogs

What is Invoice OCR and its use cases?

Read More

Invoice Processing Software and Key Features

Read More

Importance of invoice ocr in data extraction

Read More

How Precision and Speed Are Key’s to an Invoice Data Extraction Process?

Read More

What is Invoice Data Extraction and Its Use Cases in 2025

Read More

Best features to consider for an invoice ocr software

Read More