NeSL DDE Integration

Pixl India’s leading NeSL DDE Integration Platform

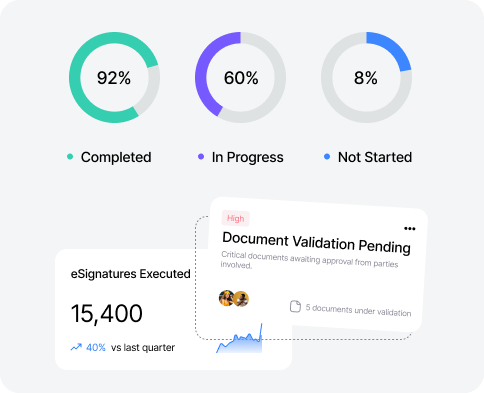

Pixl’s NeSL DDE platform enables secure, remote documentation with e-Signing and digital e-Stamping, allowing instant contract completion without customer visits. This streamlined process boosts daily loan document processing for MSMEs and individuals while significantly reducing turnaround time.

Pixl is the One-stop solution for banks and NBFCs looking to integrate and implement the NeSL workflow. With Pixl NeSL Solution, you can now easily submit your information to NeSL DDE and stay compliant with the latest regulations.

Also, we offer document templates for loan documentation, options to add multiple signers, and approval workflows that enable a Bank to digitize the en cost-effective.

ADVANTAGES

Advantage of Pixl NeSL DDE Integration Software

Customizable Branding

Ensure our client's brand is highly visible throughout the entire document process. We can even customize our interface to suit your needs.

Secure Data Management

The software ensures the secure management of sensitive data, protecting it from theft or misuse. It is compliant with data protection regulations such as GDPR and the Indian IT Act

Scalability

The software is designed to handle large volumes of data, making it scalable to the needs of banks and NBFCs of all sizes.

Cost Savings

The software reduces the need for manual intervention, which can lead to cost savings for banks and NBFCs.

Automated Processing

The software ensures the secure management of sensitive data, protecting it from theft or misuse. It is compliant with data protection regulations such as GDPR and the Indian IT Act

Advantages for All Involved

The NeSL DDE platform offers convenient access to all stakeholders involved in debt management, including borrowers,lenders, guarantors, security providers, auditors, and policymakers. This central source of information streamlines the debt management process and benefits everyone involved.

Traditional vs PIXL

Bank Documentation: A Comparison

Slow

taking days or weeks to complete.

Consumes significant time

on manual documentation tasks.

Requires

customer or staff travel to branches.

High costs

for physical storage and transportation.

Mistakes

lead to legal and regulatory risks.

High carbon footprint

due to paper and physical processes.

Quick processing

reducing customer waiting time.

Enables focus

on financial advice and personalized services.

Eliminates

the need for physical travel.

Reduces costs

for storage, transport, and printing.

Built-in systems

reduce mistakes and data loss.

Low carbon footprint

through digital and paperless processes.