ICR, which stands for Intelligent Character Recognition, is a transformative technology that is reshaping how businesses handle documents and data. Modern OCR systems hold the Intelligent Character Recognition (ICR) technology to emulate human text reading. We employ advanced methodologies that instruct machines to mimic human cognition, primarily through machine learning algorithms. Central to this process is a neural network, a key component of machine learning, which conducts a multi-level analysis of the text while iteratively processing the image. This network scrutinizes various image attributes, including curves, lines, intersections, and loops. The conclusion of these diverse analyses yields the final output.

ICR is useful for organizations that handle extensive paperwork daily, including those in finance, legal, and healthcare sectors. In these industries, efficient document management is critical for maintaining precise consumer records, demanding impeccable data accuracy. ICR emerges as a straightforward solution to error reduction, simultaneously optimizing time and human resource utilization.

Working of ICR

Intelligent Character Recognition (ICR) uses artificial intelligence and machine learning to extract handwritten text from images or documents, transforming it into machine-readable content. While similar to Optical Character Recognition (OCR), ICR surpasses it in sophistication, effectively tackling diverse challenges like deciphering intricate handwriting, accommodating various handwriting styles, and navigating intricate document layouts.

ICR starts by enhancing image/document quality and identifying document sections like text, images, and background during preprocessing. Following preprocessing, the ICR system employs diverse techniques to extract handwritten text. These techniques include:

- Preprocessing: The image or document is preprocessed to improve the quality of the image and to identify the different regions of the document, such as the text, the images, and the background.

- Feature extraction: Features are extracted from the handwritten text, such as the shape of the letters, the spacing between the letters, and the size of the letters.

- Pattern recognition: The extracted features are compared to patterns of known handwritten characters.

- Machine learning: The ICR system uses machine learning to improve its accuracy over time.

- Text conversion: The ICR system converts the extracted handwritten text into a machine-readable format, such as ASCII or Unicode.

Preprocessing

The preprocessing step is important for improving the accuracy of the ICR system. Some common preprocessing techniques include:

- Binarization: The image is converted to a black-and-white image.

- Deskewing: The image is deskewed to correct any rotation or skew.

- Noise removal: Noise is removed from the image to improve the quality of the text.

- Region segmentation: The different regions of the document are identified, such as the text, the images, and the background.

Feature extraction

The feature extraction step involves extracting features from the handwritten text. Some common features include:

- Shape features: The shape of each letter is extracted.

- Spacing features: The spacing between each letter and word is extracted.

- Size features: The size of each letter and word is extracted.

Pattern recognition

The pattern recognition step involves comparing the extracted features to patterns of known handwritten characters. This is done using a variety of machine learning techniques, such as support vector machines (SVMs) and neural networks.

Machine learning

The ICR system uses machine learning to improve its accuracy over time. This is done by training the system on a large dataset of handwritten text. As the system is trained, it learns to better identify different handwriting styles and to extract the text from more complex documents.

Text conversion

The text conversion step involves converting the extracted handwritten text into a machine-readable format, such as ASCII or Unicode. This allows the text to be processed by other computer systems, such as word processors, databases, and search engines.

How ICR differ from OCR

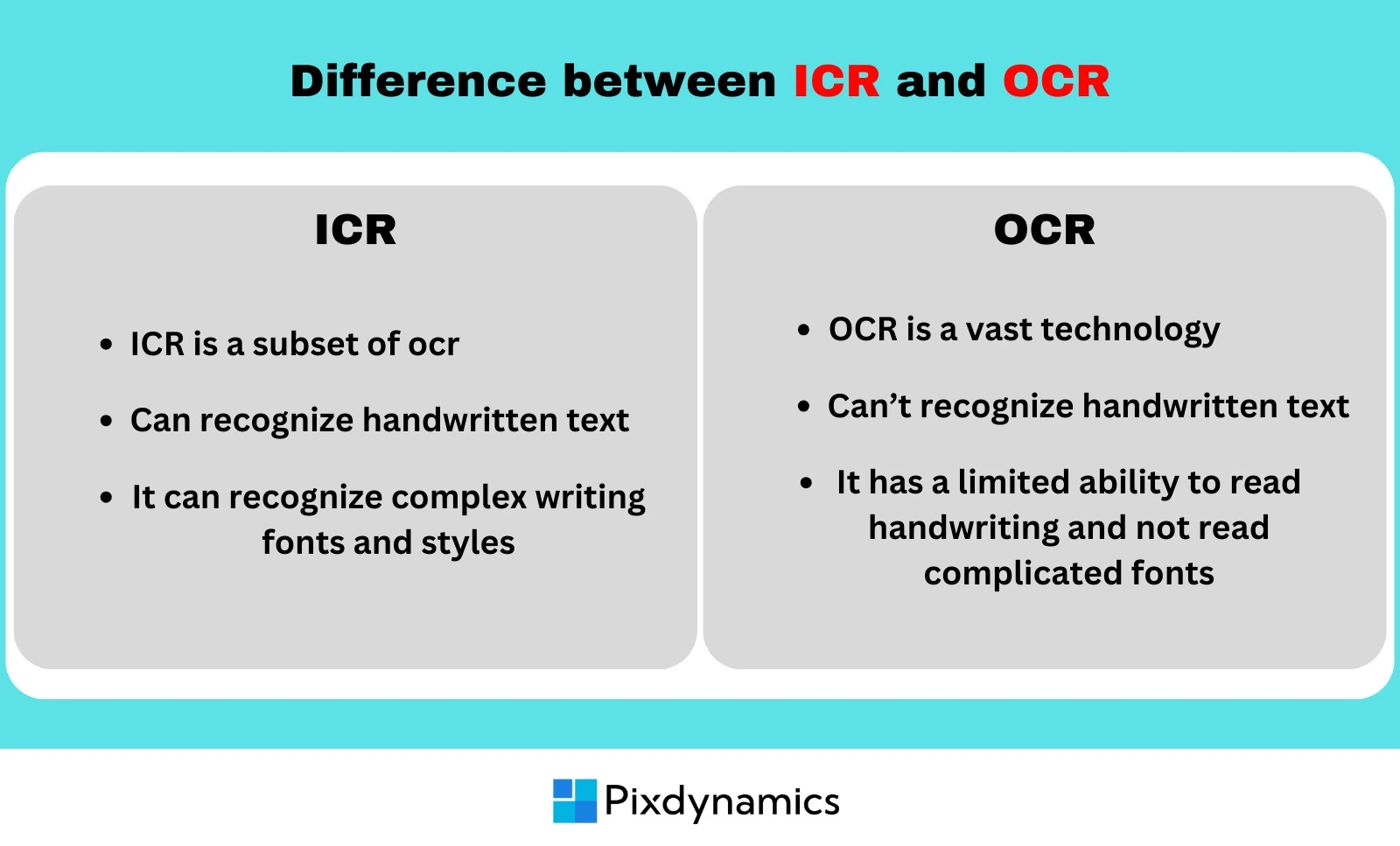

The main difference between ICR (intelligent character recognition) and OCR (optical character recognition) is that ICR can recognize handwritten text, while OCR is typically only able to recognize printed text.

ICR is a more sophisticated technology than OCR, and it uses artificial intelligence and machine learning to improve its accuracy. ICR systems can be trained on a large dataset of handwritten text, which allows them to learn to identify different handwriting styles and to extract the text from even difficult-to-read documents.

OCR systems, on the other hand, are typically only trained on a limited data set of printed fonts. This means that they may not be able to recognize handwritten text or printed text that uses unusual fonts.

Here is a table that summarizes the key differences between ICR and OCR:

What are the benefits of ICR

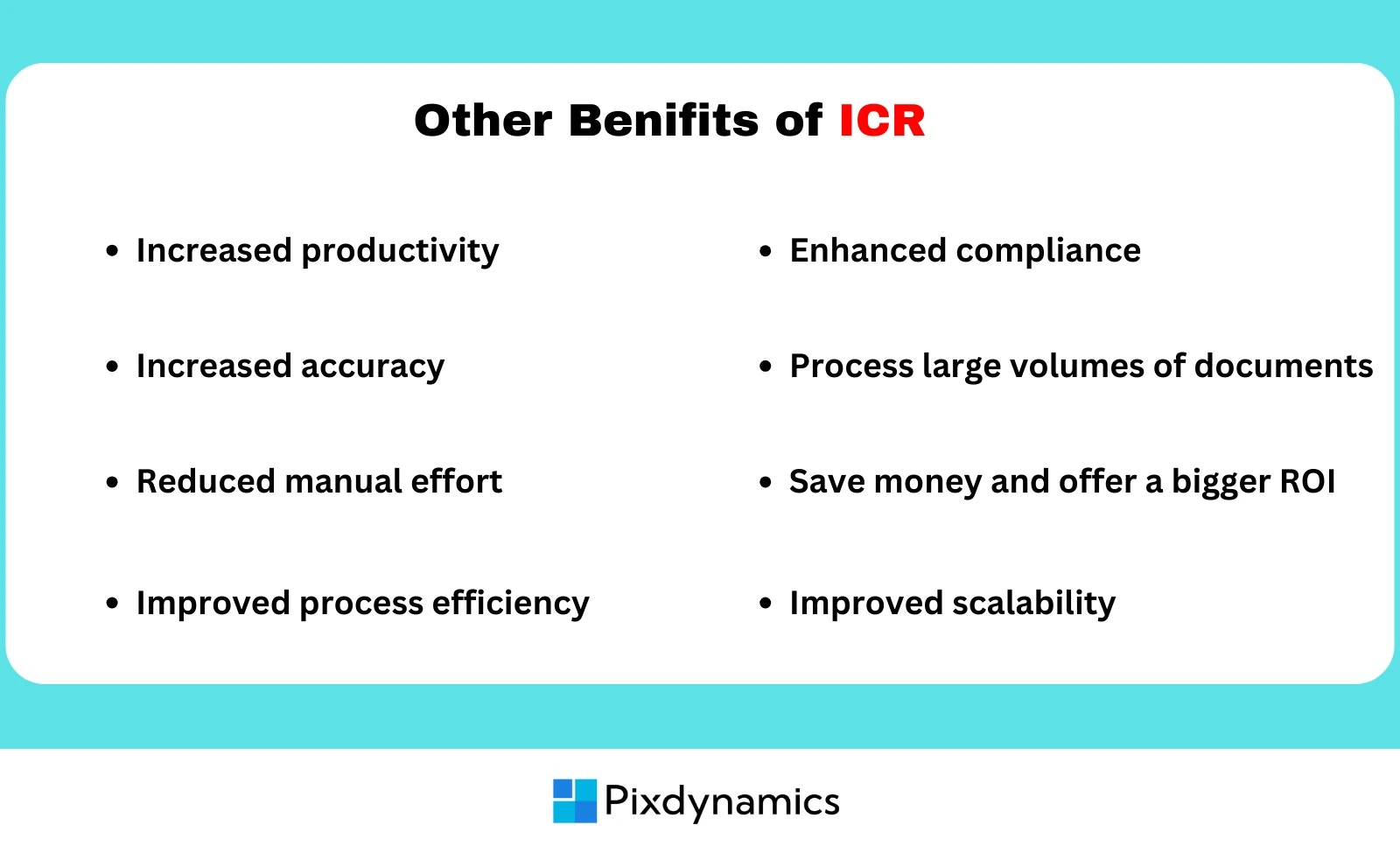

ICR services enhance OCR technology, effectively interpreting diverse fonts and styles using AI and neural networks. With each new dataset, ICR autonomously improves its learning, making it adept at extracting data from structured or unstructured documents, including digital and cursive handwriting. This is invaluable for sectors like finance and healthcare, which handle numerous forms daily, streamlining data processing and minimizing errors. Intelligent Character Recognition excels in accurately transcribing handwritten notes, crucial for industries with zero tolerance for mistakes, enabling efficient data input with minimal errors.

ICR provides several advantages compared to conventional OCR technologies, such as:

Individual Handwriting Recognition

Unlike OCR, which primarily focuses on printed text, ICR specializes in recognizing the variations of individual handwriting styles. It can adapt to variations in slant, size, spacing, and even minor imperfections in handwritten characters.

Document Type Identification

ICR has the ability to identify and classify the type of document being processed. It can differentiate between invoices, contracts, receipts, legal documents, and more. This document categorization is valuable for efficient document management and retrieval.

Machine Learning and Training

ICR systems incorporate machine learning algorithms that enable them to be trained on various handwriting styles and fonts. This training involves exposure to diverse datasets containing different writing styles and typefaces.

Contextual Understanding

ICR doesn't rely solely on pattern matching but also develops a contextual understanding of the text. It recognizes the context in which characters appear, making it more accurate in deciphering handwritten content.

Multilingual Support

ICR's adaptability extends to supporting multiple languages and character sets. It can recognize and adapt to different scripts, further enhancing its versatility.

Accelerated workflows

ICR can be used to automate manual tasks that involve processing handwritten documents, such as data entry, form processing, and invoice processing. This can free up employees to focus on more strategic tasks.

Use Cases of ICR

Document Digitization

ICR is used to convert paper documents, including handwritten text, into digital formats. This is valuable for creating searchable archives and reducing physical storage needs.

Data Entry Automation

ICR automates data entry tasks, reducing human error and speeding up data input from printed or handwritten documents.

Invoice Processing

In finance and accounting, ICR is applied to extract data from invoices, such as vendor details, amounts, and dates, streamlining accounts payable processes.

Check Processing

Financial institutions use ICR to process checks by extracting information like account numbers, check amounts, and payee names.

Form Recognition

ICR recognizes and extracts data from various forms, such as surveys, application forms, and questionnaires, enabling efficient data collection and analysis.

Healthcare Records

ICR is utilized in healthcare for digitizing handwritten patient records and extracting critical medical data for electronic health records (EHRs).

Banking and Finance

In the banking sector, ICR assists with customer onboarding, signature verification, and document management.

Legal Document Processing

Law firms use ICR for automated processing of legal documents, making it easier to search and retrieve case-related information.

Customer Service

ICR enhances customer service by quickly extracting and processing customer queries and requests.

Retail Inventory Management

It aids in managing inventory by reading handwritten notes and data from inventory sheets.

Library Cataloging

Libraries use ICR to catalog handwritten index cards, making their collections searchable online.

Education

ICR automates the grading of handwritten exams and the processing of admission forms in educational institutions.

Legal Compliance

It is used for extracting and managing data from legal contracts and compliance documents.

Industries Benefiting from ICR

Intelligent character recognition (ICR) is benefiting a wide range of industries, including:

Banking and financial services

ICR is being used to automate the processing of checks, loan applications, and other financial documents. This is helping to reduce the time it takes to process these documents and to improve the accuracy of data entry.

Check Processing

ICR is used to recognize and extract information from checks, such as the account holder's name, account number, check amount, and routing information. This automation streamlines the handling of checks, making it faster and more accurate. It helps in deposit processing and fraud detection.

Loan Applications

When customers submit loan applications with handwritten or printed information, ICR can be employed to extract the necessary data, such as personal details, financial information, and signatures. This accelerates the loan approval process and reduces the chances of errors in data entry.

Financial Document Processing

ICR technology assists in processing various financial documents, including invoices, purchase orders, and receipts. By automating the extraction of data from these documents, financial institutions can improve their record-keeping, track financial transactions, and expedite payment processes.

Healthcare

ICR is being used to automate the processing of patient records, medical claims, and other healthcare documents. This is helping to improve the efficiency of healthcare delivery and to reduce the number of errors that are made.

Patient Records

ICR automates the process of digitizing patient records, including handwritten notes from healthcare professionals. This digital transformation makes patient information easily accessible to healthcare providers, reduces the need for physical storage, and minimizes the risk of losing or misplacing records. It also aids in extracting relevant medical data from these records for quick retrieval, which is crucial for accurate diagnoses and treatment.

Medical Claims Processing

ICR is employed in processing medical insurance claims. It can efficiently extract information from claim forms, such as patient details, treatment codes, and healthcare provider information. This automation accelerates claims processing, reduces errors, and ensures timely reimbursement, benefiting both healthcare providers and patients.

Insurance

Insurance companies are using ICR to automate the processing of insurance claims and applications. This is helping to reduce the time it takes to process these documents and to improve the accuracy of data entry.

Automation of Data Entry

ICR automates the extraction of critical information from insurance claims and applications, such as policyholder details, claim amounts, medical records, and more. Instead of manual data entry, ICR software scans and interprets handwritten and printed characters, reducing the time-consuming and error-prone manual data input process.

Faster claim Processing

By automating data entry, insurance companies can process claims and applications much more quickly. This speed is vital in the insurance industry, where timely claims processing is essential for policyholders. Faster processing also means that policyholders can receive their claims or policy approvals in a shorter time frame, improving their overall experience.

Government

Government agencies are using ICR to automate the processing of passports, driver's licenses, and other government documents. This is helping to reduce the time it takes to process these documents and to improve the accuracy of data entry.

Efficiency

In government offices, a substantial amount of paperwork is filled out by hand, which can be time-consuming and prone to errors. ICR automates the process of extracting data from handwritten forms, significantly reducing the time and effort required for data entry.

Faster Processing

ICR enables government agencies to process a higher volume of documents in less time. This is especially valuable for time-sensitive applications, such as processing permits, licenses, or benefits, where citizens benefit from quicker turnarounds.

Improved Citizen Services

Faster and more accurate document processing means improved services for citizens. Government agencies can provide timely responses to applications and requests, leading to greater satisfaction among the public.

Legal

ICR is being used to automate the processing of legal documents, such as contracts, court records, and discovery documents. This is helping to improve the efficiency of legal operations and to make it easier for lawyers to access the documents they need.

Document Processing

Legal firms handle an extensive amount of paperwork, including contracts, court records, and legal correspondence. ICR automates the conversion of printed or handwritten text into digital format, making it easier to store, search, and manage documents efficiently.

Time and Cost Savings

Manual data entry can be time-consuming and costly. ICR significantly reduces the time and resources required for data entry tasks, allowing legal professionals to allocate their time to more critical legal work.

Accuracy

Legal documents must be transcribed accurately to maintain the integrity of the legal process. ICR technology is highly accurate in recognizing and transcribing text, minimizing the risk of errors that could have legal consequences.

Conclusion

In conclusion, Intelligent Character Recognition (ICR) plays an important role in simplifying and automating various processes across industries. Its ability to convert handwritten and printed text into digital data not only enhances data accuracy but also boosts operational efficiency. Whether in finance, healthcare, legal firms, or other sectors, ICR has proven to be a valuable tool for reducing manual labor and minimizing errors. As businesses continue to embrace digital growth, ICR emerges as a modern technology that empowers organizations to handle data more effectively, ultimately contributing to their success in the industry.

Now that you understand what ICR is, the implementation of ICR technology depends entirely on the specific needs of the company. It's worth noting that OCR is a more cost-effective option in comparison to ICR technology. However, if your company deals with large volumes of daily data processing, encompassing both structured and unstructured documents, adopting a combination of ICR and OCR is a strategic move. This approach not only minimizes the need for manual labor but also ensures high levels of accuracy in the results generated.