How easier can bank compliance with CKYC RBI Guidelines?

The boom in technology hasn’t touched some areas of Fin-tech organizations. One of the clear cut examples is the manual work done in the banking sector for the classification, extraction, and segregation of documents in the C-KYC process. Banking sectors are not able to fulfill the rules of RBI regarding digital documents. As long as now, the bank collects the copies of our documents and identity proofs like aadhaar card, pan card, driving license for the documentation process. They also perform numerous other essential services for its customers which further required different kinds of documents. Without any classification and segregation, the bank maintains and stores scanned copies of such documents that are saved as images. This is the usual practice till the RBI directs the banks to have a systematic document collection. As per the directions from RBI they now need to classify, extract, and segregate the documents for its C-KYC process for further usage and record-keeping purposes. Our CKYC Classifier & Extractor in India is the exact solution for this.

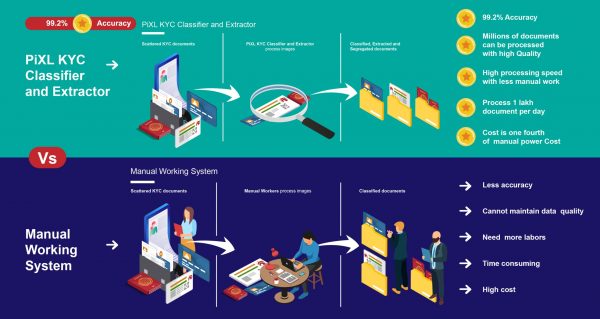

We can imagine the bundle of documents they need to filter. The only way in front of them was to do the processes manually. Even though they had a great concern regarding the rule they have no solution other than manual working. But there are several obstacles in manual human power. Since they have to process millions of documents within the estimated deadline, some banks made use of available software applications. But unfortunately, they didn’t get the accuracy they expected. Those vendors can meet the accuracy of 70% that is almost the same as human power. But human power can cause errors that can be a risk factor.

Usual Method

At first, the bank’s employees will look into each OVD images, classify them into various groups, for instance, all the aadhaar cards are classified into aadhaar category and the same procedure for other categories. Once this has been done, the next step would be to extract all the important data from these categories. The third step would be to segregate the extracted information according to the need to ease down the process. Large scale banks usually deal with a large amount of data collection daily which would accumulate to even bigger proportions for C-KYC process. The issues regarding the manual process are:

- Chance of potential errors

- The accuracy of the work is low.

- The cost which the bank would incur to do this grind would be tremendous

Due to these reasons the bank did not choose this option rather they preferred going forward with some vendor’s services. But still, they are not happy with the accuracy rate.

Here is our solution

PixDynamics had introduced PiXL CKYC CLASSIFIER AND EXTRACTOR in India which can sort all the issues of the current C-KYC process in the banking sector related to classification, extraction, and segregation of documents. And it guarantees accuracy and completes the processing within the RBI deadlines. It is an AI-based image classification and data extraction system introduced especially for banking sectors. It provides top-notch technology in image processing. The service is capable of performing all the classification, extraction, and segregation of unorganized and scattered documents.

How does it work?

PiXL CKYC CLASSIFIER AND EXTRACTOR in India started the job by firstly classifying the data into various categories that is the classification. It would do so by reading each image pixel by pixel, doing so it would be able to identify the document type. It would also make a quality check for the documents. If there is any discrepancy with the quality required it would be reported to the bank. PiXL KYC can automate the customer identification and verification process and link documents and the respective user account. This step would ensure the banks of the safety as it would be able to detect potential fraud or mismatch in the documents of the C-KYC process.

Next is the extraction process, it would extract all the useful information from the pool of data available which can be any type of document. The product can deliver 98.2% of the accuracy, which is the highest when compared to any other product. The remaining 1.8% accuracy loss is because of the corrupted documents. The product could play such a crucially vital part in automating digital document classification and extraction or segregation. The automated process ensures the elimination of the errors which human labor could have caused, this saves the bank from the unnecessary fuss and provides a smooth delivery of the functions with a surge in satisfaction level on the part of employees as well as the service takers of the bank. This helps in increasing efficiency.

Advantages

- High speed: Speed in processing is high as compared to competitor products. This speed allows us to deliver products on time with accuracy and quality.

- Upgrade Data Accuracy: The product can deliver 98.2% of the accuracy which cannot be assured by any other products.

- Improve Data Quality: Decreasing the chance of errors improves data quality.

- Increase Document Throughput: Accelerates the business processes by processing any type of digital documents, different types of text content can be processed

- Advanced Productivity: Productivity will be high as compared to manual working.

- Reduce Labor Charge: Only human assistance is needed for the services thus the bank doesn’t need to introduce much labor for the work.

- Highly cost-effective: Our service is highly cost-effective and can be afforded at a reasonable price. Therefore, even the most price-sensitive businesses need to worry.

- Staff to More Productive Tasks: Classification, extraction, and segregation are time-consuming and tedious. By automating all these processes, workers can be involved in any other assigned tasks.

- Any Document Types: The data can be processed in any type of document without any restrictions.

- Improve Data Security: The data in the documents and the documents are highly secured and not being prone to risks.

Features of PiXL CKYC CLASSIFIER AND EXTRACTOR

Our services will help banks in not only saving time and providing the best quality but also ensure a great cost-cutting for them. If a manual power can process 1 million of data in 10 or more months, our product is capable of processing the documents in 1 month, saving 9 months in the work process was of immense significance.

- Extract meaningful information with Accuracy 98%.

- Organize the un-scattered documents.

- High data quality delivery.

- Map documents & user accounts with minimal effort.

- Alert on mismatches and potential fraud.

- Automate customer identification and verification processes.

- Automates CKYC and OVD extraction.

- AI-based image classification & data extraction system.

- Quality Checking of ID proof submitted.

- Capable of extracting meaningful information from scanned images and documents.

- Organizations maintain and store scanned copies of KYC documents in image format.

The accuracy, quality, and efficiency of PiXL CKYC CLASSIFIER AND EXTRACTOR are not what we demand rather these are the customer feedback after implementing the product to their organization. We were always with banks to deliver them the best products to make their work more ease.