What is Credit and Debit Card OCR?

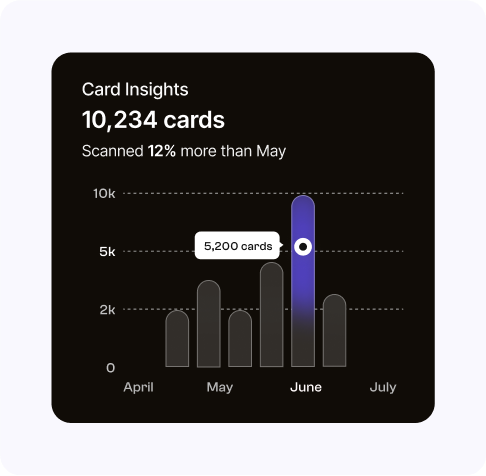

Credit/Debit Card OCR is a technology that can be applied to the cards to extract and interpret text information from them.

The Process

The technology behind Credit/Debit Card OCR involves using image processing, LLM (large language model) and Generative AI to recognize and convert the text on the debit card into machine-readable text. This can be particularly helpful in reducing manual data entry errors and simplifying processes that require accurate and quick access to Credit or Debit card information.

Faster

Transaction

1

Enhaced

Security

2

Seamless

Compatability

3

Key Features of Credit/Debit Card OCR

Prompt based search

You can extract data from cards using prompts. Our API supports simple and complex prompt based searches.

Read embossed text from Credit/Debit card

Reading embossed text from a credit or debit card refers to the process of extracting information from the raised characters on the card's surface.

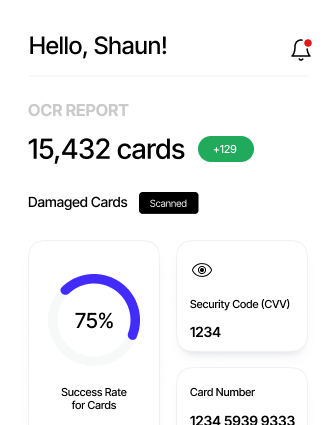

Read text from damaged card

OCR solutions can often read text from cards that are damaged, such as scratched, bent, or faded cards.

Read text from different card orientations

Reading embossed text from a credit or debit card refers to the process of extracting information from the raised characters on the card's surface.

Extract data from low resolution images

OCR solutions can read text from cards that are held in different orientations, such as horizontally, vertically, or at an angle.

Let’s Extract

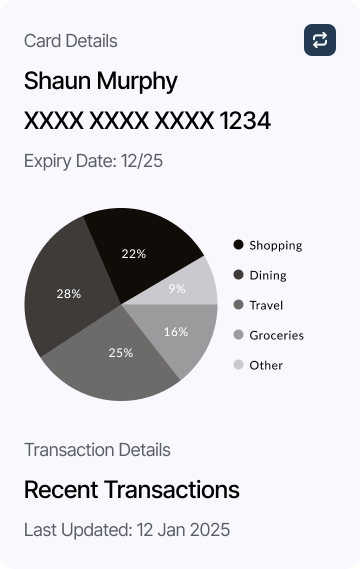

Fields that can extracted from credit and debit cards

Security Guarantee

The full name of the cardholder

Card Number

A 16-digit unique card account number.

Expiration Date

The date when the card expires, typically in MM/YY format.

Expiration Date

The date when the card expires, typically in MM/YY format.

Chip Data (EMV)

EMV chip cards store dynamic data that changes with each transaction, enhancing security

Cardholder's Signature

On the back of the card, there's often a designated space for the cardholder to sign.

Card Issuer's Information

This includes the bank or financial institution's name and contact details.

Magnetic Stripe Data

For cards with a magnetic stripe, it contains additional information encoded magnetically.

Security Code (CVC/CVV)

A 3 or 4-digit security code, also known as Card Verification Code (CVC) or Card Verification Value (CVV).

BUILT FOR YOU

Benefits of Card OCR

Efficiency

Extract data from documents quickly, faster than humans, and with higher accuracy

Simplified Integration

Our API offers mobile integration, allowing employees and users to capture and process receipts on the go. This is especially useful for sales teams, field personnel, or frequent travelers.

Secure Data Storage

Card OCR API providers often offer secure cloud storage options, ensuring that financial data is safely stored and accessible when needed.

Conveniece

Our card OCR can automate the process of entering credit and debit card information, which can save users time and effort. This is especially useful for mobile payments and digital onboarding.