The Importance of Digital EKYC

Digital identity verification is essential for ensuring secure and trustworthy online interactions, enabling businesses to confirm user identities effectively.

Secure

Transactions

Helps verify individuals during sensitive processes like opening bank accounts or accessing digital services.

Multiple Verification

Methods

Utilizes document checks, biometrics, and behavioral analytics to authenticate identities.

Fraud

Prevention

Protects organizations and users by reducing the risk of identity fraud and unauthorized access.

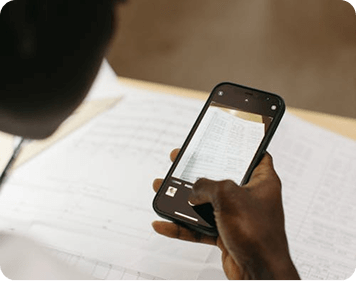

Effortless Data

Providing a Digital eKYC Solution for

Streamlined Customer Onboarding

Data Extraction

Effortlessly extract names, addresses, and birthdates from scans with our fast, accurate OCR—boosting efficiency for Argentine businesses.

Facial Verification

Real-time facial matching in video calls ensures the person matches their ID, enhancing security and authenticity.

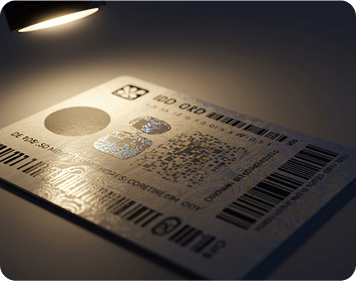

OVD Checks

Argentina’s government databases enable secure and accurate identity verification by ensuring document integrity and reliability.

Live Interaction

Interact live with customers, asking spontaneous questions to verify KYC info and ensure legitimacy.

Multi-step Authentication

Leverage Liveness Detection to detect fraud. Strengthens security and ensures customer honesty and authenticity.

Improved Response Time

Resolve inquiries faster with efficient support, improving customer satisfaction and reducing wait times.

Secure Future

Benefits of eKYC Solution in the

Digitized World

Remote and Secure Customer Onboarding

Streamlined New Account Opening

High-Assurance Transactions

Compliance with Regulatory Standards

High Accuracy

Low Bandwidth Solution

50% Reduced Drop-Off Rate

Complete Automated Journey

Trusted by Many

Why Choose Pixl

eKYC Solutions?

01

End-to-End Interaction Platform

Fast setup—operational in days, easy integration, and scalable for businesses of all sizes.

02

Quick implementation

Fast setup—operational in days, easy integration, and scalable for businesses of all sizes.

03

AI-Driven Onboarding

Real-time AI performance even in low bandwidth—adaptable to all devices and conditions.

04

Versatile APIs

Industry-ready APIs that automate data flow and reduce operational risks.